Interactive Brokers’ IBot keeps on learning

In a world where algorithms get closer to passing the Turing test, the fintech industry cannot help but follow the trend and embrace bots.

Given the current advances in the area of Artificial Intelligence, the fact that a company applies a type of natural-language interface is hardly surprising. That is why, when Interactive Brokers Group, Inc. (NASDAQ:IBKR) announced the launch of IBot, its text-based interface for the TWS platform in late 2016, the announcement did not create a huge splash.

However, over a short span of time, the tool has markedly developed and currently serves as one of the interesting examples of AI’s applications in online trading.

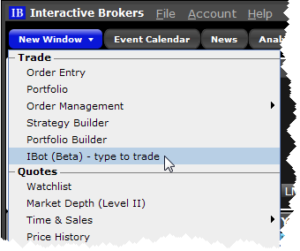

To use IBot, one has to select “IBot (Beta) – type to trade” from the New Window dropdown in Mosaic. Then enter a text query in the box at the bottom of IBot and hit Enter to send – IBot will return the results.

IBot is usually female (with one exception). This is in tune with the convention in the scientific field which is supposed to show respect for the female gender. It is the same convention that labels any subject in an experiment as “she”, regardless of their actual gender.

In the face of this form of animation, however, the IBot fails to be human enough to replace the traditional customer support service. For that matter, you may want to check out the somewhat extreme (but rather insightful) stance of Bart Burggraaf, Managing Partner, MediaGroup Worldwide on why robots should not run your marketing.

Back to IBot, what does SHE do when a trader requests “Customer Support”? She simply provides a link to the contact information for Interactive Brokers Client Services on the website. That is, we are still too far to see full automation of the client-computer interface.

Back to IBot, what does SHE do when a trader requests “Customer Support”? She simply provides a link to the contact information for Interactive Brokers Client Services on the website. That is, we are still too far to see full automation of the client-computer interface.

Of course, all this does not undermine the advantages of the solution. For one thing, she understands commands in a number of different areas of interest to traders, ranging from account information to charts and quotes. Fans of Command Line will probably appreciate this sort of interaction.

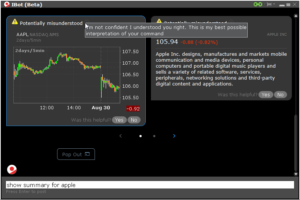

A typical Chart command would be “Show me 2 days price of AAPL”, resulting in IBot producing a chart based on an educated guess. Putting it otherwise, traders may omit bar sizes or time ranges, and IBot will display what the Interactive Brokers’ team calls “the most reasonable chart” based on what they entered. The same is valid for option contracts – in case traders leave out a parameter, IBot will try to identify the option contract with an educated guess. For instance, if the expiration is missing, she will use the nearest month.

This should be a valuable quality of a Bot for those who are familiar with neural networks and how challenging it can be to actually train a computer to do something or understand something.

The latest TWS updates have added new areas of understanding for IBot, including market scanners, option chains, Level II market data, as well as calendar-related trading commands. Does this mean that she understands all of them? Not quite.

There is a range of non-supported and misunderstood commands. In case the traders enter a non- supported command, or one that IBot cannot accurately interpret, IBot will provide her best efforts result labeled with a “Potentially misunderstood” warning message and an icon.

supported command, or one that IBot cannot accurately interpret, IBot will provide her best efforts result labeled with a “Potentially misunderstood” warning message and an icon.

Did Interactive Brokers start a scientific revolution with IBot? Most likely, not. But this seems to be a very useful and practical solution for people who’d like to talk to their platform in a very simple effective way. For one thing, trading is often a solitary endeavor (it may happen that we want the money for ourselves) and the sole communication we need is with a bot rather than a real human being.