Collateral Damage: FXCM’s Robert Lande, Eduard Yusupov have no current NFA status

Although the US regulators did not punish all of FXCM’s principals, the ban on the broker has affected at least a dozen of individuals, including Robert Lande and Eduard Yusupov.

One of the ways to gauge the severity of a regulatory action is not to look at the action itself but at its consequences. In the case of Forex Capital Markets LLC, which has been barred from membership in the United States National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), we see that the action was severe – as the extent of the consequences of the settlements between the broker and the US regulators gradually becomes apparent.

On March 10, 2017, the US NFA implemented the permanent bar against Forex Capital Markets LLC. Just a day before that, Drew Niv and William Ahdout, who were also punished by the US regulators, withdrew from their NFA and CFTC memberships.

The move by the US regulators, however, has indirectly affected at least a dozen other FXCM principals. A couple of notable examples are Robert Lande and Eduard Yusupov, both of whom are known figures in FXCM Inc, now renamed to Global Brokerage Inc (NASDAQ:GLBR). Suffices to say that both these individuals were mentioned in the management ranks in 2010 when FXCM went public. Although they are not targeted by the US regulatory action dated February 6, 2017, they felt its impact.

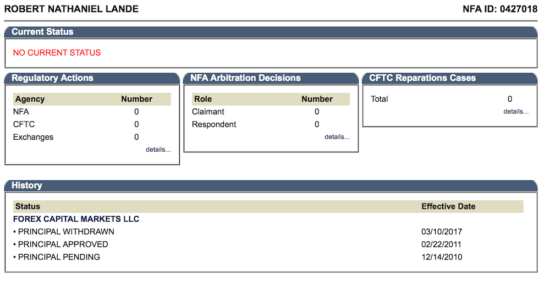

Following the implementation of the permanent bar against Forex Capital Markets LLC, the NFA database shows “No current status” against the name of Robert Lande. Effective March 10, 2017, his registration as a principal of Forex Capital Markets LLC is withdrawn.

According to recent reports by FXCM, concerning the management structure of Global Brokerage Inc and FXCM Group, Robert Lande, Chief Financial Officer of Global Brokerage, Inc., is on the six-member Board of Directors of FXCM Group. In terms of legal matters, Mr Lande’s name is mentioned along with that of Drew Niv in at least three cases – brought up by the Rosen Law Firm, Pomerantz LLP and Levi & Korsinsky, with regards to US regulatory findings against FXCM from February this year.

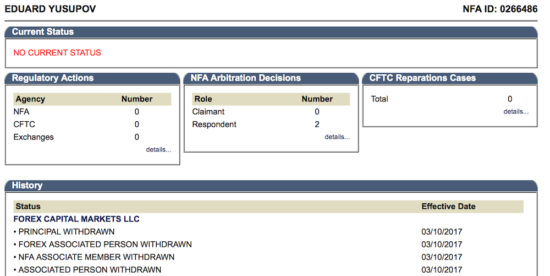

With effect of March 10, 2017, Eduard Yusupov, who has been Chief Dealer and Managing Director of FXCM since 1999 and is one of the original founding partners of the firm, has no current NFA status either. The registrations as principal, Forex associated person, NFA associate member and associated person have been withdrawn.

The most recent transaction in FXCM shares by Eduard Yusupov (Global Head of Dealing and and Managing Director) reported to the Securities and Exchange Commission (SEC) is dated January 3, 2017.