Passing the bucket: Is your PB really sending orders to the market, or does STP stand for Straight to Pocket?

So much attention is given by retail clients and those in the know to the subject of straight-through processing (STP), which is the execution process in retail FX by which orders are sent directly to a liquidity provider rather than internalized by a dealing desk. The STP model, otherwise known as A-book, has become the […]

So much attention is given by retail clients and those in the know to the subject of straight-through processing (STP), which is the execution process in retail FX by which orders are sent directly to a liquidity provider rather than internalized by a dealing desk.

The STP model, otherwise known as A-book, has become the favored model by which to onboard wary retail customers who may otherwise fear that their brokerage is not operating in the most transparent fashion.

Despite the flaws which were shown in the A-book model on January 15 this year when brokers were exposed to negative client balances which in some cases signaled the end of the road, the A-book model still represents transparency in the eyes of a retail trader.

But what about beyond the eyes of the retail trader?

What happens to the order flow once a broker, in good faith, passes it to the prime broker? Most of the time, it will appear as though this is a total A-book system from end to end, but there is always the possibility that the internalization is being done one level above the actual brokerage, and is being conducted at prime brokerage level?

FinanceFeeds today spoke to senior executives in the prime brokerage sector in order to establish how a broker can ensure transparency.

Norbert Lukasiewicz, COO of Divisa UK provided his perspective.

“If trades are being warehoused we don’t have a true PB/PoP – broker setup” said Mr. Lukasiewicz.

“It’s simply a liquidity provider (counterparty) vs. broker relationship” he continued.

“I would say that as long as it’s a transparent and fair (best execution, etc.) relationship between a broker and its counterpart it can be beneficial for both sides. Unfortunately that is not always the case” Mr. Lukasiewicz continued.

When FinanceFeeds stated that we expect that a lot of small retail firms don’t realize that they are dealing directly with a counterparty, Mr. Lukasiewicz said “that is absolutely right. A lot of them expect that they trade against Tier 1 market makers, but the reality is very different.”

“We see a lot of new prime brokers or prime of primes in the market that offer liquidity at extremely low commission rates and we both know that after SNB credit is very expensive” Mr. Lukasiewicz told FinanceFeeds.

FinanceFeeds concurs that as a result, counterparty credit risk is now a big worry for all industry participants, an aspect with which Mr. Lukasiewicz agrees.

The cost of clearing and technology tips the balance, and finally how to spot a B-book LP

“If we add clearing and technology fees it’s very often more expensive than some of the ‘Prime of Prime’ offerings in the market” said Mr. Lukasiewicz. “That should be the first sign that something is not right – ie it is too good to be true” he said.

For a b-booking broker, spread is just a fraction of their revenue, so they can afford to lower it” he said. “However we can still get very competitive spreads with a provider that is fully STP and Divisa Capital is a good example of that” explained Mr. Lukasiewicz.

“When it comes to ‘spotting’ a b-booking provider, any kind of profit shares should sound alarm bells. There is also speed of execution, usually the quicker the better, but if it is too quick, it means that someone somewhere is warehousing that flow.”

“We work very closely with our LPs and clients to understand their business models and liquidity needs. That allows us make to tailor liquidity to broker’s needs and at the same time ensure that LPs can still offer competitive pricing. I believe that with a good feedback from both sides (LP and brokers) and right feed customization STP PoP can be competitive against pure market makers” is his conclusion.

Natallia Hunik, Global Head of Sales at Advanced Markets/Fortex put her perspective to FinanceFeeds

“You’ve probably heard a number of FX market players referring to themselves as a “Prime Broker”, “Prime of Prime”, “ECN”, “STP” or “Clearing House”. The market is inundated with these buzzwords. But how can you verify whether these are just marketing traps or that the advertised claim is legitimate?” she asks.

Ms. Hunik then provided a series of four indicators which according to her research, show the difference between a real prime of prime, and one which is internalizing all of its flow.

1) Does your provider have a Tier 1 Prime Broker?

If they claim they do, can they provide support by way of an endorsement from this entity? As a true Prime of Prime, Advanced Markets has this verification of its PB relationship with UBS

2) What is their business model?

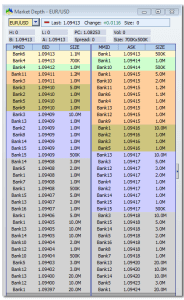

Do they claim that they STP everything to the market? If so, request that they show you their depth of market. What is their top of the book liquidity? What is the total depth of their book? Can they handle higher frequency flow? How about trading in larger sizes? What if you need to execute an order of 5 Million, or 10 Million? Do they impose a maximum trade size, as some do, to limit their risk because they are taking the risk on client positions (Usually 5 million)? Here is an example how the depth of market book looks at Advanced Markets:

3) What kind of platform is used for you to reconcile exposure and manage your brokerage’s omnibus account?

Companies that are using prime only as a buzz word in their name, usually just manage the book inside of MT4 or send the flow from client’s MT4 to some other mt4. These will not have their own proprietary platforms or real-time dealing Interface for you to manage your brokerage clearing account. Instead, you will be given MT4 manager or MT4 account to manage your omnibus account.

4) What level of transparency does the PoP provider offer?

Transparency is paramount in any relationship with liquidity providers. Does the vendor offer post-trade transparency? Do you know how many fills it took to execute your trade? How long did it take for each fill? What was internal latency? Can your prime broker provide granular reporting showing timestamps, fills etc.

5) Are they licensed or registered?

Be very careful with this one. It is important to know that your broker, who is acting as the counterparty to your trading activity, must adhere to some form of regulatory capital requirements, operational policies and procedures, an AML/KYC regimen and Disaster Recovery procedures at the very least. Without oversight from a competent regulatory body, the PoP broker is essentially free to run their operation as they see fit, not how generally agreed standards would dictate. Inquire about the regulator that has authorized the Prime Broker to carry out FX activities. Be sure to verify their claims with that regulator’s registry to ensure the license type and permissions they have been granted.

6) Who is the technology provider behind the offering?

Is the vendor dependent on 3rd party technology? If so, which one (you may want to conduct due diligence on the vendor separately)? Do they have their own technology?

As a client, some of the key things that you should be looking for from the technology are stability, scalability and robustness.