CFD & FX Association undergoes changes as new rules loom for UK CFD sector

As new tighter rules are about to reshuffle the UK CFD sector, the CFD & FX Association changes its composition.

FinanceFeeds has sought to keep its readers up to date with the potential consequences from the planned changes to regulations of the UK CFD industry, outlined by the Financial Conduct Authority (FCA) in December last year.

Reactions of leading CFD providers like IG Group and CMC Markets have been made public since, with FinanceFeeds also presenting you with a raft of opinions from industry experts on the topic.

We thought it would be useful to see what’s happening at the CFD & FX Association, especially after a recent report by the Financial Times stated that “a faction within the industry group for retail online trading companies, the CFD & FX Association, is pushing for the trade body to resist proposed regulatory changes”.

Let’s add some history to the name. The Association was incorporated on May 30, 1996 and has previously been known as Sports Spread Betting Association and Spread Betting Association Limited. The company changed its name from Spread Betting Association Limited to CFD & FX Association Limited with effect from October 12, 2015.

Formally, the “nature of business” of the organization is gambling and betting activities. The principal activity of this entity is that of a trade association for firms operating in the spread betting and foreign exchange markets with the objective of promoting the common interests of its members.

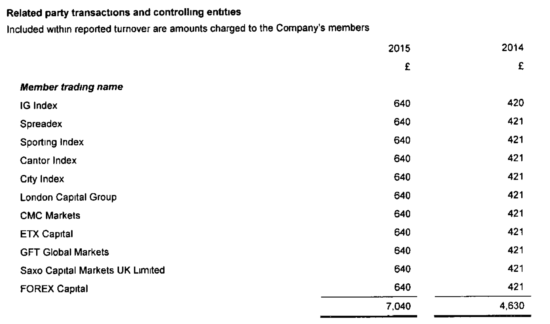

The present status of the member list is unknown to us – the latest “Full Accounts” report by the Association is for the year to June 30, 2015. At that point, the member list included 11 members (see below).

According to a Subsequent Events report by the Association, Cantor Index relinquished its membership on August 6, 2015, whereas Sporting Index abandoned its membership on December 31, 2015. GFT and City Index (for obvious reasons) relinquished their membership from the Association with effect from September 29, 2015 and GAIN Capital was accepted as a member on the same date.

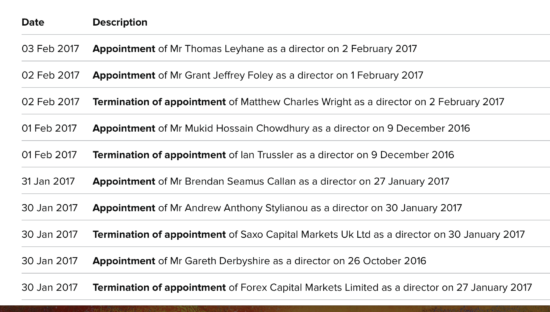

Over the past couple of weeks, the Association has filed a number of reports with the UK Companies House. The reports show a number of changes on the Association’s directors’ list.

Most interesting to us, in light of the recent events in the US Forex market (yes, the exit of FXCM), is the termination of appointment of Forex Capital Markets Limited (FXCM UK) as a director on January 27, 2017. It is worth noting that this decision was made before the US regulators published their findings that showed FXCM US having traded against its clients for a number of years. Drew Niv is not a director of FXCM UK, effective February 9, 2017.

What prompted the change at the CFD & FX Association concerning FXCM UK is yet unknown. We can only speculate whether the US regulatory actions were anticipated in January – but this is mere speculation. One further note – Brendan Callan, who, according to the UK Companies House, is CEO, Forex Capital Markets Limited, is a director of the CFD & FX Association. So, the changes affect FXCM UK as a company but not the individual employees.

Another company to relinquish its place on the director’s list is Saxo Capital Markets UK Ltd. Let’s stress, however, that Andrew Anthony Stylianou from Saxo is on the directors’ list. His appointment as a director of the Association is effective January 30, 2017.

The list of current officers of the CFD & FX Association includes 9 individuals – one secretary and eight directors. Directors are from IG Group, Saxo, FXCM UK, London Capital Group, ETX Capital, CMC Markets, GAIN Capital, and Spreadex.

Obviously, the UK FX and CFD market is now boiling. The next annual report by the Association is due by the end of March 2017 – shortly after the FCA closes its consultation on the proposed changes to the CFD industry.