Chinese IB ticking time bomb: Strict laws prevent transfer of money to FX firms abroad, government hamstrings banks

For brokers with no physical presence in China, relying on overseas transfers from IBs, the days of working with a Chinese IB network may well be well and truly over. For those who thought it through properly, the market is yours!

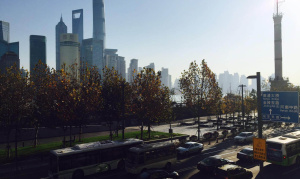

FinanceFeeds will be reporting live from Shanghai this week, and will be investigating this subject at great length to be able to bring you the full details, accurately, directly from the source itself.

As 2017 began, FinanceFeeds reported that one of the most ubiquitous streams of income for retail brokerages could potentially come to an end, that being the reliance on introducing brokers from mainland China.

Any speculation by industry bodies, central banks, liquidity providers and brokerages in the free market nations of the world that China would somehow liberalize its policies and angle them toward allowing overseas business to be conducted more freely has most certainly been quashed last week as China’s communist government set in place new requirements for citizens wishing to convert the yuan into any foreign currency.

The State Administration of Foreign Exchange, the currency regulator, said in a statement which was issued on December 31 2016 that it wanted to close loopholes exploited for purposes such as money laundering and illegally channeling money into overseas property.

While the regulator left unchanged quotas of $50,000 of foreign currency per person a year, citizens faced extra disclosure requirements from January 1 this year.

The new rules stipulate that customers of firms that need to send money abroad must give reasons for doing so, including having to pledge to the government that any money sent abroad won’t be used for overseas purchases of property, securities (including online trading), life insurance or investment-type insurance. While such rules aren’t new, citizens previously didn’t have to sign such a pledge.

FinanceFeeds believes that pretty much nobody will flout this rule, because if an individual or company executive signs a form to show what the funds are for, and then it transpires they have been used to buy securities or fund an overseas account against the terms signed for on the pledge, the government will not litigate as they do in other nations, but instead treat it as a criminal matter, and given the Chinese respect for law and order and the unwillingness of any citizen to go against the government, this law will be taken very seriously indeed.

Today, the Chinese government took a further step, that being to instruct SAFE, which is part of the People’s Bank of China, itself a government owned entity, has instructed banks not to reveal its role in any capital control or outflow restrictions, which will likely be damaging to clients because the bank is now unable to explain why they have to turn their business away – in short, why they refuse to transfer funds overseas for the purposes of any of the restrictions, one being transferal of funds to FX brokerages.

One of the main commercial tugs-of-war has been that whilst mainland China is a vast and highly attractive place in which to do business, with eager retail traders that often have enormous property portfolios generating long-term investment potential whilst trading the monthly rents from said properties on the extremely liquid currency market, all loyal to regional introducing brokers (IBs) which themselves are more like large brokerage firms, while at the same time the entry barriers are high because of the inability to gain any transparency with regard to any metrics in China, and the Chinese government policy of blocking the vast majority of internet sites, payment channels and connections with the non-Chinese world.

Yet on the other end of the virtual rope is the closed nature of the Chinese business environment, with the government’s watertight firewall blocking and monitoring domestic business and its (heavily frowned upon) relationship with the free world.

SAFE’s reticence began at least as far back as August, when its Shanghai branch called at least 20 of the major foreign and domestic banks operating in the city to a meeting with the regional heads of several SAFE departments.

A representative from an international bank attending the meeting said there were no written instructions, but a high-ranking SAFE official told them explicitly what was expected of them.

“You must control your forex deficit, but you can’t say that SAFE is controlling capital outflows,” the official told the bankers.

The banks were told to “manage sentiment” to prevent public panic, the banker said, and the banks’ research analysts should not broadcast any negative views on the yuan.

“They told us not to publish bad house views – analyst house views – on the yuan”, stated the representative yesterday.

In a verbal order to at least two major Chinese banks, SAFE said it would vet all cross-border money transfers worth $5 million or more, down from $50 million, banking sources told Reuters in late November.

Bearing in mind that many FX firms have large joint ventures and IB agreements with Chinese entities and in some cases use omnibus accounts to transfer bulk sums on a monthly basis, this will be very problematic indeed.

The regulatory authorities also told the banks to interview clients to make sure the forex deals were not for fake transactions, or else face punishment, according to two bankers at separate listed banks.

In response to those orders, one of the banks sent an internal notice to employees, seen by Reuters, to alert them to SAFE’s requirements, explaining that the regulator’s penalties could include “cancelling business qualifications” needed for the bank to conduct overseas transactions which involve sending funds out and converting them to a different currency to be received by a bank or entity (FX firm or similar) abroad.

Bearing in mind that many firms have made substantial inroads into China, and the ones doing it the right way have actually put themselves on the ground in mainland China, using local knowledge. Blackwell Global’s massive IB network is a case in point, as is the huge market share FXCM and FXDD have managed to engender, all using locally based executives which look after that particular region, from that particular region.

A visit to the vast majority of large IBs from Shenzhen to Zhengzhou, or Guangdong to Chengdu will reveal Chinese-language brochures from these firms marking them out as the brokerages of choice, however business for firms without Chinese footprint of any kind is now likely to become somewhat difficult indeed.

It was always a chance that smaller brokers took.

They did not have the capital or the will, and in some cases acumen to go into China properly and forge long term joint ventures with Chinese partners by founding and establishing Chinese mainland branches of their business.

The large companies that have succeeded in China have done this properly, and as per the cases of FXCM, BMFN, Blackwell Global, Saxo Bank and FXDD, these are companies that have approached it correctly and will be able to carry on their business from within China without any difficulty at all.

The firms that managed to gain a few deposits from Chinese IBs without making the actual effort of understanding how to sustain business there, knowing in the back of their mind that one day this will be stopped, are now likely to find that that day has now come.