FXCM global subsidiaries seek to reassure clients

As customer uncertainty over the future of the broker mounts, so do the efforts of FXCM’s international subsidiaries to assure clients that “there is no change”.

Several hours ago, Gain Capital Holdings Inc (NYSE:GCAP) announced it has entered into a definitive agreement to acquire the US client base of FXCM Inc (NASDAQ:FXCM) – this has been the latest in a series of rapid developments around FXCM, which was fined and banned from the US market by the US regulators.

Uncertainty has been piling up amid clients of the broker inside and outside of the United States, with social media channels getting filled with questions.

Uncertainty has been piling up amid clients of the broker inside and outside of the United States, with social media channels getting filled with questions.

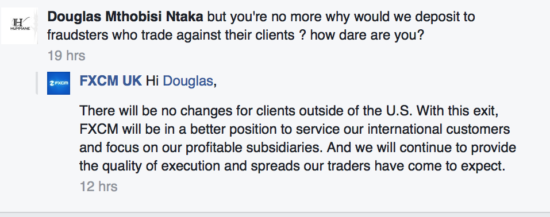

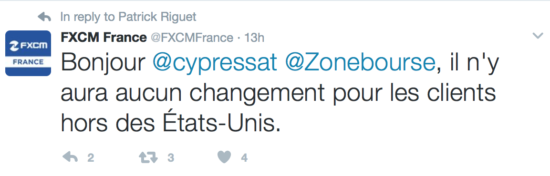

In the face of the tension, FXCM’s international subsidiaries keep telling their clients that it is business as usual. FXCM UK and FXCM France accounts on Facebook and Twitter feature reassuring messages.

“There will be no changes for clients outside of the U.S. With this exit, FXCM will be in a better position to service our international customers and focus on our profitable subsidiaries. And we will continue to provide the quality of execution and spreads our traders have come to expect” – FXCM UK.

These statements are hardly surprising as they echo the tone of FXCM’s official announcement on the actions of US regulators and the pending sale of its retail FX business in the US to GAIN Capital. FXCM US stressed that the settlements “have no impact on any customer of FXCM’s global businesses”.

In its press release from February 6, 2017, the United States National Futures Association underlined that FXCM has had a long history of disciplinary actions. Excluding the most recent actions against the broker, NFA’s Business Conduct Committee (BCC) has authorized four prior complaints against FXCM. In 2011, FXCM was charged with engaging in asymmetrical price slippage practices and had to pay a $2 million monetary sanction. Back then, the company was also ordered not engage in the types of deceptive and abusive practices.

Importantly, the UK Financial Conduct Authority (FCA) then reacted to the US regulatory action against FXCM. The UK regulator noted that although senior managers of the FXCM Group sat on the Board of FXCM UK and knew about the investigation, FXCM UK failed to alert the FCA. This was in violation of the FCA’s requirement that firms are open and cooperative with the regulator. When it became aware of the investigation in August 2011, the FCA stepped in to review FXCM UK and secure redress for affected consumers.

As a result of this investigation, the FCA fined FXCM UK £4 million for making ‘unfair profits’ and not being open with the UK regulator. Such investigations, however, take time – up to several years. This is hardly a good piece of news for those who’d like a swift regulatory response.

The question is how overseas regulators will react this time. Will they react at all?