FXCM UK claims it faces no fines, no public sanctions from the FCA

The business practices indicated in settlements of FXCM and US regulators have allegedly not led to any detriment for customers of FXCM UK.

One of the foci of industry attention after the February events that led to FXCM’s US market exit has been on possible action against the broker by non-US regulators. Several months have passed since the settlements between FXCM and US regulators became a fact and, yet, there has been no action by other regulators. A persisting question has been: Will the UK Financial Conduct Authority (FCA) do anything?

We have just been provided with the official stance of Forex Capital Markets Limited (FXCM UK) on the matter. According to a regulatory filing, FXCM UK is not facing any regulatory action from the FCA over the business practices uncovered by US regulators and made public in February.

Here is what FXCM UK (referred in the text below as “the Company”) says:

“The Company’s Board has received thorough explanation of all the matters outlined in the CFTC and NFA letters, both from FXCM Group’s general counsel and external law firms engaged to represent the FXCM Group during the settlement process. After such an explanation the Board is satisfied that no customer detriment to the Company’s clients has occurred, neither have clients been misled as to the execution policies of FXCM Group. We are therefore comfortable that the Company will not be put into enforcement with the FCA and will not face any fines or public sanctions.”

FXCM UK insists in its report that one of its execution models is Non Dealing Desk (NDD).

To make the picture even more bullish, FXCM UK promises new platforms to its clients, including MetaTrader 5 (MT5).

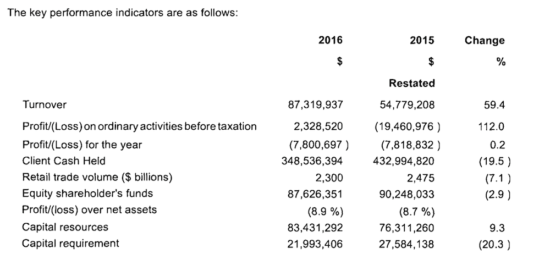

On the financials side, let’s note that the company registered a loss of $7.8 million for the year to December 31, 2016, compared to a loss of $7.82 million in 2015. The Board of Directors of FXCM UK insists that the company is capable of meeting its obligations at least in the next 12 months.

Following the reporting period, Drew Niv and Brandon Mulvihill resigned as directors of FXCM UK. Earlier this month, Mr Niv officially resigned as interim CEO of FXCM Inc, now known as Global Brokerage Inc (NASDAQ:GLBR).