FX liquidity will always be solely centered in regions of political stability – Op Ed

…..and that means just five places: Britain, North America, Singapore, Australia and remarkably, China

France. A country with a longstanding enviable lifestyle, a sophisticated culture that dates back several generations and encompasses fine wines, gourmet cuisine and regional specialties.

A nation of not only high epicurean standards but also of sophisticated lifestyle choice, whether it be the haute couture of Cannes, the apres-ski social scene of Courchevel, the fashion centric Paris with its famous boulevards and art galleries, or the chic Loire-Atlantique villages in which local produce is revered and bicycles with wicker baskets carry fresh bass from the coast of the Charente-Maritime region, home made tartare, and local Muscadet wine, the mandatory baguette protruding from said basket in order that the village square will be an array of fine local fayre later that day.

French society is one of art, ingenuity and laisse-faire trendiness, too, but where is the financial markets economy and its associated technology sector? One can hear les mauvaises herbes blowing across the Massif Central every time there is mention of any significance of Europe’s jewel in the crown of refined civilization.

The reason is quite simple. Whilst everyday life in France is respected and admired by all nations, the country’s political and economic structure is as organized as Serge Gainsbourg’s whiskey cabinet.

Disorder vs absolute organization – The FX industry will always gravitate toward the latter

Perhaps it is a hangover from the revolution, a moment which changed French society from the ground up, however some activities that would alarm the global senior executive board members of the large interbank FX dealers are commonplace and do not require any form of investigation.

Whilst Hong Kong’s corporate sales divisions of Asian or Western banks spend their Thursday evenings in commercial hospitality boxes at Happy Valley Racecourse sipping champagne which has been ironically imported from France, refining their business relationships and conducting discussions on how to build greater prime brokerage integrations and distribute liquidity to retail brokers in the most efficient method possible technologically and in terms of capitalization, along with their electronic communication network (ECN) counterparts most of which are Asia Pacific-facing branches of western companies (Thomson Reuters FXall and Currenex both have offices in Hong Kong), the French ‘workforce’ downs tools at 5.00pm, goes home and then puts the shutters down whilst the skies of Paris, Lyon, Toulouse and Marseille are alight with the combusting contents of Molotov cocktails and anti-capitalist riots.

…Or race riots, or militant trade union action which grinds the entire country to a halt, or parades of hippies wantonly smashing the property of small business owners, or the vigorous waving of placards by bearded soap-dodgers calling for the ousting of yet another president who does the math and realizes that a 30 hour working week, two month summer vacation and a national debt of 300% of GDP (US = 57%, China = 5%, Mexico = 4.5%) is not sustainable and the only way out of the mire is to work harder.

France, therefore, is never going to be a mainstay in any financial markets economy. Instead, it is a socialist country whose militant trade unions are bolstered by les anarchistes.

Yes, there are two banks in France that have some market share in liquidity, those being BNP Paribas, and Societe Generale. But they do this from London, Hong Kong, Singapore and New York, not from Paris, where the trade union shop steward would be doing the rounds of the office to ensure that nobody moved the MaxPax vending machine without sanction from the staff in the department that uses it during government-stipulated coffee breaks.

If it was found to have moved, then the entire staff would be out on the picket lines.

This type of political and social framework strikes fear into the heart of every executive of every modern business, and as a result, mainland Europe – France being the most advanced of the European nations in terms of core social structure – will never, ever be anywhere that will sustain its own market economy.

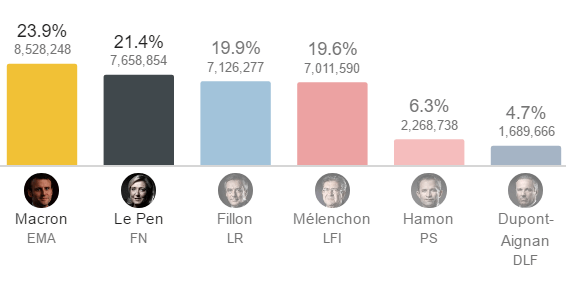

The elections that are about to take place are yet another case in point. So much unrest has occurred in France, as it has with many parts of mainland Europe recently, that Marine Le Pen is in pole position to do a ‘cleaning up job’ of France’s social problems.

Yet again, such extreme politics prevail, lurching from extreme left to center left, from almost communism to business-suffocating socialism (tax in France is 72% if all of the levies and charges are added up!) to a workforce that is used to spending 3 hours every day poring over fresh salmon and baguettes instead of working and dare his management criticize him, the entire staff would walk out and block the entrance to the company.

Emmanuel Macron is a sensible conservative, which is all very nice, but let’s not forget what happened last time France elected a sensible conservative who knew how to use an excel spreadsheet instead of blow taxes on follies.

Nicolas Sarkozy did the calculations, worked out what was glaringly obvious – that being that France is bankrupt and is living from the ‘welfare’ of the European Central Bank, and that people must work more and the country must produce more. The result? He was voted out almost immediately and replaced by a staunch socialist.

London is the center of all interbank FX and most of the world’s institutional-level financial technology ranging from single-dealer bank platforms such as BARX to the retail trading proprietary systems developed at great expense and with great expertise by CMC Markets and IG Group, right down to the latest automation technologies being invested in and developed by large institutions that will bring distributed ledger solutions to large banks, cutting down their operating costs.

Britain went through a period of socialism twice in the last 45 years. Once in the 1970s which resulted in piles of refuse adorning the streets and a three day working week due to inability of companies to pay salaries, and then once again from 1997 to the turn of the millennium when a supposed newer, more hipster-orientated touchy-feely version of socialism continued to do the damage that the original hard-line trade union-style version of it did in the 1970s.

There is a huge difference between this and mainland Europe, however, that being the strength of resolve, corporate excellence and commitment to continual development and commercial responsibility displayed by London’s Square Mile and Canary Wharf.

The periods of political difficulty in the UK have been absolutely nowhere near those of Europe. There is very little corruption in Britain, which, considering that it has been a member of the European Union since 1973, is remarkable.

The workforce of Britain’s financial sector, whether sales people or senior management, is highly knowledgeable, takes a massive pride in its work and views the topography of the financial markets economy as a global entity, focusing largely on North America, Asia, Australia and China, hence the fantastic synergy between British companies at their London heartlands and their subsidiaries and contemporaries in equally modern and urbane financial centers around the world.

For this reason, Britain will always be a mainstay, and will always be able to do business on a vast scale in the equally stable and well organized regions of the world, and will not need to be burdened by the inward-looking disarray within Europe.

London is a bastion of modernity whereas Paris, Frankfurt and Brussels are relics of a post-revolution socialist tinderbox.

Yes, there is an election scheduled to take place in just a matter of weeks, an election that was called suddenly by Prime Minister Theresa May, but there is no discourse, no virulent shouting, and no commercial or social uproar, just democracy at work whilst the business continues its surefooted direction.

Singapore, the world’s third largest financial center, is so well ordered that even a stray paper napkin will not find its way onto the street in error. The governance of the small island nation is so strong and so well backed that institutions from China, India, Britain, America, Australia and Malaysia operate their entire APAC divisions from within Singapore at interbank level. By 2013, Singapore had become Asia’s largest interbank FX center, and has never been the subject of fiscal or political opposing forces.

This bodes well for Hong Kong, China’s special administrative region, which connects its retail businesses via Singapore and mainland China. Hong Kong is a stable and highly respected financial center, and has an international workforce who are as likely to rub their employers up the wrong way as the Germans are to admit that Mercedes-Benz make unreliable cars, or that Berlin, far from being a technology hub, is the last port of call for bearded backpackers who adorn coffee shops all day, working out their entitlements, eating mung beans and engaging in anti-everything graffiti instead of knuckling down.

As far as Western business is concerned, America is always going to be the benchmark. It is a business-friendly, honest and non-corrupt nation run by forward thinking business advocates instead of militant vegetarians.

One of the factors that makes for much more comfortable prime brokerage relationships between domestic brokerages and the banks in America compared to other regions is the necessity to maintain publicly available reports of financial metrics each month, which are published on the CFTC website.

This allows for a continual and accurate set of figures which banks can refer to on a real time basis in order to assess their risk according to not just brokerage performance, but also the structure of the company and its capitalization.

The banks that provide Tier 1 liquidity to America’s brokerages are the same firms as those which provide it to British or Australian firms, however risk assessment and continual chekcks and balances are somewhat easier to perform in the United States due to the detailed reporting of metrics that are required by the CFTC and NFA.

The condition of America’s retail FX brokerage industry is absolutely sterling, a dynamic that is reflected by the upbeat nature of its enthusiastic leaders, whose relaxed and composed prose during the FinanceFeeds New York Cup event was matched by their unfaltering interest and wish to continue to seek very astute methods of improving and furthering the business on an ongoing basis.

Unlike regions outside of North America in which there have been exits from the markets of brokerages and in which the banks have held many OTC firms at arms length with the gap between the control that the banks have on the industry, America is somewhat different.

It was pointed out to me several times last month in New York that in America, some of the electronic trading divisions of the major interbank FX dealers are not that much more highly capitalized than the brokers themselves, putting the large brokerages in a position of power.

On this basis, making sure that orders are processed directly with the bank is a relative breeze in America compared to some other regions.

Australia’s retail sector echoes this line of thinking, however the nation’s government has been very sensible in toeing the line between stringent regulation to encourage the best companies to thrive and to remove the flies in the ointment, whilst keeping a lower capital adequacy requirement than in the US.

This has meant that Australia’s local firms are not only of very high quality, and run by highly experienced and very highly qualified industry executives who really understand liquidity provision and market connectivity on a cellular level, but it also places Australia as the top quality bridge between Asia and the West, a very important linchpin in the electronic financial markets economy globally.

China. A People’s Republic, but with first rate stability and business ethic

An anomaly here is China. It is, by all purposes, a communist country that is closed to the entire world, yet its unique business structure and extremely stable political environment, matched to the pragmatic and avantgarde cultural advantages of the Chinese mindset, make it one of the world’s most modern and most effective corporate powerhouses.

FinanceFeeds has extensively traveled China, and has forged relationships with key entities in the country, hence at today’s FX industry conference, our opinion and perspective was proffered as a result of extensive and detailed research into the future direction of China’s retail FX business.

Liquidity provision and prime brokerage

Last year was most certainly a year in which the entire prime brokerage sector was subject to a massive amount of evolution in the Western world, largely due to the increasing demand from brokerages for the best possible execution and access to the most accurate pricing and trade processing environment, as well as the counteraction to this, which has manifested itself in the major Tier 1 banks having curtailed the extension of credit to OTC derivatives firms due to their extremely conservative approach to counterparty credit risk.

Indeed, Citigroup, the world’s largest Tier 1 FX dealer with over 16% of FX order flow by market share, produced a report in the middle of last year that indicated that the firm expected a 56% potential default ratio on OTC derivatives credit, causing the entire sector of interbank dealers to raise their capital requirements for brokers to be able to maintain prime brokerage agreements.

Just five years ago, it was possible to obtain a prime brokerage agreement with a capital base of just $5 million, but now it is almost impossible with $50 million and in some cases no deal will be done unless $100 million is on the table.

This matters for two important reasons when considering unlocking the massive potential of China’s retail business.

Firstly, Britain’s large interbank dealers are weary. Their non-electronic trading divisions such as mortgage and consumer credit lending entities have been battered by financial crises in the last few years of the previous decade, and have been subject to multi-million dollar fines for misselling of payment protection insurance, have been censured for benchmark rate corruption, and have lost billions in unpaid credit during the 2008 and 2009 credit crunch, which saw most of them having to be bailed out by the taxpayer.

This has created a situation in which the main Tier 1 banks are now ultra-conservative and are still licking their wounds by selling off retail divisions in their entirety, and restricting how much risk they take on counterparty credit extension to retail brokerages.

Complexity due to lack of credit and massive capital requirements? No problem in China

Meanwhile, brokers which have to face these counterparties have to stump up massive capital bases to maintain relationships with them and still be subjected to last look order execution on single-dealer platforms and then have to strike up relationships with further non-bank electronic communications networks such as EBS, Currenex, Hotspot FX and FXall in order to attempt to provide a more comprehensive liquidity solution against the banks’ pulling the rug out from under everyone’s feet.

The same brokerages are battling with this whilst focusing on mainland China, and its own restrictions toward allowing any transaction over $50,000 (which is nothing because most brokers have an omnibus account or a prime brokerage agreement and have to send much higher figures than that each month to overseas banks of the brokers they work with) out of the country for the purposes of derivatives trading.

As of last week, all transactions over $50,000 are subject to a client signature to document the purpose of the transfer. If it is for derivatives trading of any kind, it is no longer allowed.

Just as this is happening, China’s own banks, all of which are owned by the state, are massively well capitalized and have a very clever model indeed.

They do not expose themselves to risk, and they have assets which consist of property, cash, investments in company stock and indices that are so enormous that it is hard to quantify.

These banks, unlike the weary western banks, will extend counterparty credit to FX brokerages in China without the blink of an eyelid over risk.

Western banks are already wounded enough and are restricting what they can see quite transparently. It would be futile for a Western prime broker with no presence in mainland China to go to a Western bank’s eFX desk and ask for a large prime brokerage deal because of a massive Chinese partner that has been onboarded.

There is no way for the bank to check how large and how well capitalized that firm is, as one is one side of the firewall, and the other is, well, the wrong side.

The answer would be no.

For Chinese banks, offering Chinese liquidity to Chinese prime of primes and then distributing aggregated feeds to Chinese FX brokerages, the sky is the limit and this single factor, when it unfolds and is in place on a widespread scale, will cause the Chinese FX industry to absolutely mushroom in volume and power.

Prime of primes that have presence in China, that are not Chinese by origin, including Sucden Financial (HK) Ltd, Advanced Markets (Shanghai) and Saxo Bank’s APAC division will be able to participate very freely in this because they will be considered Chinese entities as they have their entire infrastructure based in China and therefore inside the firewall and under the all-seeing eye of the Chinese government.

Platform and integration technology

With a fully domestic Chinese ecosystem would come Chinese price feed and infrastructure technology, meaning that a need will exist to host market connectivity, platform technology and market depth indicators that can connect to Chinese liquidity effortlessly by running on native Chinese servers and connected to local venues, with full transparency to the government.

The same would apply to payment channels in which clients can deposit and withdraw funds. Chinese IBs sending large sums of client assets to brokerages would be absolutely simple if the prime of prime and entire banking facility was hosted within China. We are very well aware of several large IBs from Shenzhen to Zhengzhou that regularly trade 90,000 lots per month and hold over $250 million in assets under management.

Do Chinese primes and Chinese banks want this business rather than see it flow outside? Yes they certainly do indeed.

Major platform developers such as MetaQuotes and Spotware Systems are already well and truly on the map in China, their foresight will do them the power of good when the entire Chinese system becomes completely domestic.

A particularly interesting development was last year’s creation of an IB portal by Spotware Systems on its cTrader platform, which finds and hosts IBs within the platform itself. This could well be a linchpin in China, where the retail FX industry is very business-to-business orientated in that it relies completely on IBs, as there is very little direct retail business.

Brokerage solution providers that have presence in China will be well positioned also. Leverate has an office in Shanghai, and has the remit of developing Chinese market-specific fully integrated brokerage systems from CRM to back office, to trading platform connectivity, all from within China. Similarly, Gold-i has an office in Shanghai.

Removing the barriers

Let’s look very simply at the barriers that western banks face.

Credit is very hard to obtain for OTC firms

Banks are browbeaten following several financial crises

Risk management is a huge concern

Transparency when extending credit and working with Chinese counterparties is impossible, and any Yuan based transaction is impossible to value or clear on an open market

Infrastructure is subject to continual blocking and capital bases are hard to define

Now let’s look at the barriers Chinese banks face

When facing Chinese counterparties and providing services to Chinese brokerages, there are no barriers whatsoever.

Barriers in China only exist between the mainland and the rest of the world. Inside China, the entire system is controlled and supervised by government departments that connect all components together and can see everything clearly.

The banks are not alone. The government, which has enormous business acumen and purchasing power, is right behind them, driving them forward just as it would do for primes and retail brokerages.

At the conclusion of this particular presentation, several executives in the Chinese FX industry as well as heads of Chinese divisions of Western firms with their headquarters here in Shanghai concurred and agreed.

Therefore, the future for the entire commercial structure of the Chinese industry is, well, Chinese.