NFP Fizzles, Dollar Bull Fights Back

USD/JPY shot past 104 after a disappointing Non-farm payroll. Fullerton Market’s research team look at why and what can be expected.

By Wayne Ko, Head of Research & Education at Fullerton Markets

Last week’s finale ended with a disappointment. Non-farm payroll printed at 151K, missing the expectation of 180K by close to 30K. Average hourly earning rose by 0.1%, which is lesser than the consensus of 0.2%. Unemployment rate remained stagnant at 4.9%, but market expected a slight improvement to 4.8%.

Just by looking at these figures, anyone would have expected the dollar to weaken. USD/JPY fell more than 50 pips in the first couple of minutes. What made everyone scrambling for an answer was USD/JPY gained 150 pips gained in the next 2 hours. So what could be the explanation?

Although investors were looking at the NFP figure to adjust their rate hike expectation, but many had already priced out a September rate hike even before last Friday’s data. The underperformed data had little impact on September rate hike expectation. The next possibility would be in December. There are 3 months of data ahead, so investors decided to give Fed the benefit of a doubt.

The figure for July was revised upwards from 255K to 275K, which makes it the second highest in 9 months. This could be one possible reason that motivated the dollar bull to fight back. We continue to hold our bias towards a probable rate hike in December rather than September.

Sterling had a good run in the last one month, gaining close to 500 pips against the greenback. Last week’s manufacturing and construction PMIs outperformed, gave the sterling a boost to go beyond 1.33. The big surprise came from the manufacturing sector. The latest PMI came in at 53.3 showing expansion, versus the consensus of a slight contraction in the manufacturing sector at 49.1.

Manufacturing expanded the most since November 2015; coincidently, the sterling had been weakening since then. A weaker pound definitely favours exports and manufacturing. The sterling should be driven by data until end of this year unless fresh news is available as to when UK Prime Minister will invoke Article 50.

This week would be an exciting week again, with plenty of market volatility expected. Three central bank interest rate announcements and statements are scheduled across three days. Reserve Bank of Australia is quite unlikely to implement a back-to-back rate cut after slashing it to historical low last month. With the Aussie hovering around 76 cents, they are likely to remain dovish.

Canada’s job data and inflation is a worry, however, the recent GDP surprised on the upside. With oil price remaining above $40, we expect Bank of Canada to maintain their optimistic outlook. The chances of policy changes by European Central Bank are slim. Their forecast may be gloomy, as the inflation is still way below their target.

Our Picks

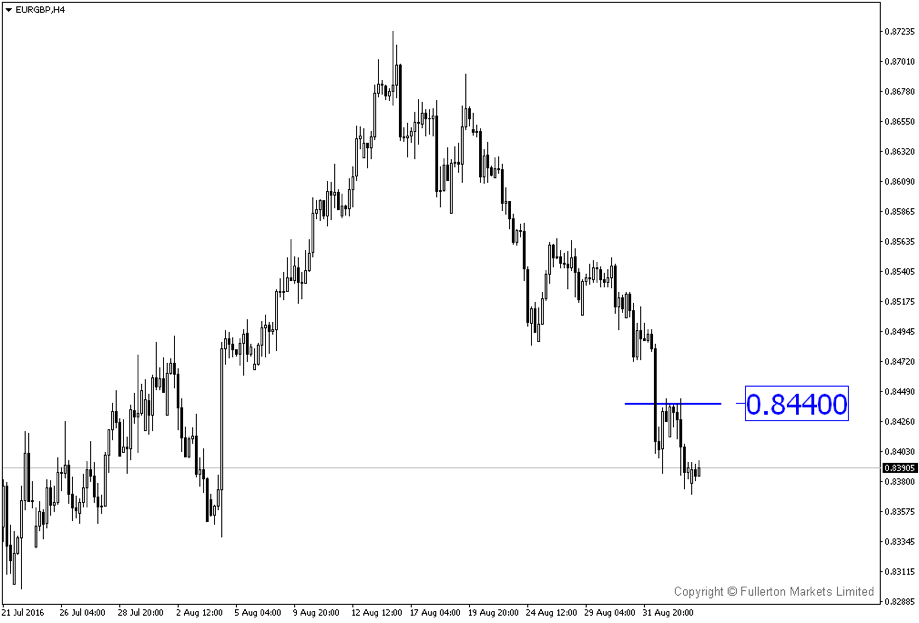

EUR/GBP – Slightly bearish. EUR/GBP is in a downtrend. ECB’s outlook may be unfavourable to the Euros. Possible buy at peaks.

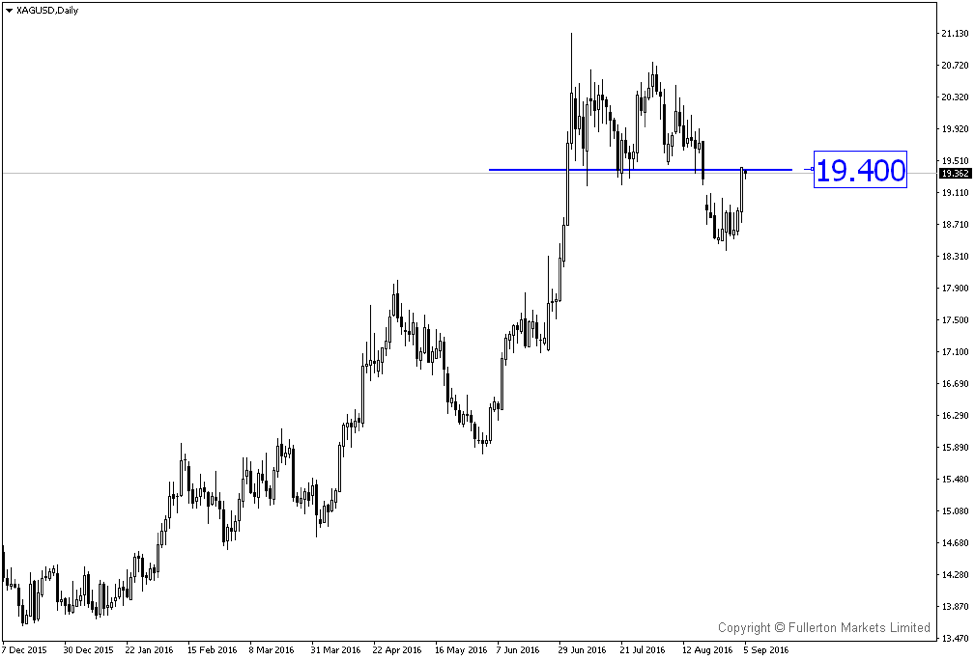

XAG/USD (Silver) – Slightly bearish. Silver broke the neckline of a double top formation. Price retraced back to the neckline around 19.40. Possible short after a bearish candlestick pattern is formed.

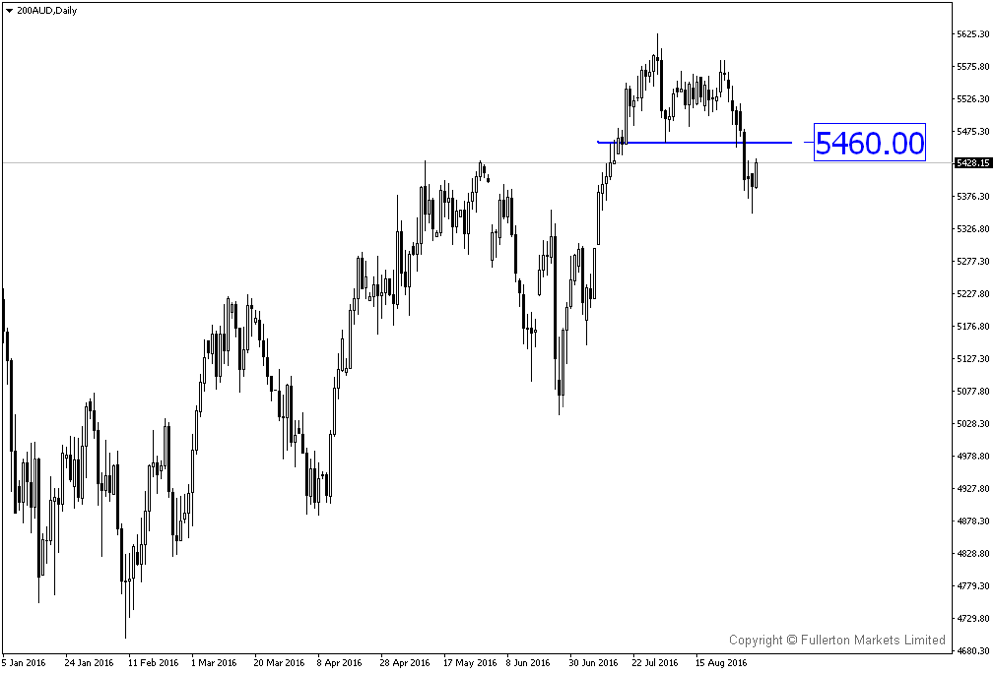

200AUD (ASX200) – Slightly bearish. Price broke 5460 support. Possible reversal in trend.

Top News This Week (GMT+8 time zone)

Australia: Cash Rate. Tuesday 6th September, 12.30pm. We expect figures to come in at 1.5% (previous figure was 1.5%).

Canada: Overnight Rate. Wednesday 7th September, 10pm. We expect figures to come in at 0.5% (previous figure was 0.5%).

Europe: Minimum Bid Rate. Thursday 8th September, 7.45pm. We expect figures to come in at 0.0% (previous figure was 0.0%).

Fullerton Markets Research Team – Your Committed Trading Partner