Mind your language!

Q: When is a retail FX brokerage a multilateral trading facility or clearing house? A: Never.

It is all so easy to make a distinction between acceptable presentation via marketing materials and brand positioning in the retail FX industry these days, especially when considering that, despite its completely borderless, online nature, trading platforms and the brokerages that make the connection between the retail trader and the live market, the default language is English, and the rules and regulations in most jurisdictions are clearly defined.

In Britain, North America, Australia, most of Europe, Cyprus, Hong Kong and Singapore, all regions with large retail FX participation, the regulatory stipulations are widely understood by the vast majorities of companies, and the marketing and product development divisions of the array of companies that operate in these regions and serve the world, are very familiar with the specific, industry related terminology used to describe a retail electronic trading system to customers, and most importantly, and adhere to it with aplomb.

For example, if a company with regulation in Australia or Cyprus presents itself as a brokerage which offers ‘straight through processing’ (STP) order execution, when it either does not, or it internalizes most of the flow, there would be outrage among its peers, and probably a censuring from the regulator.

Indeed, incidents such as this have been highlighted in the past.

But what about China?

In China, which is home to some of the most accurate and astute professionals, the eye for detail and level of understanding among retail customers, IBs and brokerages being very high indeed across the entire country, there is an anomaly.

Chinese brokerages, when positioning their services, have some very ornate and somewhat embellished methods of defining what sector their products fit into, which is at the very least, quite confusing, and at the most, misrepresents the product altogether.

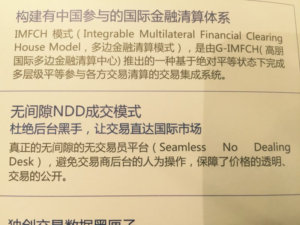

Describing a MetaTrader 4 retail brokerage with a white label platform license from MetaQuotes as a multilateral trading facility or a clearing house would very likely attract the immediate attention of a regulator in any region of the world which has a developed financial markets economy.

Indeed, many small brokerages have been censured in recent times by the FCA, CySec or ASIC for distributing misleading marketing material, and in some cases ordered to pay a penalty and remove the material, in other cases had their licenses removed, and in all cases been the subject of regulators having published this on their websites to inform customers of any misleading material.

Here in China, however, it is entirely possible for a retail brokerage with a white label MetaTrader 4 license to describe itself as a multilateral trading facility, or a clearing house.

In this particular example, a precursor to the somewhat tenuous definition has been added, that being ‘integrable’, which is a word that does not exist at all in the English language.

If this particular word has been selected to refer to a component that can be integrated, its purpose is no clearer, as it begs the question as to which component of a clearing house or multilateral trading facility – of which the product and service is neither – is intended to be integrated into what.

Clear as mud

There may well be a quite plausible school of thought that because brokerages which use this type of description in their material and product placement are Chinese and therefore are specific to the mainland Chinese market, what is written in the very small amount of English that exists on the promotion is of little relevance.

Since English is almost completely absent from absolutely everywhere in China, including all business environments from small firms to large entities, why include any English at all?

The state regulator, SAFE, which oversees all domestic Chinese FX business and is owned by the People’s Bank of China, which in turn is owned by the Chinese government, does not recognize English at all, and the vast majority of systems and employees do not speak English.

These phrases, therefore, may be a case of difficulties in translation, or it could be that they are wordings that have been copied from institutional terminology that has been researched generically such as in investment and infrastructural technology sections of encyclopedias. It is important to remember that many search engines and information resources on the internet which are open in free market nations are blocked in China, thus translation to English and obtaining certain terminology in English is very difficult indeed.

All of this, then, may not bother anyone unduly, as the Chinese audience that it is intended for would fully understand that this is a retail brokerage and not an MTF or clearing house, however the difficulties will arise when Chinese brokerages begin to export their services overseas.

In China this week, a great many astute and urbane FX industry executives, all of whom are highly knowledgeable and operating in an ultra-modern, highly capitalized and well organized environment, have aspirations of taking Chinese brokerages to a global audience.

At that point, marketing departments from Anglophone countries will be required in order to ensure that the Ps and Qs are watched, and that nobody can mistake one product for something that is entirely different.