Interbank FX giants strife continues as RBS announces $2 billion loss: Shares worth half of what the government paid in 2008

Royal Bank of Scotland Group plc (LON:RBS) is the most recent among large banks to announce its full year earnings for 2015, and as has been the case for many of the interbank FX giants, a loss was recorded. In this case, the loss amounts to $2 billion for the year, which has now resulted […]

Royal Bank of Scotland Group plc (LON:RBS) is the most recent among large banks to announce its full year earnings for 2015, and as has been the case for many of the interbank FX giants, a loss was recorded.

In this case, the loss amounts to $2 billion for the year, which has now resulted in the bank looking to make 200 people redundent from its commercial banking unit.

Whilst the second largest FX dealer in the world, Deutsche Bank AG (FRA:DBK) experienced a very sizable loss during 2015, the ensuing lack of investor confidence in the bank’s cash position and fears over liquidity having caused Germany’s Finance Minister Wolfgang Schaeuble to speak out and state that there was ‘no cause for concern’ a few weeks ago, and Credit Suisse had announced its first loss since 2008, these two giants still maintain their position with Deutsche Bank still retaining its number one slot in terms of global FX market share during 2015, and Credit Suisse remaining in 14th position, handling much the same order flow that it did the previous year.

RBS has experienced a different set of circumstances, because in addition to the vast loss that has added it to the list of unprofitable banks throughout 2015, it has been losing market share in the FX sector for two years now.

In 2014, RBS lost a substantial amount of business, its FX market share dropping from 5.62% in 2013 to 3.25% in 2014, falling from seventh to eighth place overall. As recently as 2009, RBS ranked fourth in the world in terms of global FX order flow, with a market share of 8.19%.

By the first quarter of 2015, the market share was back up to 6.9%, but had dropped to tenth position in global terms by that time, with its percentage of market share dwindling further as the year progressed.

Currently, the firm’s FX operations are not affected by the plans to make redundancies. Instead the bank will look toward making 140 commercial managers, 45 area lending managers and 15 senior lending directors redundant in order to attempt to run that particular division of the bank more efficiently and with much lower costs.

The commercial banking division handles 12,000 of RBS’s largest corporate customers and provides loans of more than £250,000. Many will now be handled by the business banking arm, which previously handled smaller borrowing.

The burden of this continually flagging performance has been transferred to the British taxpayer, as 73% of RBS is owned by the state, a situation that came about following the series of events which blighted the bank in eight years ago under then CEO Fred Goodwin, whose strategy of aggressive expansion primarily through acquisition, including the takeover of ABN Amro, eventually proved disastrous and led to the near-collapse of RBS in the October 2008 liquidity crisis.

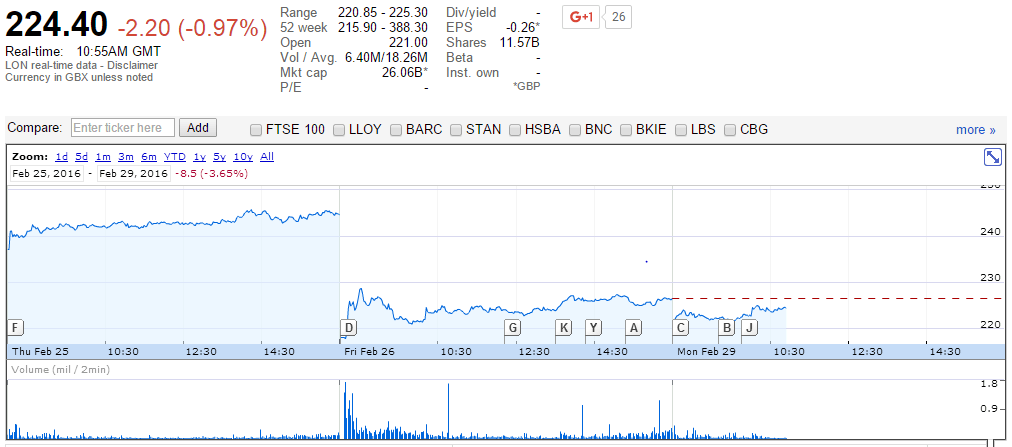

Indeed, following the announcement of the losses that were sustained in 2015, which were partly due to low performance and partly to having to settle large regulatory fines and class action litigation following the FX rate rigging investigations that were concluded at the end of 2014, share prices in RBS stock collapsed on Friday, opening over 20 points lower than the previous day as a result of the losses made during last year having been made public.

This means that the current value of RBS shares is half that of what the government paid for them during its acquisition of its 73% stake in the company when it was on its knees during the 2008 bailout.

Back in 2008, the €71 billion (£55 billion) ABN Amro deal, of which RBS’s share was £10 billion, stretched the bank’s capital position in that £16.8 billion of RBS’s record £24.1 billion loss is attributed to writedowns relating to the takeover of ABN Amro. Interesting indeed it certainly is that a loss of $2 billion last week could reduce the price of the bank’s shares down to half of their value after a £24.1 billon loss.

At that time eight years ago, the ABN Amro deal was not the sole source of RBS’s problems, as RBS was exposed to the liquidity crisis in a number of ways, particularly through US subsidiaries including RBS Greenwich Capital.

Although the takeover of NatWest launched RBS’s meteoric rise, it came with an investment bank subsidiary, Greenwich NatWest. RBS was unable to dispose of it as planned as a result of the involvement of the NatWest Three with the collapsed energy trader Enron. [clarification needed] However the business (now RBS Greenwich Capital) started making money, and under pressure of comparison with rapidly growing competitors such as Barclays Capital, saw major expansion in 2005-7, not least in private equity loans and in the sub-prime mortgage market.

It became one of the top three underwriters of collateralised debt obligations (CDOs). This increased exposure to the eventual “credit crunch” contributed to RBS’s financial problems.

The third contributor to RBS’s problems was its liquidity position. From a position around 2002 where the bank was essentially ‘fully funded’ (i.e. was funding its lending positions fully from deposits gathered from customers), the rapid growth in lending within the GBM (Global Banking and Markets) division led to a reliance on external wholesale funding.

The combination of this, along with the weak equity capital position, and the massive exposure to losses on CDOs via Greenwich, were the factors that destroyed RBS. The bank experienced severe financial problems, and attempted to shore up its balance sheet with a £12 billion share issue in April 2008, one of the largest in UK corporate history. The attempt to raise an additional £7 billion capital by selling off insurers Churchill and Direct Line failed due to lack of interest in the context of the global liquidity crisis.

Chart courtesy of Google Finance