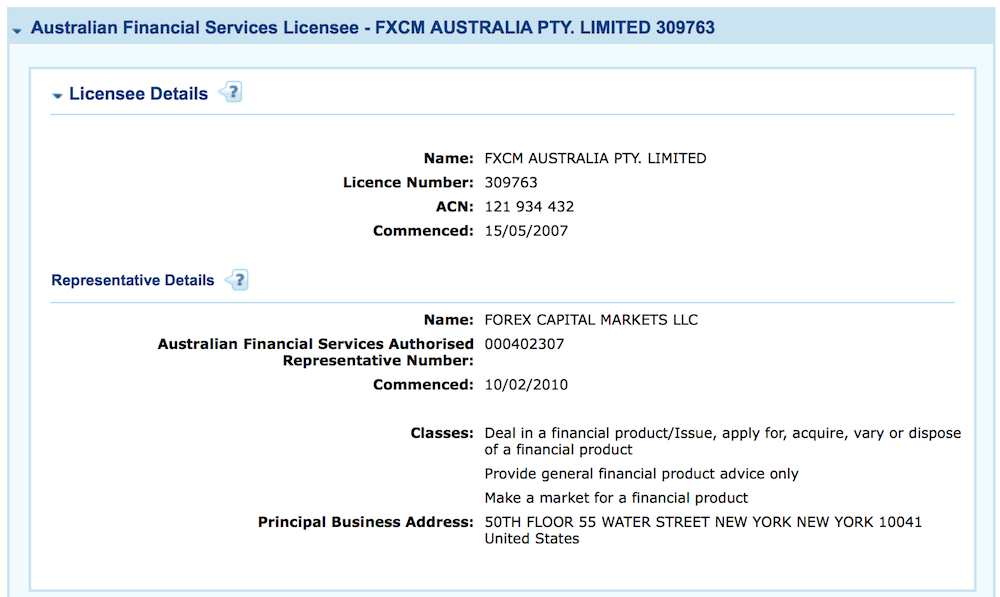

Forex Capital Markets LLC still on Australian Financial Services Authorised Representatives list

About a month after the US regulators announced they will permanently bar Forex Capital Markets LLC, the latter is still an Australian Financial Services Authorised Representative.

About a month has passed since the United States National Futures Association (NFA) and the United States Commodity Futures Trading Commission (CFTC) published their findings into practices used by Forex Capital Markets LLC that misled the regulators and the broker’s customers about the company’s trading and reporting practices. During this time, there have been numerous changes at FXCM, including restructuring, the change of name of publicly listed FXCM Inc to Global Brokerage Inc (NASDAQ:GLBR), management reshuffle…

While FinanceFeeds keeps informing you of the latest developments around FXCM, we cannot skip the fact that non-US regulators are silent about FXCM. The public is kept uninformed on whether there are any investigations going on currently with regards to FXCM and whether there will be any at all. It could be that non-US regulators will simply repeat the pattern displayed by their US counterparts and turn into what an FXCM attorney once called “the dog that didn’t bark”.

What is even more remarkable is the slow reaction (if any) by some regulators to changes to which they should react. Such appears to be the case in Australia.

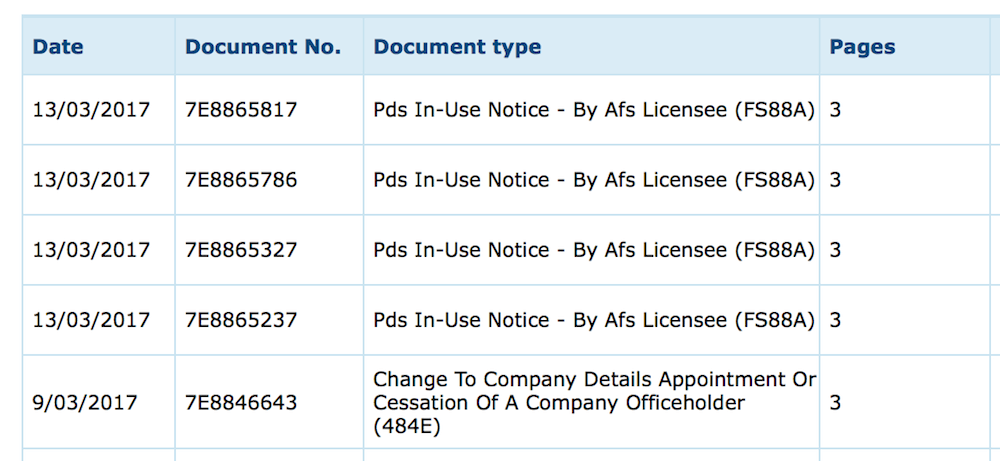

According to FXCM itself, its Australian business, like all other non-US subsidiaries, continues its business as usual. The ASIC Connect system shows indeed that all is fine with FXCM Australia’s authorization. One thing to note – since March 9, 2017, the company has posted five documents with the Australian Securities & Investments Commission (ASIC), including one concerning “Change To Company Details, Appointment Or Cessation Of A Company Officeholder”.

Access to these documents is limited – certified copies cost certain sums, require payment by credit card only and are sent only to people with physical addresses in Australia by post. How fast and easy is that?

Nevertheless, what transpires through the latest set of documents filed by FXCM Australia is that the company is duly informing the regulator about changes going on.

What about the regulator?

ASIC Connect still shows that Forex Capital Markets LLC, the company which was punished by US regulators, is an Australian Financial Services Authorised Representative. This happens more than a month after US regulators said they would permanently bar the company from membership. Moreover, the US NFA implemented the permanent bar on Forex Capital Markets LLC on March 10, 2017.

ASIC shows no reaction.

Of course, the regulator may refer to the period of 30 days given to any AFS licensee that decides to terminate an authorization of a representative. The report of the cessation should be made through ASIC Connect. It seems that FXCM Australia is filing the necessary reports… But there is no change in the system.