Global Brokerage? What’s in FXCM’s new name?

FXCM’s change of name leaves the room open for questions, with respective domain names for GLBR up for sale and nine companies in New York state having “Global Brokerage” inside their names.

The fall in the share price of FXCM Inc (NASDAQ:FXCM) that followed the US regulatory actions against the company has given birth to a popular tweet: “FXCM is about to find oil if its shares keep drilling like that”.

Interestingly enough, the last couple of days did not witness such a sharp fall – in fact, on Friday, the shares closed slightly up (+1.82% on the day).

There are a couple of explanations for the change, which is not significant, of course. The first is that on Friday FXCM US’s client accounts were transferred to GAIN Capital’s Forex.com. Any M&A deal, albeit this transaction concerned only client accounts and not the share capital of FXCM Inc, usually triggers a rise in the share prices of the company whose business is acquired and a drop in the share prices of the acquirer. The latter reflects the fact that a merger may not be completed and the acquirer bears the risk for that. So, this is one of the simplest explanations for the small rise in FXCM’s share prices last Friday.

Another explanation would be that the market “bought” the name change announced on February 21, 2017. That is, the formal move had the effect of a psychological trick and psychological tricks do work in the market quite often.

We had a set of announcements from FXCM on February 21, 2017, with the company announcing that FXCM Inc will become “Global Brokerage Inc.” (as per the SEC filing) or Global Brokerage, Inc. (as per the press release). The name change, accompanied by a change in the ticker on Nasdaq is set to become effective today.

That choice of a new name raised some questions. For instance, if you change the name of your business, wouldn’t you buy the respective domain(s)? At the moment of publication of this article, globalbrokerage.com and globalbrokerageinc.com are up for sale. The same goes for glbr.com. If we dare to extend the check to addresses like globalfx.com or glbrinc.com, the server returns error messages. Meanwhile, FXCM’s old sites are all active.

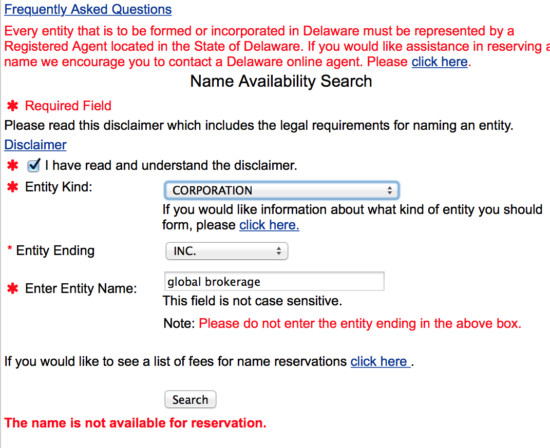

Considering the new name itself, the Delaware Government website shows that Global Brokerage Inc name is not available for reservation.

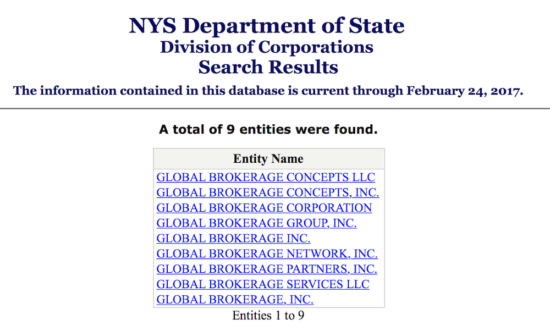

Further checks show that there are nine companies registered in the State of New York whose names feature “Global Brokerage”.

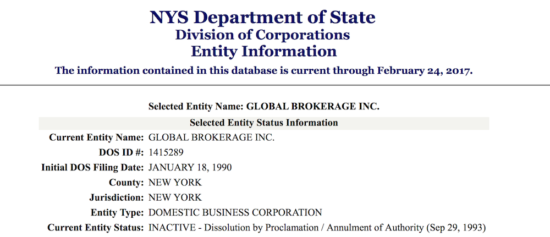

The two of interest to us – Global Brokerage Inc and Global Brokerage, Inc are inactive, as per information current through February 24, 2017.

We have yet to see how the name change move is executed by FXCM Inc (Global Brokerage Inc) but at this point, the official registers make the situation less clear instead of elucidating it.