FCA customer complaints report: London’s FX industry displays excellent ethics

The Financial Conduct Authority (FCA) has published a report regarding customer complaints in H2 2015 revealing a drop by 1.4% in a total of 2.11 million, with general insurance and pure protection accounting for 59%, while banking and credit cards representing 32%, home finance with 4%. Decumulation, which is the process of converting pension savings to […]

The Financial Conduct Authority (FCA) has published a report regarding customer complaints in H2 2015 revealing a drop by 1.4% in a total of 2.11 million, with general insurance and pure protection accounting for 59%, while banking and credit cards representing 32%, home finance with 4%.

Decumulation, which is the process of converting pension savings to retirement income, accounted for 3% of total complaints, and the investment sector amounted to 2% of all complaints (broken down to personal investment (1%) and investment management (1%).

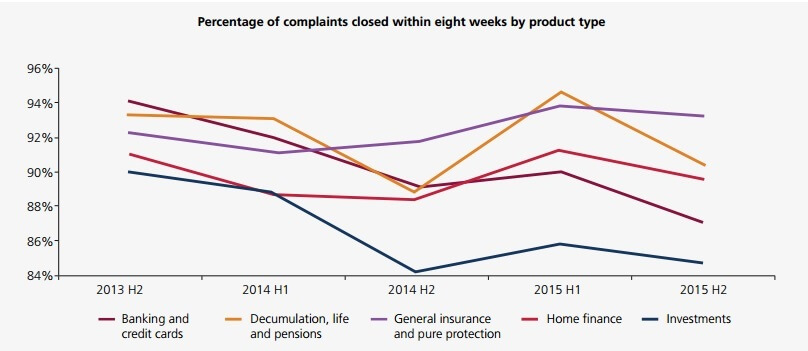

While complaints regarding investment products proved to be a very small fraction of the total reported by the FCA, these products are the most complex and hardest to close within eight weeks. The rate of closure has been dropping from 90% since 2013 H2, and seems to be stabilizing between 84% and 86%.

A particular point of interest with regard to the FCA’s statistics in this report is that FX firms on the retail and institutional side of the business fared the best in terms of their commercial etiquette, with absolutely no FX firms having been the subject of concern in any area, reinforcing London’s position as a bastion of good business practice, especially toward customers.

Source: FCA

The number of investment related complaints has been in an upward trend between 2010 H1 and 2015 H1, but the last semester saw a drop by almost 20% (9,107) in 2015 H2 to 36,963.

This includes a 15% fall in complaints related to PEPs/ISAs (excluding cash ISAs) to 11,848 and a continued decline in complaints related to investment bonds, to 6,202 in 2015 H2 from a high of 12,306 in 2011 H1. However, this goes in line with the drop in the sale of investment bonds and continued low investment bond yields over the same period.

Given that the first half of 2015 (from January to June) saw complaints declining by 54%, today’s news are not as cheerful, but point to a continuation. Christopher Woolard, Director of Strategy and Competition said:

“It is positive to see that the longer term reduction in the volume of complaints has continued into the latest period. Firms seem to have taken on board our previous feedback on levels of complaints and we are slowly seeing firms address these issues, however, firms still need to do all they can to reduce complaints and ensure that they are working in the best interests of consumers.”

When it comes to investment products, HSBC Bank Plc saw complaints rising from 2,759 (H1 2015) to 3,007 (H2 2015), as well as Barclays Bank Plc, from 2,759 to 2,880. On the other hand, the number of complaints dropped for the following companies: Equiniti Financial Services Limited, at 1,567 (from 1,626), and The Prudential Assurance Company Limited, at 1,212 (from 1,532).

Santander UK Plc had the sharpest drop in complaints, coming from 4,375 to 1,375, approximately a third. Having been rated the worst bank in the UK for customer service frequently, the firm has been tackling many issues as it considers an initial public offering (IPO) since 2014, pending until further notice while market conditions prove to be stormy.