Bucket shops continue to run rampant in targeting French customers, even after supposed Police crackdown and ad ban

Brokers trading against customers in France, and asking them to send money to an account owned by Worldpay are among many manipulative activities that unregulated firms run unsalubrious individuals are still resorting to, even post-sanctions. Here is a detailed insight

Back in the middle part of last decade, the retail FX industry’s fringe fraternity with its origins well and truly outside the respected financial centers of New York, London, Sydney and Hong Kong discovered a very cheap means of emulating the genuine retail FX market, with very little accountability.

The rise of popularity of the MetaTrader 4 platform soon after its official launch in 2005 created a plethora of unregulated brokerage customers of MetaQuotes, whose owners, morphing from affiliate marketing, gambling or lead buying (or other similarly back-street businesses) simply paid their $5000 for a white label license to use the software, which was never designed to operate in a live financial market, but was intrinsically designed for a “me against the house” execution model.

This prevailed for a few years, resulting in the number of small unregulated brokerages which were operated by the management teams of online casinos as opposed to the bona fide, proprietary platform CFD and FX firms of London, Sydney and New York.

The contrast was as wide as the distance between London and the Middle East, as London’s top quality firms continued to be a bastion of quality and maintain their loyal domestic client bases via ingenious development of proper trading environments, whilst New York’s giants went on a public listing spree, and developed global presence that is today absolutely cast in stone, with connectivity to Tier 1 liquidity in many cases covering the entire world, and offices from Singapore to London, and from Sydney to Hong Kong.

Today, Australia, Britain, North America, Hong Kong, mainland China (and the Western giants that have massive presence there) and certain elements within Cyprus dominate.

Anywhere else has not evolved in its methodology at all.

In April last year, FinanceFeeds reported that the Israeli Police had begun a collaboration with the French regulatory authorities to place 15 company directors of these firms under criminal investigation.

According to the French government, 4XP, BForex, Sisma Capital, Tradaxa and Aston Invest involved in a massive scam operation that took an average of €210,000 from each victim.

Just these firms alone are the suspected operators of a fraud that totals approximately €105 million. 50 cases, involving at least 500 identified victims are being treated by the Paris prosecutor. Two resulted in the opening of a judicial inquiry.

Nothing has come of it yet, and these five firms are just a scratch at the surface.

Market liquidity via the platform integration, connectivity and liquidity management providers that have become well recognized in the genuine FX industry’s pinnacle of offerings in bona fide regulated jurisdictions – those being PrimeXM, Gold-i, and oneZero – the majority of the firms who understand this properly are within the aforementioned good quality regions with well recognized financial markets economies.

Good advice to a new customer of a small retail firm would be to ask which liquidity provider they use and which of the three recognized companies listed here connects their platform to the live market.

Just a few years ago, there was a substantial influx of French speaking people to the State of Israel. Many had moved from Morocco to France 15 years previously, before settling in Israel at the latter part of last decade, just at the time when the less than salubrious unregulated brokerage scene was at its high point.

Many of the firms established large French speaking desks, and targeted customers across France, ripping them off to the tune of several hundred million Euros.

Whilst the perpetrators of this are well known to the authorities in all regions concerned, absolutely no recourse has been forthcoming.

Today, FinanceFeeds has obtained client records that demonstrate that although the French authorities have taken a very dim view of this type of fraudulent activity, often perpetrated from companies such as those listed, by people with false names and who when asked about their location seem to have a very limited memory of where they reside, or where their office is located, as it changes on every telephone call, these activities are still well and truly being practiced.

The documents obtained today by a brand known as FTradition, or ForexTradition, demonstrate a very common practice among these firms that are not licnesed to conduct FX business and are based outside the jurisdictions which host bona fide firms.

FTradition has been the subject of many regulatory warnings by the FCA, saying that it is a clone of a genuine firm, meaning that the company’s name has been chosen so that it gives the impression of being a genuine financial institution, hence customers subconsciously associate it with the genuine firm and deposit funds.

The FCA said back in 2015 (!!) “This is what we call a ‘clone firm’; and fraudsters usually use this tactic when contacting people out of the blue, so you should be especially wary if you have been cold called”.

The FCA deem FTradition to be a deliberate attempt to emulate the Swiss interdealer broker Compagnie Financiere Tradition, often known as Tradition, which is a bona fide company indeed.

Warnings listed on regulatory websites are as much use as a chocolate teapot, and are as effective as a coal fire on a glacier.

These are a hand-wringing gesture by government department to say that they have put a check in the box and made some arbitrary action toward a wrongdoing over which they have little jursidiction, and then they say “OK chaps, now we can move on”.

In France, due to the nature of the aforementioned ruses that have caused so much ruin to French customers, the AMF, the French regulatory authority, has at least made some steps toward stemming it, banning the advertising of binary options (which is where most of the owners of these false FX firms moved on to subsequently, along with their equally dubious staff), and have made extensive attempts to ensure that their domestic audience is not troubled by them.

It is still going on with surprising verve, however, as FTradition has conducted business with customers in this fashion, one particular customer having explained to FinanceFeeds today “In my case, I had been told by Ftradition they had problems with their liquidity providers, and that they had stopped allowing withdrawals and some months later blocked the platform. Fortunately I saved my daily history.”

“He continued “The talk about liquidity providers is a joke. Of course I never allowed them to trade my account, as I was well aware of the manipulations that were going on, in fact I knew that the broker was trading agaisnt me” he said.

Commenting on the collaborative investigation between Israel and France into these matters, the trader said “It’s a year now since the French investigated in Israel, the very last legal writings date was in September 2016 and involved Worldpay. Since then we have not received anything from the French Courts except for absolute silence about whatever they achieved” he said.

The thing that annoys me” said the client, based in France, “is that all of the authorities call this type of thing victims losses, including large news sources in France, highlighting the tremendous losses of French customers of these firms, however to me it is a straight forward robbery scheme.”

With regard to the police investigations, all of the owners of the aforementioned companies are at large, many of them owning binary options brands, which continue to defraud members of the public globally and have become a major bete noire for police and law enforcement agencies globally.

One of the very worst instances of attempting to pull the wool over customer eyes is the attempts to encourage customers to deposit funds into Worldpay accounts.

Since PacNet was sanctioned by the US Department of Treasury for being a fraud and money laundering organization, and labeled a criminal entity along with its subsidiaries which include Counting House, a firm that did a lot of business with binary options and unregulated FX firms in Israel, and the demise of other fraudulent peer to peer payment processors such as Liberty Reserve, somewhat wry methods of attempting to gain funds via the back door from unsuspecting clients have been introduced.

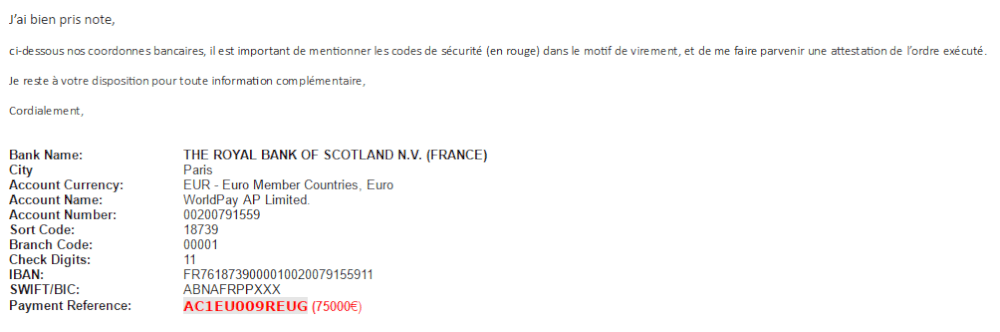

Here is a prime example by FTradition, asking its customers to pay to an un-named Worldpay account, rather than a client fund holding account in the name of the brokerage.

This came directly to the client from the sales person at FTrade. Translation from French:

“Dear Sir, I have taken note,

Below are our bank details, it is important to mention the security codes (in red) in the reason for transfer, and to send me an attestation of the order executed.

I remain at your disposal for any additional information.”

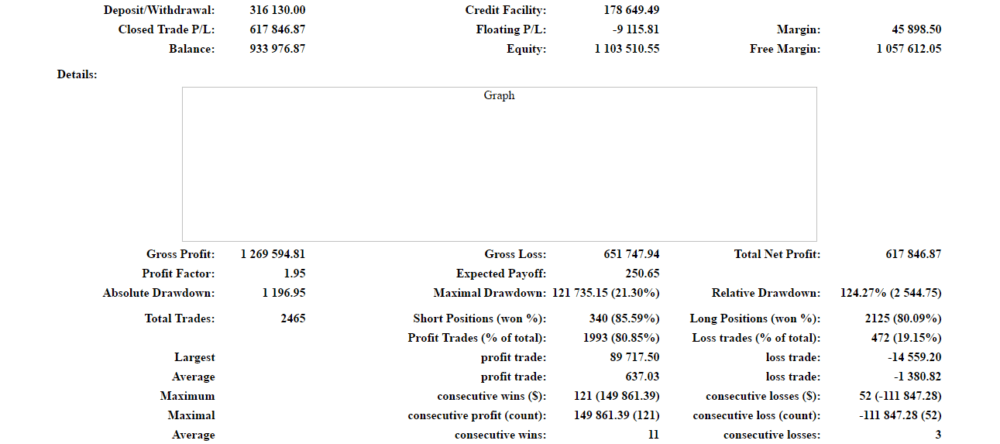

This MetaTrader 4 statement from a client account demonstrates the practices in use:

FinanceFeeds has detailed statements from trading accounts and can see a pattern in that the trader is allowed to ‘win’ to start with, so that he gains confidence and trades more and deposits more funds, and then losses are made very quickly to erase the funds. This is the exact same model as online casinos use as well as binary options.

Often, a hard sale phone call takes place after a big (but of course false) win, to deposit more funds, and then when this tails off, the firm generates large losses. This bears no resemblance at all to a genuine FX firm’s modus operandi and has no relevance to a live market.

Although some degree of censuring has occurred, an example being Aviv Talmor’s arrest in Israel last year, very little real prosecution has taken place, aside from Yigal Felix Haddad, CEO of Aston Market who had his collar felt but was only jailed for five months in 2015 for alleged embezzlement and released to enjoy the proceeds of his crimes with very little punishment.

Worldpay, the London Stock Exchange listed company that FTradition is asking clients to deposit funds to, was sanctioned by the French government in October 2016 for its part in assisting companies such as this.

The sanctions against Worldpay represent a similar action to how the US has begun stopping fraudsters illegally continuing to steal from members of the public in nations where it is illegal, by going after the payment processors, which would subsequently make it impossible to do business in those nations even if a fraudster wanted to.

The French authorities have noted that Worldpay has provided services to bforex, Aston Market, FXGM, 4XP, Sisma Capital and Tradaxa, all of which are under criminal investigation, along with their directors, some of whom are still at large.

French judge Buresi visited Israel in April 2016. The Israeli authorities are actively cooperating with countries that request assistance with regard to bringing the felons to book.

France is attempting to regain the trust of the public in its national regulator, AMF, but Mr Haddad’s short sentence did not resonate well with the French investing public.

The unregulated brokerages in question have been accused of operating without regulatory approval in any jurisdiction, and soliciting clients either online or by phone, promising annual returns of up to 88%, for derivatives trading, most commonly FX, with certain investment products guaranteeing the total amount invested during the first year.

Investigators have alleged that they disguised themselves as representatives of the company’s offices in London or Paris to induce a more credible approach and have them convinced that the money would be transferred to European banks such as ING, RBS or HSBC. Instead, it was moved outside the EU, mostly to Israel, Georgia or Singapore, and offshore tax havens Seychelles (where FTradition is actually registered), Belize and the British Virgin Islands.

Given that the French prosecutor said that the investigations ongoing regard to 50 cases, 500 victims, and a total sum of €105 million, then the average scam must have been worth €210,000. French economic daily ´Les Echo’ estimates the volume ranges from €100,000 and €500,000 for each victim.

Two employees at 4XP were already charged by the French police, according to the French press. One of them was involved in a hate crime against a Palestinian taxi driver in 2007. The second employee, Jeremias C., was arrested in a suite of a luxury hotel in Paris last November. He was carrying €6,000 in cash in €50 bills, claiming he earned it playing poker. He paid bail of €80,000 and the directors of the other firms involved have yet to face the music.

Mainstream media across the world is highlighting the non-financial markets orientated nature of these disguised gambling platforms that are weighted in favor of the house and pose as financial investment platforms, the Times in Britain having labeled them a ‘complete fraud’ and several governments working together now to extinguish it – which would indeed be for the greater good of the genuine electronic financial services industry.

In addition to the sanctions on payment processors, France holds the banks responsible for not checking where payments were coming from and being sent to.

Member of the Bar of Paris and Tel Aviv, Deborah Abitbol is one of the lawyers following the case for the plaintiffs.

According to Justice Abitbol, “We have engaged the responsibility of banks. You have a client, not especially wealthy. All his savings are siphoned off in two months by transfers abroad. The regulation is clear, a bank must report abnormal movements.”

In January 2016, the lawyer Helen Feron-Poloni, representing fifteen victims, assigned to the Commercial Court the Royal Bank of Scotland, Credit Agricole, Societe Generale and Crédit Mutuel, for failing in their duty of vigilance.

These civil proceedings are separate from the criminal investigation, but they have much in common:

Same companies, the same procedure and often the same financial intermediaries.

The million euro deposit of Worldpay is a drop of water in view of the extent of the injury.

François Molins, Attorney General of Paris, estimated the total held by banks and processed (including funds that have been returned to customers) at four billion euros in April 2016!

A copy of the order of sanctions by Justice Deborah Abitbol is attached here.

Loading...

Loading...