iFOREX and the Israeli market: The real story

Various reports this morning have proliferated the media regarding the current operational changes within Israeli online trading company iFOREX having closed its operations in Israel. FinanceFeeds has conducted extensive research into this matter, and can confirm that this is not the case. During the late hours of May 30, mainstream Israeli news sources conducted reports […]

Various reports this morning have proliferated the media regarding the current operational changes within Israeli online trading company iFOREX having closed its operations in Israel.

FinanceFeeds has conducted extensive research into this matter, and can confirm that this is not the case.

During the late hours of May 30, mainstream Israeli news sources conducted reports which indicated a retraction of operations from Israel by iFOREX, however the company’s marketing and operations department remains completely operational and is still situated in Herzliya, Israel.

Investigations today by FinanceFeeds can confirm that far from having closed the Israeli operations, the company had begun to look toward gaining a license to provide retail FX services to Israeli customers following the new licensing laws that apply to FX firms that were implemented recently.

The company is operated and managed via the international divisions of Formula which is the main market market maker of the group, which is based in Athens. Formula is the owner of the Intellectual property rights for the iFOREX brand.

One year ago, when the regulations in Israel were about to enter into force, iFOREX made a decision not to apply for a license for itself, but to find a partner in Israeli with experience with working with the Israeli regulatory authorities. The company’s executive team met with a number of companies in Israel and decided to sign an agreement with A Online Capital which is a publicly listed company on the Tel Aviv Stock Exchange.

Within that firm there are two main business divisions. One is a brokerage firm which deals with equity trading on the Tel Aviv Stock Exchange, and the other is a firm which conducts distribution of market data.

This particular company has been established for over 20 years and has vast experience with working with the regulatory authorities in Israel, as well as the stock exhange and as a result, iFOREX considered that company to be a suitable candidate for opening a trading arena to offer exchange traded equities to retail customers in Israel.

The next part of the procedure was that iFOREX signed agreement with A Online Capital to establish a new company that will use iFOREX brand name, trading platform, IT systems, and marketing capabilities.

They established the company, applied for the license, recruited sales and customer support representatives and started the process that has been going on for a year which involved a series of questions and answers which were posed to the Israeli regulator.

According to the sources that FinanceFeeds spoke to, the Israeli authorities had been very impressed with application, especially bearing in mind the potential partnership with a publicly listed company that conducts its trades via an exchange.

During the last few weeks, however, there have been a number of decisions by the Israeli authorities which center on the banning of certain products including CFD on single shares, exotic currency pairs and indices and along with it they came up with regulatory requirements which have a very high cost to comply with.

At that point, A Online Capital issued a public notice, filed with the Tel Aviv Stock Exchange, that it will not be proceeding with this partnership. This notice was not picked up by the Israeli mainstream media, despite its public availability.

As a result, over the last few weeks, A Online Capital decided that in light of the new requirements and restrictions that it would be un profitable to establish a trading arena which operates Israel under Israeli regulations and requested iFOREX to pull out of the deal and withdraw the app for the license.

The decision to not proceed was taken by A Online Capital rather than iFOREX, and iFOREX ofered assistance to A Online Capital to proceed with regulatory discussions but the decision was made not to continue. iFOREX then accepted the decision and as an international company decided to continue in international markets with existing regulations and nothing has changed with regard to the company’s modus operandi.

According to research by FinanceFeeds, iFOREX has annual revenues of $100 million and has signficant global presence with client bases in Europe, South East Asia, Middle East, and Latin America, and holds regulatory licenses in Cyprus, Hungary, the British Virgin Islands and Turkey, Hungary and Turkey being via third parties that are partners.

Bearing all of this in mind, it is a case of business as usual.

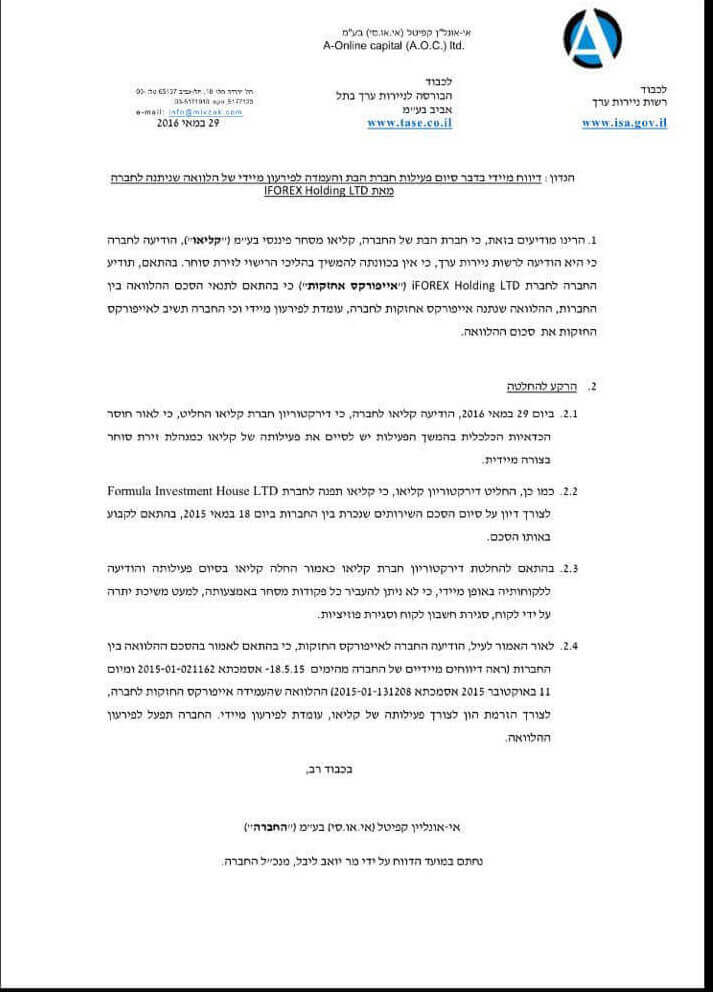

Here is the full publicly available report by A Online Capital (Hebrew only):

Photograph: Tel Aviv midtown district. Credit: Israel Police Airborne Unit.