After Drew Niv, William Ahdout’s FCA register status goes “inactive” too

Effective March 16, 2017, Mr Ahdout is no longer a partner at Lucid Markets LLP, thus becoming “inactive”, according to the UK FCA register.

Former executives of FXCM, whose US operations were slammed by US regulators in early February this year, resulting in a permanent ban from membership in the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) for the broker and several of its principals, continue to shed top roles.

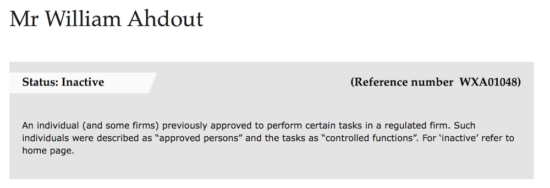

According to the latest information in the Financial Services Register managed by the UK Financial Conduct Authority (FCA), the status of William Ahdout, one of the ex-principals of FXCM US punished by the US authorities, is “inactive”.

Mr Ahdout was assigned such a status after having relinquished his position as a partner at Lucid Markets LLP. The move is effective March 16, 2017.

The change is barely surprising to those who monitor the developments around FXCM’s businesses following the US regulatory action in February 2017. Drew Niv has already abandoned his director role in Forex Capital Markets Limited (FXCM UK), as well as his position as a partner at Lucid Markets LLP. The latter, as FinanceFeeds has elaborated in a separate article, is an electronic market maker and trader in the institutional FX spot and futures markets, based in the UK. The FCA register shows that the status of Mr Niv is “inactive” too.

Moreover, as per FinanceFeeds’ recent report, Mr Niv and Mr Ahdout resigned as directors of Lucid Markets Trading Limited, a company that is on the officers’ list of Lucid Markets LLP. The change is effective March 10, 2017.

Just a day before that – on March 9, 2017, Mr Niv and Mr Ahdout abandoned their NFA registration as listed principals of Forex Capital Markets LLC. Meanwhile, the NFA database displayed a principal permanent bar and an NFA member permanent bar against the name of Forex Capital Markets LLC. On March 10, 2017, the company had six US registrations withdrawn, including (inter alia) the ones as Forex Dealer Member, Forex Firm, Retail Foreign Exchange Dealer, and Futures Commission Merchant.