Exclusive: Leverate launches payment service as integrated or stand-alone solution

Payment solutions providers have traditionally come from other industry sectors. This week, broker solutions provider Leverate launches a payment solutions service uniquely for the brokerage business.

A matter of high importance that has been a major concern for retail FX brokerages for quite some time centers around the methods by which retail traders can fund their trading accounts.

Cross-border payment transactions are less of a concern for merchant services providers than they are for FX firms, largely due to the combination of the financial markets’ business nature, as well as the risk management that has to be implemented to ensure safety of client funds whilst they are in the custody of a brokerage.

Additionally, regulatory stringency has borne down on how client funds are handled, with compliance departments of both the merchant services providers and brokerages applying close scrutiny to the origin of funds.

Today, with the sole funding methods of FX accounts being either via bank transfer or by credit card, payment service provision is paramount.

What are the options?

Until now, algorithmic payment aggregation services, which have been established as part of an electronic payments ecosystem that is largely dedicated to the electronic trading industry, have become a de facto choice for retail brokerages, especially since the demise of less transparent services such as Liberty Reserve, which for a long period of time was the payment method of choice in emerging markets with less well-established financial markets infrastructure.

The demise of services such as Liberty Reserve has caused the regulators and merchant services firms to take even further risk management measures, however nowadays another matter of importance has arisen.

Whilst the existing payment service providers are in widespread use in the FX industry, there has not been an FX brokerage technology solutions provider thus far that has provided a dedicated payment processing system which can be made part of a full broker service solution or provided as a standalone product.

Until now

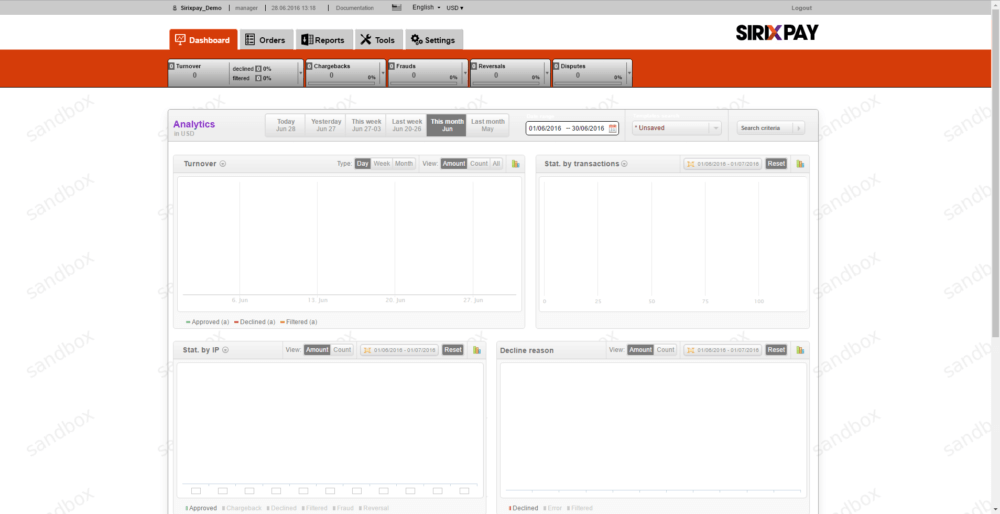

Today, here at the head office of Leverate in Tel Aviv, Israel, FinanceFeeds took a comprehensive look at the new SIRIXPay system, which is a specialist payment aggregator and payment solutions provider specific to the brokerage industry.

A differentiating factor between this solution and those in current operation within the industry is that its origins lie in the FInTech sector that Leverate operates within as one of the largest and most widely recognized end-to-end solutions providers, rather than having its roots in the affiliate marketing, gaming and adult entertainment industry.

Industries such as the adult entertainment industry, gambling or lead acquisition have been categorized as “high-risk” and therefore many traditional PSPs stray away from providing payment processing service to these sectors, leaving them with little choice for acquiring customer’s funds.

SIRIXPay will be provided as part of a full, all-in-one solution or as an independent payment provision to existing brokerages with either proprietary technology or a third party system from another technology provider.