KPMG puts illustrative financial outcome for clients of Alpari (UK) at up to 83.2%

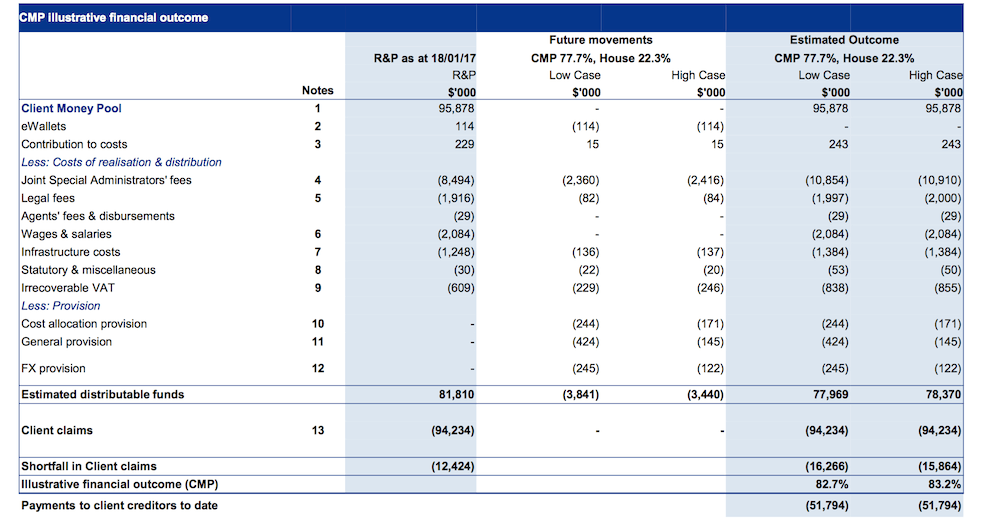

The illustrative financial outcome varies between 82.7% and 83.2% depending on the amount of estimated distributable funds.

Following the publication of their Fourth Progress Report into now-defunct FX broker Alpari (UK) Ltd, the Joint Special Administrators (JSAs) from KPMG have today published a separate document, concerning the illustrative financial outcome based on data from January 18, 2017.

The illustrative financial outcome varies between 82.7% and 83.2% depending on the amount of estimated distributable funds. In the table below, the size of the outcome is calculated by dividing the amount of estimated distributable funds by the amount of client claims. In the low case, the estimated distributable funds are approximately $77.97 million, whereas in the high case these funds are $78.37 million.

The difference in the estimated distributable funds in the low and high cases reflects different approaches to costs and assets realization. Whereas the low case assumes a more prudent approach to the future estimated asset realisations and higher costs incurred, the high case assumes the future asset realisations are slightly higher and costs slightly lower than those estimated in the low case. For instance, the FX provision for the low case is two times bigger than the provision for the high case.

The client funds recovered to date total approximately $95.88 million, whereas agreed client claims against the CMP (client money pool) total $94.2 million. This is somewhat lower from the previous report as the last date for proving claims in the CMP passed on October 30, 2016. As per an order by the English High Court, any clients who did not submit a client money claim by the bar date are no longer entitled to any distributions from the client money pool.

However, as noted in KPMG’s Fourth Progress Report, the Claims Portal is still available to clients who previously had a claim into the CMP. Those claims will be treated as unsecured creditor claims. Eligible clients are able to assign their claims to the Financial Services Compensation Scheme (FSCS) at any time. FSCS have confirmed they will compensate all eligible clients of Alpari UK up to a maximum of GBP 50,000, including those clients who agree their claim after the bar date.

To date, the FSCS has taken assignment of 12,759 claims from ex-Alpari (UK) clients and has paid compensation of $50.8 million to 12,305 clients.

A final distribution from the CMP is expected before July 24, 2017.