Central banks; Ease or observe further?

Fullerton Markets research team takes a look at how the banks from Australia, Canada, UK and Japan are setting rates, and what picks are bullish.

By Wayne Ko, Head of Research & Education at Fullerton Markets

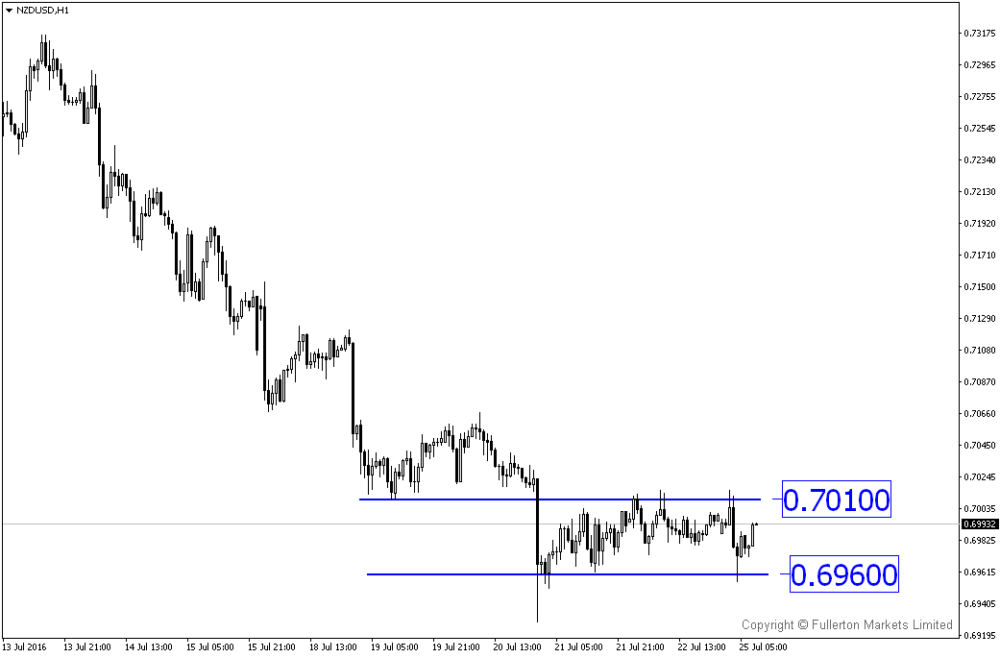

Most of the major Central Banks are looking either to ease further or remain status quo. Royal Bank of New Zealand (RBNZ) displayed clear intention in their latest economic assessment, saying, “likely that further policy easing will be required”. It is highly anticipated RBNZ will cut rate in August.

RBNZ’s closest neighbour, the Royal Bank of Australia (RBA), stated in their latest meeting minutes they are watching economic data to make appropriate adjustment to their policies. A strong Aussie dollar remains a threat to their economic balance and low inflation. Inflation expectations remained below average, increasing the chance of rate cut by RBA in August too.

Smack in the middle of Europe is Switzerland, which market is expecting a high chance of rate cut in September after UK Brexit referendum. BOJ is a long time member of the easing club; we believe it is only a matter of time they announce more stimulus or more accommodating policies.

Last week, ECB announced they would maintain their current policy. They are observing to see if future data shows deterioration before acting. Monetary policy will remain, which will provide some support for the Euro. Deteriorating data will increase expectation of further easing, possibly weakening the Euro.

Bank of England went against market expectation and kept rate unchanged. They are also looking at data to assess the impact of Brexit before taking action. UK’s new PM has indicated she is unlikely to invoke article 50 (to initiate the exit from EU) in the next 2 years. If UK post disappointing data during this period, market may start to doubt whether the outcome of the referendum will be followed through.

The least likely to ease is Bank of Canada (BOC). Although oil prices have been falling from the high in mid June, a healthy US economy should balanced things up. BOC has also maintained their optimism so far. We see a relatively high chance of them keeping their rate unchanged in the near horizon.

US Fed is likely to be the only central bank among the G7 to talk about possibility of tightening. With the Brexit uncertainties still looming and US Presidential election in November, Fed is unlikely to initiate any surprises to stir the market. Fed will announce their rate and FOMC will make their statement this week. Will US Presidential election influence Fed’s decision?

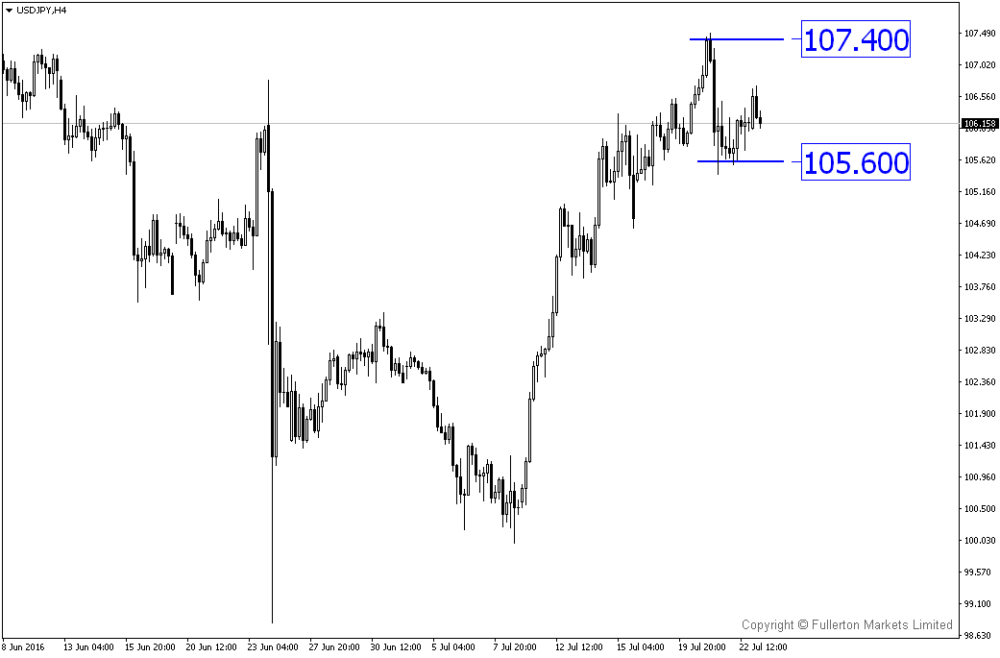

Market will be watching BOJ monetary policy statement and press conference this week. Volatility in the Japanese Yen is to be expected if more stimulus or easing package is announced.

Our Picks

USD/JPY – Slightly bullish. BOJ may announce more easing policy. The downside risk is disappointing policy, which may cause the USD/JPY to fall below the support of 105.60.

NZD/USD – Slightly bearish. Potential rate cut in August will continue to weigh down on the Kiwi. Possible to look for Short opportunities around 0.7010 or after price broke support of 0.6960.

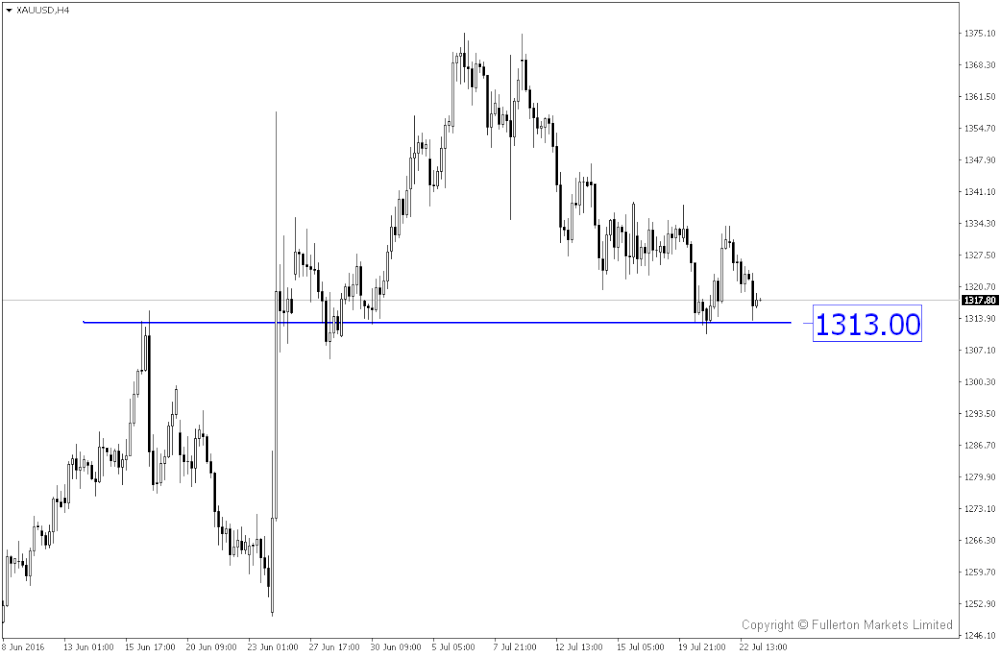

Gold (XAU/USD) – Slightly bullish. No surprises expected from FOMC, Gold is likely to find support around 1313.