Care for a libation, Sir? Don’t mind if I do… Financial institutions cracking down on London’s corporate drinking culture

The once famous gregarious and alcohol-fueled lifestyle of London’s financial elite is under threat from the politically correct. We take an amusing and tongue in cheek look at how the cut glass decanters and wood paneled chambers are being replaced by rubber-cornered desks and muesli

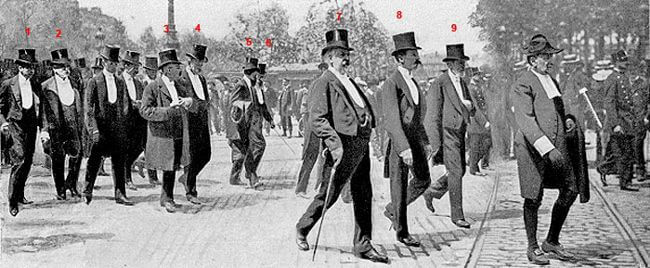

London has long since been associated with suited and sophisticated boisterousness, its corporate financial services sector being steeped in tradition which ranges from board level ramblings late into the evening in wood paneled cigar lounges, to cut glass whiskey decanters that provide a tot or two to esteemed clients who would meet with their hedge fund manager, or senior executives of stockbroking companies wishing to enjoy a civilized couple of hours building stronger relationships with prime brokerage divisions of banks.

Back in the 1980s, before the era of financial technology which has now engulfed London’s Square Mile and turned it into the ultra-modern tour de force that it is today, its infrastructure powering the entire world’s electronic markets from Tier 1 bank level right down to retail banking and online trading from just a few streets within the City of London’s financial district, things were somewhat different.

Today, Central London is ultra-modern, lined with plate glass technologically advanced financial services providers whose leadership consists of senior executives in their thirties and forties, many of whom have graduated from top universities with computer science degrees before embarking on internships or technology partnerships within the towers of Canary Wharf where modernity prevails and in-house proprietary systems dominate, whilst spending their spare time at the gym in the morning, and enjoying fine, low-calorie, fresh cuisine at the array of London’s artisan-style restaurants.

Gone is the Churchillesque portliness and gone are the stags heads on the walls. Gone are the wood and leather bureaux and Parker fountain pens, and gone are the stiff upper lip crested school ties worn by out-of-touch prewar establishment with little business acumen but the right social connections. Bagging pheasants and snaffling whiskey has been replaced by acai berries, chia seeds and ramen soups and an array of fruit smoothie bars. The trad has given way to the modern. Squire has given way to dude.

Or has it?

Whilst the financial technology sector in London is now the largest and most highly developed in the world, emanating not just from the startups of Silicon Roundabout run by Millennials on electric bicycles, many of whom are far too young to have seen a Rolls Royce Silver Shadow with a hamper full of port in the Wilton carpet-lined luggage area, but also led by the major financial institutions that were once traditional.

Thus, life in London today for most executives in the City is one of enlightened modernity, however there are still signs of the days of yore and its historic all day drinking culture, which has now become the bete noire of even the oldest, and in some cases, most notorious institutions.

Lloyds of London, whose ‘Names’ are often of the elite and share Ernest Hemingway’s views on conspicuous consumption, has now succumbed to the politically correct self-consciousness that now pervades London’s ultra-trendy younger classes.

Whilst Lloyds of London conjures up images of top hats and rolled up umbrellas compared to the Apple Macbook Pros and cloud hosted infrastructure of the movers and shakers of the Square Mile, with the decadent history comes the culture of excess, even during the daytime, Lloyds has sent a memorandum to all employees which instructs the prohibition of consuming alcohol during the daytime because it has led to many disciplinary cases.

Naughty naughty.

The creeping in of the nanny state has been a moot point over the past twenty years and has given rise to the ‘snowflake generation’ which is anathema to the double-chinned bank and insurance magnates of the post-war era who would pop off for a jolly good hunt at weekends and show their staff a stern hand at work whilst clutching a crystal glass half full of single malt in the other.

In a complete counteraction to its traditional culture, Lloyds of London’s memo was met with sarcasm and derision by many gergarious employees.

One particular member of staff asked the firm when an official memorandum would be sent out asking him to “go to bed earlier”, which was rather an amusing jab at the political correctness which is being perceived as nannying, as many City managers expect their employees to work until very late at night.

A further employee has branded Lloyds of London as being the “PC (political correctness) capital of the world”, and of course as can be imagined, this directive has come directly from the Human Resources department, which is the department within most companies where the left-leaning muesli-chompers can be found nodding their heads in agreement with government directives that continue to point out how much of a danger to themselves everyone is whilst going about their everyday business in a very normal fashion.

An interesting reaction to this ban came from a middle management executive at Lloyds of London, who stated that it was not long ago that the company was plying its employees with alcohol at annual events, and that there was very little food to be found but copious amounts of liquor.

This may be a manifestation of the PC-emasculated nadir of the gregarity that makes London’s social life so enjoyable, however an amusing glimmer of hope that it is still alive and well was reported by FinanceFeeds last year, when Scottish game and seafood restaurant Mac & Wild handed a bill totaling more £11,000 to employees of one of London’s investment banks after they dined at the restaurant in Great Titchfield Street, London W1 – the heart of central London’s media district.

Perhaps rather unusually, these particular well-heeled city executives, all of whom were young men, eschewed the array of modern European or Asian delicacies offered by fashionable chef restaurants that now proliferate across London’s elegant and sophisticated Square Mile and Canary Wharf, instead quaffing 10 bottles of Glenrothes 88 Speyside Single Malt whiskey, alongside Irn Bru, a famous Scottish soft drink, haggis and scotch eggs in the rather more traditional surroundings of the West End.

The morning afterwards, FinanceFeeds spoke to Adam Pinder, General Manager of Mac & Wild, who confirmed the £11,000 spend and whose representative then confirmed that the young gentlemen were employees of one of London’s recognized large financial institutions, however it was requested that the firm maintains anonymity.

100 bottles of whiskey to go, please!

At this point, it would most certainly be quite sensible to begin to wonder how some haggis and a few scotch eggs, followed by a classic Chateaubriand (beef steak particular to the Loire-Atlantique region of North Western France), three burgers and a fish pie would amount to £11,000, even with the 10 bottles of Scotch whiskey taken into consideration.

Just before leaving, the bankers ordered 100 bottles of whiskey, and asked to take it away, which took the bill to £10,027.85, which attracted a service charge of £1,253.48 making the total charge £11,281.53.

Whilst the individuals and institution consider that discretion is the better part of valor, all would have likely be revealed to our dear colleagues in London as 100 bottles of Speyside Single Malt are not that easy to disguise, and one or two may have turned up on the desks of those who now know what an expensive night out really is.

With the talk of some firms making the suicidal move to mainland Europe in the coming months (which is basically all talk and will never happen), maybe this is enough to keep London’s finest on the bottle at the thought of having to move from ultra-sophisticated London to a sleepy 19th century European boondock.