Drew Niv is still Director at FXCM UK Merger Limited – official data shows

Either UK authorities are too slow to reflect management changes in their official records, or Drew Niv is indeed still a director at FXCM UK Merger Limited.

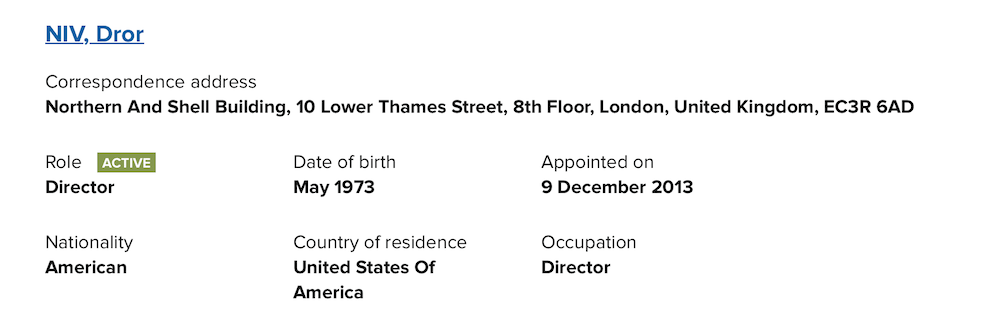

Following settlements with US regulators in February this year, Dror (Drew) Niv has attracted even more attention than ever. Mr Niv has abandoned a raft of management roles in the US and the UK since, but FinanceFeeds’ check has shown that he remains on the list of Directors of FXCM UK Merger Limited.

FXCM UK Merger Limited has significant control over Lucid Markets Trading Limited. As per the latest report available, FXCM UK Merger Limited’s ownership of shares in Lucid is more than 50% but is less than 75%. The same goes for voting rights.

Given that effective March 10, 2017, Drew Niv and William Ahdout are no longer directors of Lucid Markets Trading Limited, it will not be surprising if Mr Niv abandons the Director role in FXCM UK Merger Limited too. For the time being, however, his name is on the list of directors of the company. This means that either the UK authorities are slow to reflect the management changes that the company has already possibly reported, or Mr Niv is here to stay.

The latter possibility seems quite unlikely, especially after Mr Niv’s status on the UK Financial Services Register turned “inactive” on February 15, 2017, as he left Forex Capital Markets Limited (FXCM UK).

On February 21, 2017, Mr. Dror Niv resigned from his positions as a member and Chairman of the Board of Directors of FXCM Inc. and as the Chief Executive Officer of FXCM Inc., effective upon the appointment of his successor. In the meantime, FXCM Inc has changed its name to Global Brokerage Inc (NASDAQ:GLBR).

In March this year, the US National Futures Association (NFA) implemented a membership bar on Mr Niv and Mr Ahdout and Forex Capital Markets LLC. As of March 9, 2017, Mr Niv and Mr Ahdour abandoned their NFA registration as listed principals of Forex Capital Markets LLC. One day later, the NFA database showed that Forex Capital Markets LLC had a principal permanent bar and an NFA member permanent bar against its name. On March 10, 2017, FXCM had six US registrations withdrawn, including (inter alia) the ones as Forex Dealer Member, Forex Firm, Retail Foreign Exchange Dealer, and Futures Commission Merchant.

According to the latest annual report by Global Brokerage Inc, FXCM UK Merger Limited is amid the significant subsidiaries of Global Brokerage Holdings, LLC (f/k/a FXCM Holdings, LLC).