FSCS to levy UK financial services industry GBP 378m in 2017/18

“The £378m indicative levy represents the costs of protecting people”, says FSCS Chief Executive, Mark Neale.

The Financial Services Compensation Scheme (FSCS), the UK body that protects consumers when authorised financial services firms fail, today publishes its Plan and Budget for 2017/18.

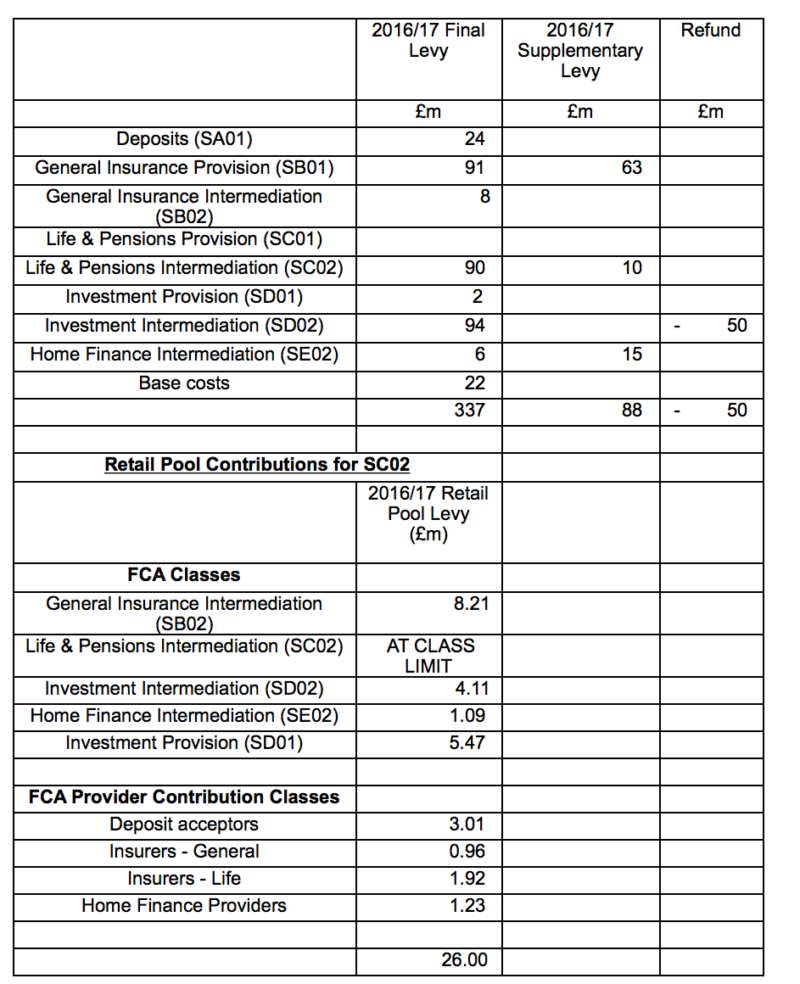

The FSCS expects to levy the financial services industry industry GBP 378 million, down from GBP 401 million in 2016/17. Including the 2016/17 supplementary levies announced today, the total forecast levies for 2017/18 are lower than this year.

The supplementary levies for 2016/17 affect life and pensions advisers, general insurers and mortgage advisers, and are set to meet unforeseen compensation costs.

The supplementary levies are as follows:

- General insurance provision (GBP 63 million);

- Life and pensions intermediation (GBP 36 million);

- Home finance intermediation (GBP 15 million).

Investment advisers will get a GBP 50 million refund for 2016/17 due to a surplus of GBP 60 million on the Investment Intermediation class reflecting lower than forecast claim volumes. FSCS Chief Executive, Mark Neale comments that the FSCS will retain GBP 10 million of the forecast surplus in case of unforeseen compensation costs.

After a rise in claims this year, for next year, the FSCS forecasts that the overall number of new claims will decline. One exception is the the life and pension intermediation sector, where FSCS expects the rising trend in complex claims to continue.

The total of FSCS management expenses, the cost of running the Scheme and of paying claims, is projected at GBP 69 million, which is GBP 1.8 million higher than in 2016/17.

“The Financial Services Compensation Scheme is there for people with nowhere else to turn when firms fail. So the £378m indicative levy represents the costs of protecting people. That protection generates consumer confidence and contributes to financial stability” – FSCS Chief Executive, Mark Neale.

The FSCS became the focus of the retail FX and CFD industry in the UK after the “Black Thursday” event in January 2015, which led to the failure of Alpari UK and LQD Markets UK. According to the latest report by KPMG, Special Administrators of Alpari UK, covering the period to July 18, 2016, “to date FSCS has taken assignment of 12,251 client claims and has paid compensation of USD 51.3 million to 11,751 clients.” Regarding LQD Markets UK, the administrators from RSM updated in August last year that at that point they had agreed 553 clients’ claims totalling approximately USD 4.38 million. These claims had been sent to the FSCS.

FSCS estimates that it has come to the aid of more than 4.5 million people, paying out GBP 26 billion since 2001.