December 17, 2018, 9:42 am UTC.

BinckBank and Saxo Bank agree on recommended all-cash public offer for all BinckBank shares

BinckBank and Saxo Bank have reached a conditional agreement on a recommended all-cash public offer of EUR 6.35 (cum dividend) per issued and outstanding ordinary share and priority share of BinckBank representing a total consideration of EUR 424 million.

The offer price represents a premium of 35% over the closing price of 14 December 2018, and a premium of respectively 42%, 43% and 38% over the average volume weighted price per share over the last one, two and three calendar months, delivering immediate, certain and significant value to BinckBank shareholders.

- The transaction was unanimously supported and recommended by BinckBank’s executive board and supervisory board.

- Saxo Bank has committed financing in place and will fund the transaction via a combination of equity injections by its shareholders and cash at hand.

- The parties have agreed to certain non-financial covenants for BinckBank stakeholders for a period of three years.

- Draft offer memorandum will be submitted to the AFM no later than end of Q1 2019.

- It is anticipated that the offer will close in Q3 2019.

BinckBank and Saxo Bank announce today that a conditional agreement (the Merger Protocol) has been reached on a recommended public offer (the Offer) to be made by Saxo Bank for the entire issued and outstanding share capital of BinckBank (the Shares) for EUR 6.35 in cash per share (cum dividend) (the Offer Price).

This announcement follows constructive interactions between the boards and management teams of both companies including a period of targeted due diligence.

For more than 25 years, Saxo Bank has strived to democratize trading and investment. The combination of BinckBank and Saxo Bank will help accelerate this ambition, achieve necessary scale and facilitate the strategic response of both companies to current market dynamics. The interests of all stakeholders of Saxo Bank and BinckBank have been carefully taken into account. The merger benefits from the two parties’ complementarity in geographic footprint, product offerings, and customer bases, covering the full retail client spectrum from mass retail to high-end. The combined entity is committed to continued significant investments in technology, thereby allowing it to remain at the forefront of innovation while adapting to changing customer behaviour.

Kim Fournais, CEO and founder of Saxo Bank:

“Combining BinckBank with Saxo Bank is a true win-win for all parties. Clients will get better products, prices, platforms and services, employees will benefit from enhanced career opportunities and, importantly, we will gain the necessary scale to further step up investments in technology and in our people. As the investment and trading industry matures and faces new regulation as well as rising expectations for digital client experience, scale, technology and multi-asset capabilities become increasingly key to long-term success.

We have a strong cultural fit with BinckBank based on a shared vision and purpose to democratise investment and empower everyone to take control of their financial destiny. Our two companies complement each other well in terms of geographical footprint, brand, client segments, product suite and not least in the talented employees of both companies.”

Vincent Germyns, chairman of the BinckBank executive board:

“Since the origins of BinckBank in 2000, we have managed to build a strong position. We have become market leader in the Netherlands and Belgium and are strong challengers in France and Italy. We are confident that by combining BinckBank with Saxo Bank, we will be able to further strengthen our offering and growth in these markets. As such, it is important to note that Saxo Bank shares both BinckBank’s vision and mind-set focused on giving investors access to financial markets through technology and innovative solutions. Therefore, the combination of BinckBank and Saxo Bank is a natural fit and secures the future growth of BinckBank within a bigger and stronger organization and provides our customers with an even broader range of innovative products and services in the area of trading and investing.

Merging both companies will help realize important economies of scale. On a term of two to three years, this will of course have consequences for staff. As far as possible these consequences will be met through natural staff turnover. In case of redundancies, a good severance scheme will apply. The executive board, supervisory board and works council support this severance scheme unanimously.”

John van der Steen, chairman of the BinckBank supervisory board:

“Talks with Saxo Bank have given us much trust in the combined future. BinckBank and Saxo Bank are quite similar companies with shared passions, ambitions and values. A combined future will strengthen our position in the European market and increases our added value to our customers. The Boards believe this transaction puts BinckBank in a stronger position going forward. The proposed transaction is the result of extensive negotiations between BinckBank and Saxo Bank over a period of several months and a shared vision for the combination going forward. The combination of a very attractive cash price, deal certainty, and strong protection of stakeholder interests through the non-financial covenants leads the boards to unanimously recommend this transaction.”

Strategic rationale

The online trading and investment sector is currently facing multiple challenges including challenging competition, increased regulation, low interest rates, considerable technology investment requirements and changing customer behaviour. Such dynamics necessitate pro-active and decisive strategic actions. Scale, diversification, state of the art technology, relentless customer focus and multi-asset capabilities are becoming ever more important to deliver customer and shareholder value.

Both parties believe that the combination of BinckBank and Saxo Bank (the Combination) represents a powerful response to market dynamics and has a number of strategic benefits including:

- Strong cultural fit with a shared vision of democratising trading and investments and a philosophy centered around customer service, transparency, simplicity and innovation;

- Excellent complementarity in geographic footprint, product offerings, and customer base, covering the full retail client spectrum from mass retail to high-end;

- Combination of Saxo Bank’s industry leading technology platform and product suite with BinckBank’s large customer base and strong distribution capabilities;

- More balanced revenue mix for the combined company balancing net interest income, fee & commission income and spread income;

- Enhanced scale economies at a time of rising technology investment requirements and regulatory costs;

- Enhanced career opportunities for employees in a larger, modern and digitally oriented, international financial services group.

Transaction details

The proposed transaction envisions the acquisition of the Shares pursuant to a recommended public offer by Saxo Bank. The Offer Price per Share represents an implied equity value for 100% of BinckBank on a fully diluted basis of EUR 424 million.

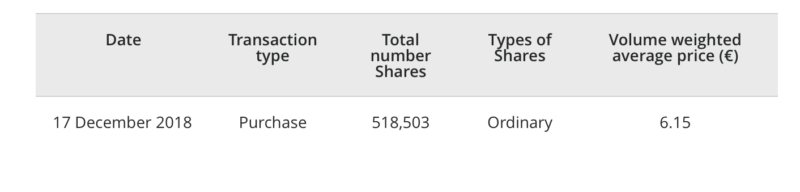

The offer price represents a premium of 35% over the closing price of 14 December 2018, and a premium of respectively 42%, 43% and 38% over the average volume weighted price per share over the last one, two and three calendar months, delivering immediate, certain and significant value to BinckBank shareholders.

The Offer Price is cum dividend.

Fully secured transaction financing

Saxo Bank will finance the Offer from its available cash resources and through equity financing of EUR 100 million. As such, Saxo Bank has received binding equity commitment letters from Fournais Holding A/S, Geely Financials Denmark A/S and Sampo Plc for an aggregate amount of EUR 100 million, which are fully committed.