CySEC proposes sweeping changes for binary options industry regulation

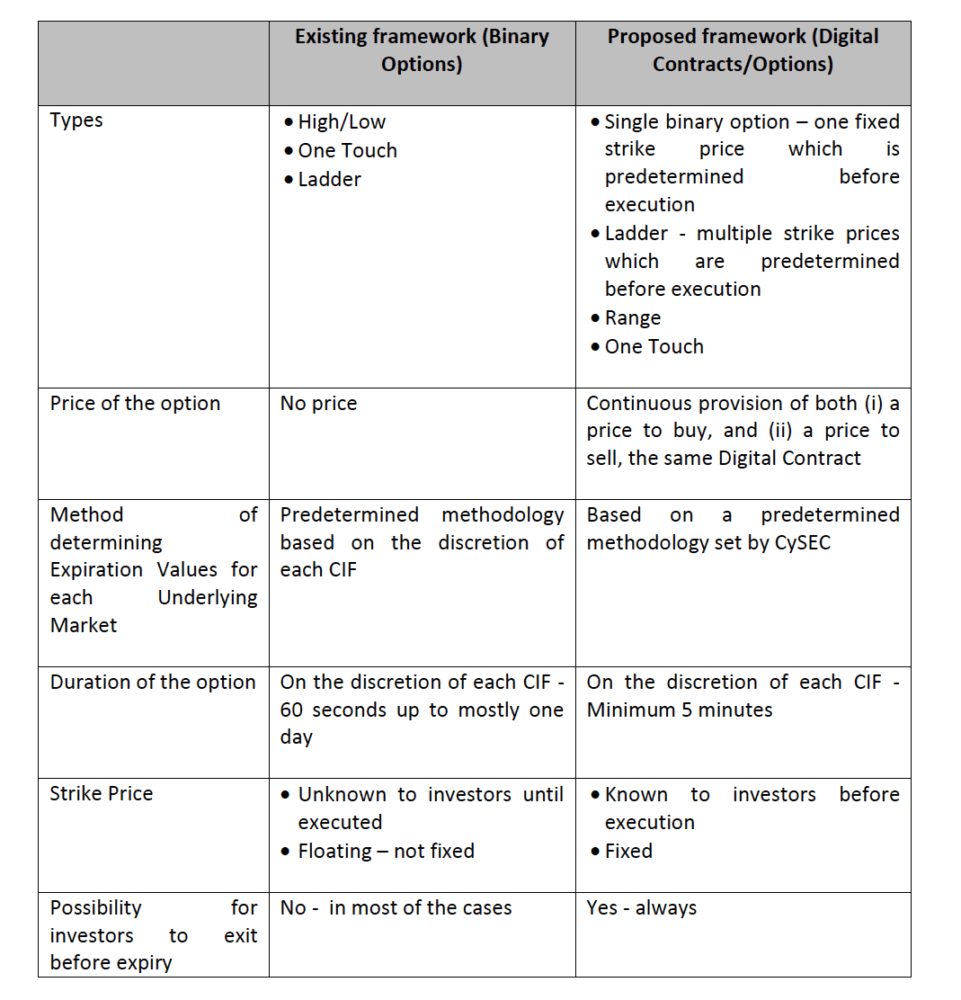

Tenor of binary options should be at least 5 minutes, with investors to be able to exit before expiry.

Cyprus was one of the first jurisdictions ever to treat binary options like financial instruments and to offer binary options brokers the opportunity to get investment firm licenses.

Lately, however, the binary options industry has been under fire by regulators owing to increased number of fraudulent entities, with Cyprus also affected. The most recent example is the folding of operations of Banc de Binary.

Earlier today, the Cyprus Securities and Exchange Commission (CySEC) made a move towards changing regulations for Cyprus Investment Firms (CIFs) offering binary options. The regulator has published a Circular with a raft of proposed changes to regulations, aimed at reforming the obligations of binary options brokers so that CIFs will “meet their obligations in acting in the best interest of their clients”.

The changes are vast and cover trading methodology, reporting, as well as the nature of binary options that can be offered.

CIFs must make clear a number of Contract Parameters to clients, before any digital contract’s tradeable period begins, including Underlying Market, Expiration Time, Strike Price(s), Put or Call (in case of Simple Digital Contracts), Style of Digital Contract (American Style or European Style). This information should be clearly presented to the client on the firm’s electronic trading platform. Interestingly, CySEC says that “options terminology should be avoided” – this is, of course, in situations where a plain language alternative is possible.

A series of changes concern the communication of general trading methodology. Thus, a CIF must publish on its website the specifications of all Contract Series routinely offered. If a CIF offers Digital Contracts which have an individual equity, an index of individual equities or a derivative contract as an Underlying Market, the identity of the Information Provider used to obtain prices used for the calculation of Expiration Values in each Underlying Market should be disclosed too. A CIF should also publish the details of the algorithm used to calculate each Valid FX Rate from the relevant streaming quotes produced by the relevant Recognised FX Providers, where a CIF offers Digital Contracts which have a spot FX rate as an Underlying Market.

Graphs in the trading platforms must be accurate, clear and understandable to the clients.

Historical records of the Expiration Values for each Underlying Market should be accessible to clients in a specific section of the trading platform or a relevant link referral to the website of the CIF.

Some binary options types will no longer be acceptable. The Tenor must be for a period of at least 5 minutes.

The Strike Prices must be fixed for all Digital Contracts within a Contract Series, and displayed electronically to clients, at least 10 seconds prior to those Digital Contracts entering their Tradeable Period.

CIFs will be required to store details of every calculated Expiration Value, including every Input Price (valid and invalid), for a period of 5 years after calculation. Also, in order to secure price transparency all Digital Contract prices must be presented in a two-way Pricing Format, with a bid and an offer with identical “good-in” size, and must be continuously tradeable by clients throughout each Digital Contract’s Tradeable Period.

Those willing to submit their opinion can do so until March 3, 2017.