New product preview: The trading platform that turns everyone into an IB

What if there was a trading platform that hosts all IB activity manages client accounts referred by IBs and was viewable by broker and IB on a realtime basis, negating the need for separate IB databases and making use of client data absolutely efficient? There is now… We take a look.

The reliance on introducing brokers (IBs) and strategic partners has become an intrinsic component of the retail FX brokerage structure recently, having risen to prominence over the past few years from its origins as a separate stream of revenue compared to organic sales and retention, to a vital stream of client management and a generator of huge volume at a lesser cost than operating an organic sales desk.

Whilst the introducing broker infrastructure has become so critical, so has the cost and procedure associated with managing, onboarding and providing service to introducing brokers, so much so that retail brokerages are now finding that the cost and administration associated with maintaining the commercial structure of introducers is almost as high as operating direct sales desks.

What if a trading platform turned everyone into an IB, and managed them all centrally?

Brokerages in many cases, despite being faced with very narrow margins and high acquisition costs which is impacting return on investment, are still hampered by using separate systems for administering introducing brokers, and on employing a dedicated (and sometimes expensive) department in order to bring them on board.

This results in having to pay a salary and commission to account managers that are responsible for working with introducing brokers, as well as expending substantial efforts in attempting to locate and onboard new introducing brokers and make their lives easy also.

In just a few days, the web-based version of the IB portal which is an integral component within Spotware Systems’ cTrader platform will be launched, joining the downloadable solution which has been available for a few months.

Today, FinanceFeeds met with James Glyde, Business Development Manager at Spotware Systems to look at the only retail trading platform in the world that turns every new customer into an IB automatically, and manages all IB activity from within the actual trading platform itself.

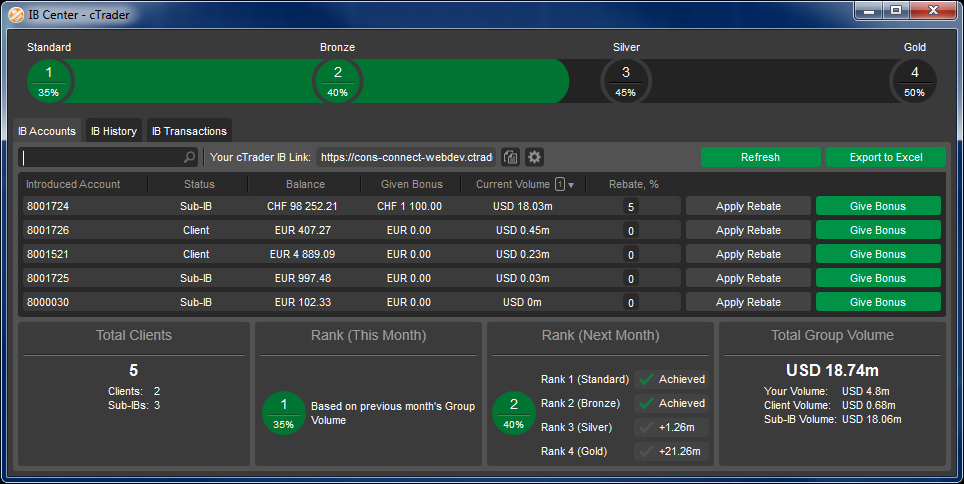

Having taken a good look at the platform today, the functionality of the system has a very ergonomic and clear user interface, which features an integrated introducing broker panel.

When a new client signs up for a trading account, that client automatically becomes an introducing broker, with a check box which the broker can set to make all new trading accounts into an introducing broker, whether the trading account is that of a retail customer or not.

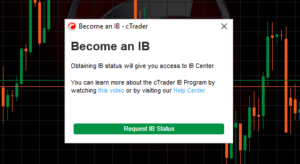

If the broker hasn’t enabled making everyone an introducing broker by default, the client gets a message that asks them if they want to submit the request to the broker to turn that client into an introducing broker. The broker then administers this from the introducing broker section of cBroker, which is cTrader’s administration panel.

The unique aspect here is that the introducing brokers are managed directly from the trading platform and there is no need to go to other websites that are unrelated to the trading platform. This means that the system is by design connected to the introducing broker’s activity, as it is reading it directly from inside the trading platform and negates the need to use unrelated systems to manually manage several introducing broker accounts.

Mr. Glyde explained “Introducing brokers can see key metrics in real time. They can transparently see every single deal created by each introduced account and exactly how much they earn from that deal.”

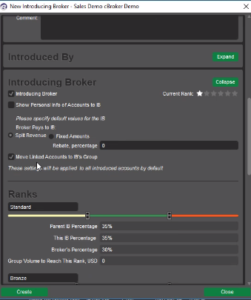

“To create an introducing broker account, once the trading account has been created and all contact details have been set, you can make that trading account into an introducing broker account, for split revenue or fixed amounts. Brokers can check a box that means that all introduced accounts get moved to the same group as the introducing broker” continued Mr. Glyde.

“Brokers can control absolutely everything from cBroker, the cTrader admin panel” said Mr. Glyde. “In addition, brokers can cater for an introducing broker’s specific needs because every account can have it’s own introducing broker profile and corresponding group for their clients. All introduced clients are automatically assigned to the introducing brokers group” he explained.

Simple management of IBs makes for ease of retention and better use of leads and sub-IBs

Mr. Glyde explained the simplicity of administering client trading accounts that belong to each introducing broker. Introducing brokers can introduce new clients or partners to other introducing brokers and sign up sub-introducing brokers via the platform, the levels of introducing brokers being ranked according to trading volume.

“Each month, introducing brokers are listed on the platform with zero volume, which then increases according to trading activity. This gets zeroed each month, so the introducing brokers have to keep validating the rank each month in order that brokers know which introducing brokers to retain and which are no longer bringing revenue” said Mr. Glyde.

Every sub-introducing broker has to share with a parent introducing broker which is at the top level of the structure before the brokerage itself, If there is no parent introducing broker as that parent introducing broker has either closed his account or become inactive, then the revenue share that would have gone to the parent introducing broker goes to the broker itself.

In essence, if an account gets deleted, then the sub-IB structure gets shuffled up one level.

Revenue share or fixed dollars-per-million remuneration

Spotware Systems has developed a sliding bar system which brokers can use to set the revenue share for introducing brokers, this way, brokerages can set their own parameters in terms of how much they want to pay introducing brokers, directly from within the platform.

In some cases, introducing brokers opt for other remuneration methods than revenue share, in which case a fixed dollars-per-million amount can be applied regardless of volume.

The broker can administer all introducing broker accounts from the “Introducing Broker” section on the main interface of the trading platform, move them to other groups, change the profile of the introducing broker and track performance of the introducing broker.

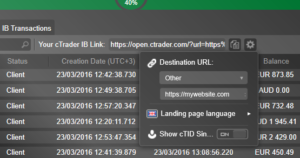

Brokers can run a report and aggregate all of the history, broken down into categories for each introducing broker using the “History per IB” tab on the platform.

Brokers can see how many sub accounts they had, how much was traded per account, how much total volume, broker commission, client commission, broker markup price, client paid markup, total IB revenue and Net Brokers revenue was paid.

The “IB Center” is actually integrated in the platform and there is a button on the main trading platform fo all users to see.

No chance for fiddling the records – cTrader server hosts entire introducing broker metrics

Using the system, introducing brokers can give a bonus and rebates to clients, however the broker to which the introducing broker refers business configures the ranks that introducing brokers can be established under as far as the hierarchy of an introducing broker structure is concerned.

These are customizable in order that they can be named according to align with the marketing strategy of a brokerage, and as an example can be set to conventions such as “Silver, Gold or Platinum” denoting the level of the introducing broker according to trading volume and hierarchical position.

Under the view, brokers and introducing brokers are able to see the contact details of client as well as see when a trading account was last used, its trading volume and client activity, so therefore can call clients and perform retention tasks such as obtaining more deposits or find out why a customer’s trading account has not been traded for a while.

As a result, the introducing broker can do all the retention instead of the broker. The introducing broker has the client’s email address, contact number and all of the metrics, therefore can communicate to the broker on behalf of client and broker, saving time from the broker’s perspective.

Transactions on the platform are shown in real time, however an interesting advantage with regard to remuneration of introducing brokers is that deposits to trading accounts are made every day at midnight (GMT) so that the IBs get paid every day into their trading account.

This of course needs to be deposited by the broker, but under this system the broker cannot manipulate the system to take advantage of an introducing broker because the data is viewable by broker and introducing broker, on a real time basis and is hosted by Spotware Sytems and not the broker.

As the role of the introducing broker, in some cases with larger businesses than some retail brokerages themselves, continues to be a cornerstone of the retail FX industry, this is an interesting development with regard to bringing the introducing broker and all associated activities into the actual trading platform itself.