What clients want from a Prime of Prime

“By ignoring the retail brokers that are “Prime of Primes” purely for the purpose of marketing themselves, we find that there are only a few remaining who are offering real Prime of Prime services” – Natallia Hunik, Global Head of Sales, Advanced Markets & Fortex

Prime of Prime in FX has undergone a lot of changes in the past few years, yet it remains one of the most highly demanded services in today’s marketplace. Prime of Prime’s role is to extend interbank market access to clients who do not have access to credit.

To put it another way, it helps create direct market access for those clients who do not meet the stringent collateral and credit criteria that’s needed in order for them to establish their own, direct, prime broker relationship with a bank. The main value that a real Prime of Prime delivers is non-latent access to institutional trading, in a secure and regulated environment.

Currently, there are a number of firms appearing in the market with the word “Prime” in their name, but beware, all is not as it seems. Anyone can use the word Prime and promise that they’re a real “Prime of Prime” but in reality very few are, and even fewer can actually deliver on those promises.

Just look at the recent “STP” phenomena where countless retail brokers claimed that they offered STP accounts with extremely low spreads, high leverage and deposit bonuses, which we all know is a complete misnomer. A similar pattern is happening with Prime of Prime where retail brokers, without a Tier 1 bank prime broker relationship, are creating “Prime” brands in an attempt to capture some of the more sophisticated clients.

By ignoring the retail brokers that are “Prime of Primes” purely for the purpose of marketing themselves, we find that there are only a few remaining who are offering real Prime of Prime services. Among those who actually have access to Tier 1 Prime Brokers, there are even fewer actually sending trades to the market; instead they are internalizing their flow.

it is evident that, due to the mixed messages coming from all sides, there is a general lack of understanding about Prime of Prime; what it is supposed to accomplish and when you may need one.

Essentially, here is the formula I’ve outlined for the truly successful prime of prime:

Real Prime of Prime = B2B + PB + Reliable Technology + STP

1) Ideally, the prime of prime is B2B-only, to avoid any conflict of interest between the broker and its prime of prime liquidity provider.

2) A real Prime of Prime needs to have a Tier 1 Prime Brokerage relationship – (example: Advanced Markets is primed by UBS AG)

3) Reliable technology – Is the vendor dependent on 3rd party technology? If so, which one? (You may want to conduct due diligence on the vendor separately). Do they have their own technology? As a client, some of the key things that you should be looking for from the technology are stability, scalability and robustness.

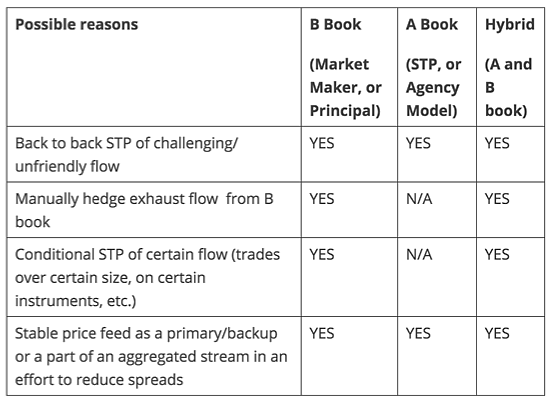

4) A real Prime of Prime must be STP-only (straight-through processing) indicating that they will be actually sending your trades directly to the market and not managing all, or some, of the risk in-house.(the whole point of entering into a prime of prime relationship).

Why does a retail FX broker have a need for a prime of prime?

What are brokers and asset managers looking for in their Prime of Prime partner’s offering?

Ideally, clients (retail FX brokers, asset managers, family offices) should be looking for a prime of prime that can address their needs and solve their problems, but also add value and help scale and grow their business.

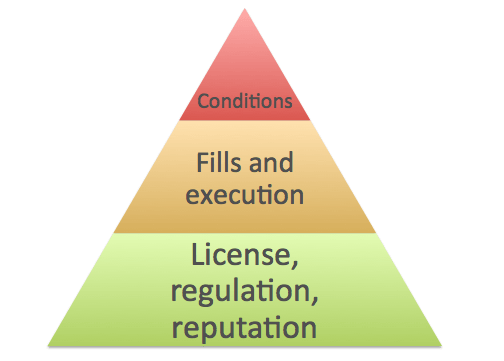

Before starting a relationship with a prime of prime/liquidity provider, the broker should be looking for a reliable, reputable, licensed partner in order to, first, ensure the safety of clients’ money. As we all know, history is the best predictor of the future, so it is imperative that the company has a clean track record and an impeccable reputation.

Quality of fills, execution, price feed stability and overall trading conditions are on the list of priorities for FX businesses when selecting a PoP partner.

Often times, clients make the mistake of evaluating an offering based on spreads and commissions and end up being misled into believing that they can get fills at the advertised prices. Many “quasi” prime of primes are offering tight spreads that turn out to be only applicable for tiny trade sizes and often requotes, rejects and slippage make the total overall spread cost significantly higher than advertised.

In conclusion, a knowledgeable prime of prime will engage in an educational conversation, by demonstrating use cases on how the offering is structured, its benefits, infrastructure specifics and delivery methods.

The professional team at the prime of prime brokerage will not pressure the prospect, or try to lure them in using price dumping or heavy discounts, but will instead listen to them and help tailor a solution to their issues and needs.