80% of MT4 traders do not understand execution and slippage – FinanceFeeds research

A comprehensive investigation into how slippage and slow execution is often overlooked, and how to combat it.

Some of the silent anomalies in today’s retail FX trading environment center around execution practices and the extremely difficult variable to monitor from the outside, that being slippage.

In some regions of the world which are populous with electronic trading companies, especially North America where the vast majority of trades are made on the interbank market or via vast wealth management desks by professional traders and all trade data must be uploaded on a daily basis to the National Futures Association (NFA)’s trade reporting system, slippage and unacceptable latency in closing trades are very much under the microscope and there have been publicly reported cases of fiscal penalties by the authorities.

For example, back in February 2014, FXCM settled with the FCA in Britain to the tune of $16.9 million following a review of trades that took place between August 2013 and January 2014, of 43,128,901 Forex and metal executions, FXCM was found to have provided clients price improvement on 15% of orders, totaling $15.5 million.

What about retail brokerages in regions where no reviews on pricing take place?

Last year, FinanceFeeds ran an automated web crawler which provided accurate results as to how many active brokerages there are that use MetaTrader 4.

The result was that as of March 20, 2016, there were 1231 active retail FX brokerages using MetaTrader 4, many of which are white label customers of MetaQuotes, having paid $5000 for a white label platform license, and then either take their price feed from another retail broker’s dealing desk, or in some cases, have no price feed at all and internalize every order.

Out of these, around 150 are based in Cyprus, and have CySec licensing, which includes adherence to the MiFID directive on market infrastructure and are subject to rulings set out by the European Securities and Markets Authority (ESMA). In Britain and the United States, MetaTrader 4 is uncommon, with proprietary platforms being far more the norm, hence it is fair to say that the vast majority of the 1231 brokers and brands are in, Asia, Cyprus and the Middle East, or are registered in offshore jurisdictions with lax regulation and little client recourse.

Surely market infrastructure relates by definition to the structure which provides access to financial markets to retail customers, right the way through from their front end trading platform, to the means by which it is connected to a liquidity and price feed, how the prices from Tier 1 banks are aggregated, to the quality and accuracy of execution via brokerage servers and, if applicable, dealing rooms that should be following their live price feeds.

This, unfortunately, rarely comes up in any discussion and is not included in any remit anywhere outside three regions, those being Britain, the United States and Australia.

Everywhere else in the world, slippage and execution method is an anomaly.

FinanceFeeds can deduce that approximately 80% of retail traders globally have absolutely no understanding of how slow execution and slippage is applied to their accounts, and are unable therefore to contest it or prove it, or even more effectively, to measure it against what would have occurred to a specific trade should it have been executed in accordance with correct practice.

Perhaps even more alarming is that many introducing brokers (IBs) also do not know how to monitor this, as many are focused on sales and marketing, rather than developing systems that can test the prices that are being quoted and validity of orders being filled by their broker.

The only region in the world in which this is tested by IBs is China, where the IBs are huge companies which employ a full array of staff ranging from back office to customer service through to portfolio management and algo development, as they have the resources to develop systems that test the operational conduct of the firm that they are referring clients to, often by developing automated software that picks up anomalies in trade history.

CySec, a unique regulatory authority in that it presides almost solely over retail FX brands and brokerages, does not monitor execution practice or slippage. This is clear within many examples, the first being that FxPro, one of Cyprus’ largest brokerages, releases its own slippage and execution data, however the data is produced by the brokerage itself, and is not subject to audit by professionals who take samples of the company’s trade history and examine it on an impartial basis, therefore, rather like volume reports of retail brokers, it can be considered to be PR rather than fact.

Indeed since FxPro began issuing reports of its slippage statistics in 2015, no impartial regulatory auditor has been to the company’s offices to check if this is valid or not.

That in itself is simply lack of transparency, however there is a more problematic situation in that FinanceFeeds has examined the execution statistics of several Cyprus brokerages, and many have clearly applied slippage and requotes to accounts in the hope that their IBs or direct retail clients will not notice.

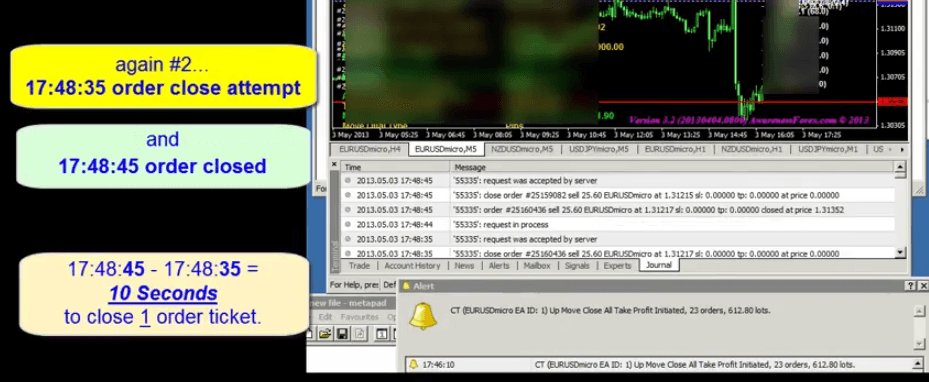

Here is an example:

In regulatory procedure, this is outside the scope and is not part of the remit of many regulatory authorities and unfortunately is commonly practiced.

How to avoid being served poor execution

Whether an IB, a small brokerage looking to take a solution or liquidity feed from a larger company, or a direct retail customer, this stealthy practice is something that can be avoided to a large extent by delving into the commercial structure of the companies that can provide an appropriate service.

In March this year, the FCA in Britain stated “If we find that firms are still not fulfilling their best execution obligations, we will consider appropriate action, including more detailed investigations into specific firms, individuals or practices.”

The FCA’s damning verdict on execution was unveiled late last year, the regulator believing that 82 per cent of spread-betting clients lose money, and is looking to include the mandatory disclosure of profit-loss ratios on client accounts to better illustrate the risks and historical performance of product being traded. This is because it is very difficult to price and clear CFDs which are an off exchange futures product.

This may be reassuring, however it is the quality of the companies that operate in Britain that speaks volumes. CMC Markets, for example, invested $100 million in developing its new Next Generation proprietary trading platform, and has its entire trading topography hosted and operated in house.

The company also provides an institutional service to other brokerages, which should be something to look for when choosing a brokerage whether on a B2C basis or B2B basis.

Swissquote, IG Bank, Dukascopy and Saxo Bank are all registered with Swiss banking licenses, hence their execution is their responsibility, and slippage and misquoting is frowned upon heavily by FINMA, the Swiss banking regulatory authority, which in turn requires any firm registered as a Swiss Bank to have its own completely ringfenced proprietary systems from server downwards, hence every aspect is free from interference by an outsourced market maker, and is completely auditable by the Swiss authorities.

When striking up a new IB relationship, it is worth checking whether the company in question has a prime of prime division. Invast Global, ADS Securities, Saxo Bank, and CMC Markets all provide prime of prime liquidity to institutions, hence they have direct relationships with eFX divisions of Tier 1 banks, meaning they are able to execute at the correct market prices with no delay (even if the trade is internalized).

Back in December last year, FinanceFeeds met with Lucian Lauerman, head of API business at Saxo Bank at the company’s offices in Canary Wharf, London.

At that time, Mr. Lauerman explained “If you lodge $5 million in total, use 5 prime of primes, put $1 million at each prime and then are long at number 1, and then short at number 2, then long at number 3, you will lose out on netting benefit re your use of collateral, and have a complex issue to manage re ensuring you minimize your funding costs.”

In terms of explaining how Saxo Bank conducts its bank relationships, Mr. Lauerman explained “Because of our balance sheet and our status as a regulated bank, we have stable, decades long relationships with the largest liquidity providers in the market, and are able to effectively evaluate the new entrants to the market. This is a major differentiator.”

This is a very important consideration when looking from a retail perspective, the question being, how well does a retail broker understand this type of liquidity arrangement further up its commercial structure?

Hosting FinanceFeeds at a private meeting in Hong Kong in February alongside global wealth managers and hedge fund operators, Adam Reynolds, CEO for Asia Pacific at Saxo bank explained “Customers want algorithmic capabilities and charts that interact with platforms, and to be able to clearly see what their holdings are. A true multi-asset strategy is a must these days, and from the point of view of a client, they’re looking at asset allocation” said Mr. Reynolds.

“Even with retail trading in today’s environment, the idea of having one platform for FX, another for shares, and another for exchange-traded futures is not a great user experience. That is the challenge that a lot of institutions have today. The history of banking has always kept a silo mentality, therefore today’s requirements are a new challenge for long established institutions” observed Mr. Reynolds.

“I spent 12 years at Merrill Lynch, during which time the bank spent an inordinate amount of money developing its own single dealer platform, which probably to this day many people have never heard of because it is not as good as Velocity, Autobahn or BARX, even though it cost a fortune. It was only designed for ISDA (International Swaps and Derivatives Association) and and CSA (Credit Support Annex) and due to this type of dynamic existing, trying to adapt that type of system alone to end users has been difficult for banks to do” – Adam Reynolds, CEO for Asia Pacific, Saxo Bank

Other vital criteria to check is how the firm approaches the market, and if it uses one of the main three liquidity integration firms to connect itself to aggregated bank liquidity provided by its prime of prime brokerage, these firms being oneZero, PrimeXM and Gold-i.

If a brokerage cannot give this type of comprehensive answer to how it interacts with the live interbank market and how its price feeds are structured, even if you are an average retail client with an average deposit balance of $3800 (the average deposit in retail FX across the world with the exception of the US), this is how to check whether it is structured properly, or whether a fly-by-night white label MT4 firm – large or otherwise – is tweaking your orders.

For an IB, who is in charge of customer accounts, this is perhaps even more of a consideration.

Mind how you go…..