Drew Niv, William Ahdout continue to abandon director roles

Effective March 10, 2017, Drew Niv and William Ahdout are no longer directors of Lucid Markets Trading Limited.

FinanceFeeds keeps exploring the fortunes of FXCM’s non-US businesses, following actions by US regulators that led to a permanent bar on the broker and several of its principals from membership in the United States National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC). We are particularly interested in what’s going on at FXCM’s UK business, given that Brendan Callan has become an interim CEO of FXCM Group and that the brokerage seems to be focusing its operations on this business.

Drew Niv has already left his director role in Forex Capital Markets Limited (FXCM UK), as well as his position as a partner at Lucid Markets LLP. The latter, as FinanceFeeds has explained in detail in a separate article, is an electronic market maker and trader in the institutional foreign exchange spot and futures markets, headquartered in the UK. The FCA register shows that the status of Mr Niv is “inactive”.

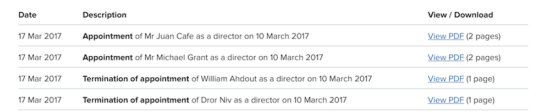

According to the latest regulatory reports, Mr Drew Niv also resigned as a director of Lucid Markets Trading Limited, a company that is on the list of directors of Lucid Markets LLP. The change is effective March 10, 2017.

On the same date, Mr William Ahdout also resigned as a director of Lucid Markets Trading Limited.

The duo is replaced by Michael Grant and Juan Cafe, who are appointed as directors at Lucid Markets Trading Limited also with effect of March 10, 2017.

This is hardly surprising given that Mr Niv and Mr Ahdout abandoned their NFA registration as listed principals of Forex Capital Markets LLC, as of March 9, 2017. One day later, the NFA database showed that Forex Capital Markets LLC had a principal permanent bar and an NFA member permanent bar against its name. On March 10, 2017, the company had six US registrations withdrawn, including (inter alia) the ones as Forex Dealer Member, Forex Firm, Retail Foreign Exchange Dealer, and Futures Commission Merchant.