Identity of Mizuho risk management exec who fell to his death whilst at work revealed; had money worries

It is always extremely unfortunate when our otherwise highly interesting industry suffers a loss in the form of human casualty. Although thankfully very rare, there are times when life’s pressures can be too much, as depicted by the fall of a bank executive from the fifth floor of the offices of Japanese financial institution Mizuho […]

It is always extremely unfortunate when our otherwise highly interesting industry suffers a loss in the form of human casualty.

Although thankfully very rare, there are times when life’s pressures can be too much, as depicted by the fall of a bank executive from the fifth floor of the offices of Japanese financial institution Mizuho Financial Group, Inc. (TYO:8411) at Bracken House in Cannon Street, London on November 26 this year to the horror of his colleagues who bore witness to this tragic event.

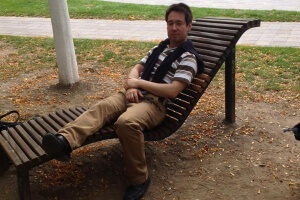

Yesterday, the identity of the person involved was revealed as Pierre Gurdal, a 42-year old risk management specialist who had worked within Mizuho Bank’s Fixed Income, Market Data and Risk Management divisions.

Mr. Gurdal, who spoke English, Japanese and French, was of Belgian and Japanese descent, and had worked at Deutshe Bank, where he supported the electronic trading platform for a year, as well as at Daiwa Securities Capital Markets in Tokyo where he was a Product Controller which involved the monitoring of trading limits.

In Europe, Mr. Gurdal had spent 2 years at BTMU as EMEA Market Risk Manager until July 2014 when he joined Mizuho in London as an administrator within the operational risk control group, which is part of Mizuho’s Europe Systems and Operations Division.

According to various reports, the Police had investigated the matter and ruled out any suspicious activity.

It is suspected that Mr. Gurdal took his own life, and that he had been suffering financial difficulties for some time.

Mr. Gurdal, along with his partner, had moved out of a small rented apartment in a basement in Baker Street in London’s West End in July last year, which was the same time that he left BTMU, and according to his former landlord, Jim Wroe, who was in the process of renovating a property, Mr. Gurdal had approached Mr. Wroe and asked if he could employ him.

Mr. Wroe yesterday said

“I was doing up a property. He asked me if I could give him a job —any job — including building work, which I thought was very strange coming from someone who was used to working in banking.”

“I didn’t have anything for him but I felt bad for him, he obviously had money worries. He did seem very down.”

Mr. Wroe, who is now retired, has experience with these matters, as he spent his career as a mental health expert for local authorities across the United Kingdom.

Mr. Wroe spoke highly of Mr. Gurdal, saying

“He was always well-dressed and polite. I just feel terribly sorry for his family. He was a lovely guy, very gentle. He was very fit and his flat was filled with running trophies. He had always been a good tenant.”

Mizuho Bank paid tribute to Mr. Gurdal by making a corporate statement as follows:

“Although he had only been employed for a little over a year Pierre was well-liked and respected by his colleagues. We remain deeply saddened and shocked at the loss. Our thoughts are with his family and friends.”

Featured image courtesy of the Evening Standard