Inside investigation: Would your trading server stand a load 20 times higher than normal?

Janet Yellen’s announcement on December 16 this year that the Federal Reserve Bank would most certainly increase the interest rate across the entirety of the United States passed with smoothness. Whilst the event itself was anticipated and did not create too much in the way of untoward effects on the global economy, much of the […]

Janet Yellen’s announcement on December 16 this year that the Federal Reserve Bank would most certainly increase the interest rate across the entirety of the United States passed with smoothness.

Whilst the event itself was anticipated and did not create too much in the way of untoward effects on the global economy, much of the media emphasis was around market commentary and the soundbytes of market analysts representing large organizations, or financial advisers.

There is a different, very important aspect to the trading environment that could most certainly be affected by events such as this, whether anticipated or not, that could have a drastic effect on trading accounts and indeed brokerages themselves – that being how well a server can cope with the processing of a massive amount of orders caused by a gigantic spike in activity.

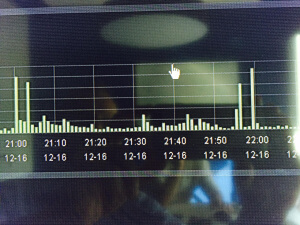

On December 16, trading activity was 20 times higer than average

According to the majority of banks and traders, stable market conditions may have appeared to be the case, however with the ensuing volatility in the markets from this event, it is very easy to overlook the stability of electronic trading systems and how the extra load on servers can have an effect.

Retail FX brokerage technology provider Leverate is a case in point, as the company’s server experienced a load equivalent to 20 times the normal trading order flow on December 17.

Today, at Leverate’s global head office in Tel Aviv, Israel, FinanceFeeds CEO Andrew Saks-McLeod met with the company’s Group R&D Manager Or Chubook and VP Sales and Business Development Avishai Ben-Tovim, who explained the importance of scalable technology solutions and how market events that pass without glitch can remain a part of the trading topography without having to concern traders and brokerages not only with volatility, but with technological outages as a result of extreme volume.

“When there is a high load in the market, there are difficulties that arise which can cost brokerages vast amounts of money. These are byproducts of system instablility caused by trying to cope with high volumes, such as arbitrage opportunities by rival traders, and outages meaning trades cannot be executed, opened or closed, and of course slippage” – Or Chubook, Group R&D Manager, Leverate.

“If you are a b-book broker, matters such as these are critical during times of extreme volume and volatility” said Mr. Chubook.

“Mr. Ben-Tovim then explained “When the regulators went through as series of regulatory examinations for slippages a couple of years ago, none of our brokers were subject to this due to the robust servers that did not create latency, slippage or non-closing of orders.”

Mr. Chubook then continued “Our data transfer speed and ability to scale up has been a major investment area in terms of R&D over recent times, this way brokers can avoid such issues.”

How stable are third party aggregators and collections of servers?

Mr. Chubook said that “A single MetaTrader 4 server has limits in terms of trades. Yes you can buy 10 servers and integrate them into a trading environment and they still may not handle the amount of orders that are being processed at times when important events occur and unusually high volumes are being traded.”

“Theoretically if there was an entity that does not cover itself for its A book flow during the entire operational period of the company’s existance, such a company would likely be wiped out in the end should a market event occur that they cannot handle” said Mr. Ben-Tovim.

“Leverate is still conducting the same type of business that the firm conducted since it was established in 2007, and we have had a lot of market events since then” continued Mr. Ben-Tovim.

“With our system it is the broker’s choose to A or B book their own order flow, and we are very clear about risk management. No liquidity source in the market gives, for example, 1,000 A book orders per second. It is also important to bear in mind that if everyone operated sole A book models then they would be exposed to negative client balances, therefore this is not the way the industry works” concurred Mr. Ben-Tovim.

Investment in robust technology over long period with single back end

“In the case of our end-to-end solution, the aggregator is our own and is linked directly to the banks, negating the drawbacks of a third party aggregation solution” said Mr. Chubook.

“Most of the brokers that work with us are running a B book. We are using our own aggregator and therefore our own hardware which although not proprietary, is owned by us, and we are using completely proprietary software rather than leasing it from a third party.”

We have put a lot of effort into execution speed, latency, how fast a trade can be processed to the market, and also by traders to our servers” – Or Chubook, Group R&D Manager, Leverate.

Despite knowing that this was a forthcoming event (unlike other major events such as the removal of the 1.20 peg on the EURCHF pair in January last year which was completely unannounced until it actually happened) Mr. Chubook explained that from a technical perspective, the company did not need to make many adjustments at all to prepare for the extra volatility that caused spikes to the magnitude of 20 times the average trading volume because the company is aware that its systems are capable of handling this.

“It was well within the parameters of the trading system” said Mr. Chubook. “I have run several performance tests on the trading system and know that this is well within the capabilities of our servers” he said.

“The main benefit of our server is that there is just one back office. It doesnt matter where the traders are based geographically, or how many traders a broker has on its books, or for example how many positions are being handled by each entity, because the back office system is integrated into a single end-point which makes it much easier to run the dealing room effectively.”

Featured photograph: Or Chubook, Leverate’s Group R&D Manager and Andrew Saks-McLeod talk system stability at Leverate’s Head Office. Copyright Andrew Saks-McLeod