What do the Millennials want from their FX broker? We find out

Executives from the marketing, technology, brokerage and institutional sectors talk to FinanceFeeds about how the next generation will view their trading environment

Sixteen years ago, the turn of not only the century, but a new millennium took place, heralding a new era.

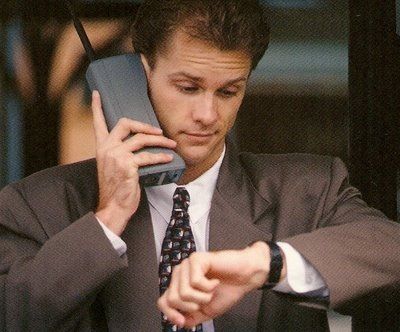

With the passing of the early millennial years, we can wave goodbye to a few of the accoutrements associated with that period.

We have long since waved goodbye to the Nokia telephone, luminous bracelets with the word ‘Livestrong’ embossed into them, V-neck t-shirts, and digital watches with large screens.

The passing of these trappings has led to the next stage in the elapsing of time, which is that those who were wearing diapers, or had just begun their first kindergarten classes whilst the under 30s of the early millennial years wore wristbands and coveted the latest Nokia phone are now in their early twenties and are as technologically astute, if not more so, than those two decades their senior.

Given that the majority of retail FX traders are between the ages of 25 and 40, the ‘Millennials’, those growing up in the millennial years, are very soon to become the target market for most of the world’s retail brokers.

These are people who not only grew up with the latest technology, but were born with it

It will not be a decade, or even half a decade, that this demographic becomes the focus of retail FX brokerages, rather the next one or two years.

Nokia? Who are they?

Whilst today’s traders were most likely some of Nokia’s most loyal customers in the 1990s, the next generation have likely either never heard of the once almost monopolistic company in the cellular phone market, or they consider it an ancient relic of yesteryear, consigned to the same type of derision by the younger generation of today as grey sweaters with patches on the elbows and shoulders, or a beige Austin Allegro would have attracted by the leading edge youth of just 16 years ago.

FX brokerages over the last five years have concentrated many resources on developing very advanced, fully functional smartphone applications that traders had to get used to, with the brokerage considering it a means of generating more volume and engaging traders on a longer term basis, however the next generation of traders will not have to be educated on how to use new technology that brokerages are encouraging them to use, it will indeed be the other way round, where the tech-savvy young trader will demand specific technology, custom functionality and accessibility from their brokers, with absolutely no education on how it works required.

One particular company who showed full understanding of this recently is CBOE LIVEVOL, which is very interesting because the Chicago Board Options Exchange’s data has been traditionally aimed at an institutional and proprietary trading audience, befitting of its Chicago derivatives exchange origins.

The company began to embark on aiming the new market data service toward retail traders, however it has done so by modeling it on the Amazon style method of purchasing, therefore completely demonstrating its commitment toward attracting young users who are familiar with the shopping carts and checkouts of e-commerce sites.

Financially and technologically astute Millennials, of which there are tens of thousands across the world as technology and financial markets have been intrinsically connected during the course of most of the younger generation’s formative years, will use electronic platforms for absolutely everything they do.

Ashraf Ebid, who today announced that he has been appointed Global CEO of Global Market Index, explained to FinanceFeeds “”Millennials demand far superior and easier to use Mobile apps which were not designed originally for the desktop and later jammed into a small screen for mobile. They require no typing and no menus, simply smooth ‘touch and operate’ apps designed specifically for mobile with no legacy designs moved over from the desktop legacy designs.”

Interestingly, Global Market Index which is owned by GMI Group of Companies also includes a joint venture between CFH and GMI called CFH Systems China, China being a particularly important region for catering for Millennials, as during many travels across China’s second tier development towns, the use by very young people of the very latest trading technology is rife.

Mr. Ebid, who is a very widely recognized senior FX industry executive with leadership positions at GKFX, and GFT forming major parts of his career further explained “for the most part, did not really innovate any totally new client facing technology since the early 1990’s. If we look at all trading platforms in the world today, they pretty much look the same with a few minor bells and whistles differences.”

“They are, for the most part, quite complicated to use, for most people. They were designed by traders for traders, which is what most online brokers are proud of. Most brokers even brag and market how complex their client facing software is. The only major problem is most people in society are not professional traders and yet most people who are not professional traders would love to learn how to trade and participate in trading the financial markets. If we add up professional traders plus semi professional traders they will account for less than 5% of people in society. So how can we include the other 95% of society who would love trade if there is an easy, intelligent and uncomplicated ways for them to learn how to trade” – Ashraf Ebid, CEO, Global Market Index.

Mr. Ebid continued “Nothing on the market today offers a real easy set of tools for new traders to learn how to research, analyze, trade and manage their own trading risk.”

“They all require spending endless days and nights fighting with the current available difficult tools to try to somehow wing it and make a profitable trade. Most available online trading platforms today are highly algorithmic and filled with very confusing and hard to analyze technical charts and news feeds. Hence, they are quite frustrating and make most people feel like they are shooting in the uncertain dark with hard earned monies on the line and a real chance to lose money” he said.

“Worst case, some new traders are even forced to blindly follow and copy the trades of unproven and extremely risky trading strategies created by other unknown traders. They hope to solve the financial markets trading puzzle but they risk and most likely end up with disastrous outcome” explained Mr. Ebid.

“It is time to innovate much easier and modern ways to teach most non professional clients how to trade and offer them effective and easy to use tools which can truly help improve their chances to make money” – Ashraf Ebid, CEO, Global Market Index

“The old and useless sales and marketing approach in the online trading industry, which has been used for the past 25 years, is also not helpful at all to most clients who are not professional traders” says Mr. Ebid.

“It is time to change the sales and marketing approach in the online trading industry to make it much more helpful and useful to clients by teaching them and continuously adding real useful value to their trading experiences than the simple empty promises like “come over here, we are the best, trade with us and by the way, you are on your own”.

“It is high time for the stagnant and frozen online trading industry to be transformed and disrupted like many other industries have been disrupted in the last few years using truly revolutionary and intelligent new technologies and value added and sincere sales and marketing approach” is Mr. Ebid’s conclusion.

Demetrios Zamboglou, General Manager at Forextime Limited spoke to FinanceFeeds today, explaining “Millennials as a generation have a number of defining characteristics which impact on how they want to trade, and in turn what they are looking for in a broker. For instance, they are far more likely to be early adopters of new technology and are seeking a slick, personalised user experience, whether that be on their smartphone, tablet or laptop. Millennials also want to be connected on-the-go, which means that mobile trading apps are really a ‘must-have’ for millennials, and act as a key differentiator between forex brokers.”

“At FXTM, we’ve taken on board these requirements in the development of our ForexTime App, which launched in November last year, and provides essential news, live currency rates and up-to-date analysis. For example, the app features a user-friendly, customizable interface that allows traders to create custom groups to track the financial instruments they are most interested in, and to filter newsfeeds so that they only see news that is relevant to their trading style and requirements” he continued.

“The next stage in the development of mobile trading apps will be the creation of solution which will satisfy all of a retail trader’s requirements. In particular, millennials are looking for apps which are a one-stop destination, which for a trading app would enable them to authorise, deposit, trade and withdraw money. Such an app should be client-centric and focused on the trader’s journey, it may also combine a loyalty scheme in order to encourage client retention” – Demetrios Zamboglou, UK Branch Manager at Forextime Limited

“As a final point, it is important to note that millennials are likely to form a core component of a retail broker’s clientele since forex trading is particular popular amongst the under 35s. Brokers should therefore focus on this demographic when developing new products and services to ensure that they are tailored to the needs of this influential group” concluded Mr. Zamboglou.

During a recent visit to Saxo Bank to see the developments that have made it possible for all assets to be traded from a single, device neutral platform, that can now be adapted with open source code by traders or institutions that wish to make their own trading applications, Benny Boye Johansen, Senior Director and Head of OpenAPI at Saxo Bank explained “I worked as an enterprise architect for many years, and argued that when the Saxo was to develop the new SaxoTraderGO platform, we must make two strategic decisions. The first was to build it on HTML5 and JavaScript rather than writing different native applications for iPhone, Android, Windows Phone, web and other technologies.”

“The other strategic decision was to build this new platform on a modern well documented REST based WebAPI, our Saxo Bank OpenAPI.”

“We should also share this API with our partners and third party application developers. I believe the very best solutions are made in collaboration where each contributor does what they do best, and API’s are an excellent way to make this possible.” Benny Boye Johansen, Senior Director & Head of OpenAPI, Saxo Bank

This shows that many modern traders as well as executives within financial institutions are increasingly wishing to develop their own applications, and to integrate them into the products and trading environment offered by large brokerages.

Bart Burggraaf, Managing Partner at MediaGroup Worldwide explained to FinanceFeeds “Traders from the Millennial generation will not have grown up with the background that older generations have, never having called in to place a trade, never having to boot up a pc for two minutes, dial in with a modem and place a trade with a confirmation after 30 seconds. Never having used legacy software. They expect things to be easy and user friendly, and there is really no reason for that not to be the case.”

“Millennials, more than any other generation, have grown up with an expectancy of things being easy and technology led. There is no reason, in their mind, to be forced to do things offline or to fill out the same information multiple times. In general, they want to be able to use whatever device or method they are using to do whatever they want” – Bart Burggraaf, Managing Partner, MediaGroup Worldwide

“So, it is not just an inconvenience that you do not have a Facebook page where they can message you and need to call instead. It is not just an inconvenience that your landing page doesn’t allow visitors to click back to the homepage and it is not just an inconvenience your website doesn’t work on their smartphone. They will just not use you, plenty of other brokers in the sea” concluded Mr. Burggraaf.

Broker technology solutions providers are also continually requiring to invest in resources to keep their products in line with requirements of the latest and up and coming retail traders to whom the brokerages that use such technology provide service.

Yael Warman, Leverate’s resident expert in web content, had an interesting observation to make with regard to the sheer magnitude of the spending power of the Millennial generation, as well as their ability to rapidly consume the technology that they equally rapidly become familiar with.

“Being the largest generation in US history and destined to obtain close to $59 trillion in wealth, puts millennials right in the bullseye of many investment brokerage firms and as a leading tech provider, our commitment to brokers is to develop tools to serve this promising market. Millennials have a great affinity for technology and are digital native” – Yael Warman, Leverate

“They are used to having instant access to product details, price information, news and reviews and as such, we must provide them with multiple channels to access this information. Right now, we offer web, mobile and tablet platforms, besides the traditional desktop application” said Ms. Warman.

“This allows Millennials to obtain the information they want from wherever they may be. We also know that Millennials are less trusting of large financial institutions than other generations and typically turn to their peers or other online networks for advice. This is when social trading communities come into play. We have been working hard on developing an EU regulated, cross-community social trading network to serve the need of millennials for knowledge sharing and crowdsourcing.”

Ms. Warman concluded “We also strive to make our platforms fully transparent, because we know millennials double-check their facts and want to build trust with a brand. Last but not least, millennials want control and personalization. We have developed -and continue to work on fine-tuning- an automated conversion and retention funnel that allows this generation’s individuals to be self-directed, while at the same time have access to an advisor if they decide they need one, through e-mail, SMS and push notifications that are personalized and customized throughout the conversion and retention funnel.”

From an analytics point of view, Andrew Lane, CEO of Acuity Trading explained “I believe Mobile trading is still very underdeveloped, with traders flocking to mobile whilst the industry is lagging in its offering. This from my perspective means Acuity has to reconfigure how we serve up data through the mobile format.”

“Data that appears through mobile has to be a lot more relevant to a trading experience, gone are the days where we can publish ‘Non Farm Payroll is +200’; that data must become relevant and actionable to each trader. Finally whereas you and I may be used to trading off price data and news, the trader of the future will look for many more data sets to build up a strategy, such as the long term rain forecasts for Soya growing countries or country specific news sentiment levels. That trader will want to access that data easily and quickly” – Andrew Lane, CEO, Acuity Trading

Retail traders Tom and Owen from TwoBlokesTrading.com and the TwoBlokesTrading podcast, both Millennials themselves, look at it from a trader’s perspective. “Millennials get a bad rap for being fly-by-night or somehow less focused on the long-term. Less committed to a ‘career’ than a variety of jobs, more about Tinder than marriage etc, but the reality is that Millennials just set far less store by institutions that their parents and grandparents did” said Tom.

“Whilst this may mean on the one hand that they are less likely to marry young or work for the same FTSE 100 company for their whole life, it also means they are less likely to choose their broker based on who has the ‘biggest name’ in the industry or who has been operating for decades.”

“In our experience Millennials will expect any service provider to be two things: 1) Open, honest, transparent and fair 2) Community focused” said Tom.

“Younger people these days are far more likely to be socially liberal and that mindset, plus growing up with free-flowing information on the internet means that closed-shop, boys-club mentalities are anathema. They want their broker to be honest with them of course, but it also means that they want them to help break the grip of institutional traders on the markets. Stories of rigged FX and Libor make people suspicious – lots of younger people we talk to would love to get into trading but just believe that the markets are stacked against the little guy” he continued.

“A broker that tip the scales in favour of the retail trader (even a little bit!) would find a very receptive audience in Millennials. Don’t ask me how – that’s their job to figure out! One idea that may be impossible to implement is real time news on major events. Most new traders are terrified of trading news events because they think that the hedge funds are getting the info a minute quicker…Maybe they are or aren’t but that’s the perception so people often withdraw from this because they can’t afford the high fees for this stuff.”

“The latter point of communities is something that was seized upon by eToro to great effect – it is no surprise that a lot of the traders on there with big followings are younger traders. Maybe brokers could focus on offering something in this area – the ability to be part of community of traders is currently serviced outside of your broker.”

“Traditionally brokers have been very secretive (for good reason) but making people feel part of something bigger is what Millennials are all about – but that something bigger is a group of peers, of like minded people, not some ancient and venerable institution that maybe their parents idolised but, frankly, they couldn’t care less about” concluded Tom.

Christian Hammer, Head of Platforms today spoke to FinanceFeeds and explained “Millennials have grown up with intuitive, customisable client interfaces and this is mirrored in their choice of trading platform where they are looking for a broker who can provide both innovative technology and all the necessary information to make informed investment and trading decisions.”

“As an agile financial markets facilitator, Saxo’s competitive advantage has always been to lead rather than to respond to digital trends and we have made significant investments in our multi-asset platform to ensure that millennials benefit from the best technology available. Because the SaxoTraderGO platform has been written entirely in HTML5 it ensures a seamless trading experience across all mobile and desktop platforms” Christian Hammer, Head of Platforms, Saxo Bank

Mr. Hammer concluded by emphasizing the technical prowess of the Millennials, and how they expect to be able to customize their trading environment “On top of this, Saxo Bank is working closely with both fintech start-ups and other companies like the financial news portal Wallstreet CN to further strengthen the position as a strong facilitator of investment and trading. Our OpenAPI gives our partners a lot of customization options to cater to their end-clients’ specific needs.”

“These partnerships let millennials trade with the specific front end interface that captures their attention, based on solid technology and 20 years of trading and investment experience. That way we make sure that Saxo both in direct contact and via our partners can fulfil the needs of millennials. It is a win-win for all and in our view this type of open cooperation characterises the future of investment and trading” said Mr. Hammer.

Helen Astaniou at FXPRIMUS explained “Millennial traders are a hugely important group within our clientele. Although younger than the traditional trader, many have a keen financial acumen or a general interest in trading that leads them to explore the financial markets.”

“As approximately one third of our traders are within this age group, we utlilse our strategic pillar of education in order to engage them and help retain their interest in navigating the markets, and we do this in a number of ways” continued Ms. Astaniou.

– We break down complex financial jargon into easy-to-understand concepts through our FX glossary: http://www.fxprimus.com/en/education/fx-glossary

– We utilise popular social media channels, using a range of visual, engaging media in order to convey important financial information and market moving events. https://www.facebook.com/FXPRIMUSbroker/

– We look ahead to the next steps in online media and work to keep ahead of popular technologies engaging millenials. For instance we recently launched a virtual reality campaign. FXPRIMUS.com/getrealwithus

– We use mobile technologies to ensure that traders are able to access their trading accounts anytime, anywhere, with only an internet connection and any portable smart device.

“We use innovative and imaginative campaigns to inspire and engage. The company always looks to appeal to its clientele in an imaginative way, in order to show millenials – and those of other generations – that we are a flexible and dynamic, yet trustworthy broker. This is done through interesting campaigns such as our fun live trading competition www.fxprimus.com/tradingtitans, also through interactive booths at events” continued Ms. Astaniou.

“The team at FXPRIMUS has been closely monitoring the tremendous increase in popularity of social media and of mobile apps through which millennials prefer to trade. For instance, by tweeting instant market updates on Twitter, this partially replaces the need for more traditional sources such as the Bloomberg Terminal. In sum, the company is sparing no effort to make its trading and research tools available through channels of convenience and of relevance, in order to make the client trading journey as efficient as possible” concluded Ms. Astaniou.

Quite clearly, the world’s population with dates of birth in the late 1990s are a force to be reckoned with in terms of technical understanding and appetite for innovative systems that empower their daily lives as well as their financial prowess.