Guangzhou, a haven for the entire FX industry: Complete montage of Day 1 of the Fortune Forum conference

In Guangzhou, the world’s large FX and OTC derivatives firms gathered to discuss in detail the important aspects of today’s highly refined business environment here in China. Here are the full highlights of day 1 of the Fortune Forum FX industry conference

The importance of China’s second tier cities is paramount, of that there can be no doubt.

Not only are they gargantuan in their proportions, many having risen from small provincial township status in very recent years to becoming giant metropolitan examples to the world in how to build a brand new city, populate it with several million people and generate incredible levels of business that would be considered unscalable outside China’s enormous government-backed development will and ability to purchase, build and implement everything in a very short time.

Here in Guangzhou, just 250km north of the border at Shenzhen, 40 million people reside in the greater metropolitan area.

That is three times the population of greater London, in a city that has grown up over the last fifteen years.

Population figures and average wealth statistics listed on sites outside China are completely inaccurate, as the government blocks many English language sites that provide information which are considered to contain sensitive information, demographic and income information falling well within that category.

40 million people is a lot by any standards, however Guangzhou has a great advantage as an electronic trading center for the south of mainland China, in that it is a cultural center for business, it is close to Hong Kong, and it has a highly developed export business which has profited massively from the vast scale of products manufactured in China and exported globally.

Guangzhou is also home to several thousand extremely wealthy individuals, most of whom are investment-savvy and have portfolios in commercial and residential real estate, stakes in export businesses, and are already involved with global financial markets, and here in China, global financial markets means OTC FX.

To China’s high net worth – and high net worth in China really means high net worth – individuals, trading restricted stocks on Chinese stock exchanges, or illiquid futures does not bring them sufficient monthly revenue on their income from long term investments, hence the massive predilection for FX.

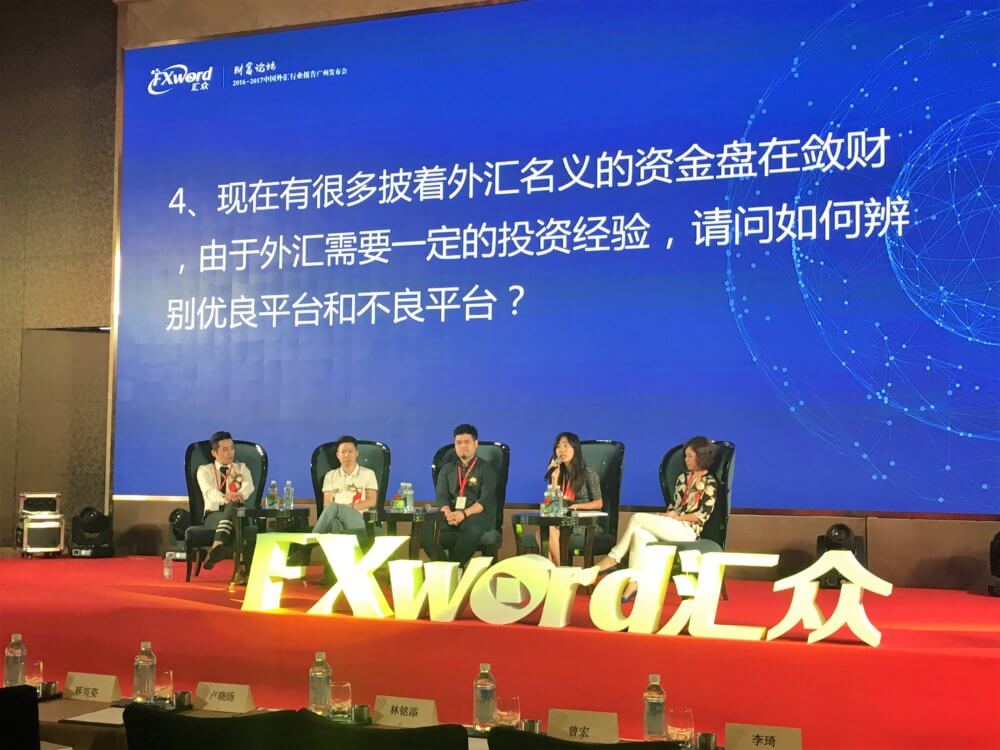

As a result of this huge economy within one modern city, Guangzhou has become an FX capital, and today, Chinese and international firms met and discussed very detailed matters at the Fortune Forum at the Sofitel Sunrich Hotel, held in partnership with FXWord.

Reporting and researching live from Guangzhou was FinanceFeeds, and the conference, which encompassed two panels, a speech by Australian expert in APAC FX trading Daryl Guppy who is also President for the Northern Territories Office of the Australia China Business Council, and was represented by a vast array of brokerages from across the world.

Firms in attendance, which fully engaged in discussions to move the industry forward, were China’s prime of prime Bondex, senior executives from the Chinese subsidiary of Australian stalwart AxiTrader, Britain’s One Financial Markets, represented by Global Head of Partners Stuart Cooke, with five further senior members of staff from One Financial’s offices across mainland China’s Tier 2 cities.

ISPrime, the prime of prime brokerage which was founded by Jonathan Brewer and Raj Sitlani with the backing of Lord Fink’s ISAM hedge fund was represented by senior executive Will Robbins from the company’s newly established Hong Kong office, eToro maintained a very significant presence, the firm’s immeasurable success in China since its onboarding of Ping An Ventures as a shareholder and distribution of service via Ping An Bank across China, and AvaTrade maintained a high profile, its Chinese subsidiary holding the flag.

ADS Securities continued to extend a presence in China, the firm having participated across the country this year marking out development towns such as Guangzhou as a viable means of working closely with IBs, something ADS Securities has achieved across the mainland over recent years, and FXCM, whilst not present with a booth, were certainly out in force among the audience and interacting with the Chinese service providers and all important B2B introducing brokers. FXCM’s fate may well have been sealed in all other markets globally, but for over 13 years, the firm has been a tour de force in China, and still is.

Chinese firms made approximately 50% of those in attendance today, not all of which were brokerages. LeanWork, a company which manufactures back office systems and bridge connectivity was in the limelight also.

It is clear that the Chinese FX industry is highly knowledgeable. FinanceFeeds conducted several very in-depth conversations with all levels within most of the companies that attended today here in Guangzhou, all of whom understand full structural and commercial aspects of how execution should be conducted, who all of the proper prime of primes are and how to maintain a close relationship with their Chinese subsidiaries for real market liquidity, and what the market and their customers are looking for.

Today, the second tier development towns are quite simply where it is at. Here is a full montage of today’s event: