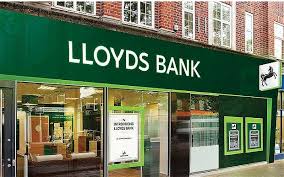

Thatcherism for the Millenials! Lloyds Bank shares to be sold, with discount offered to members of the public

It is 1979 all over again. Although this time, instead of paying down an unsustainable national debt which was increased by the nationalization of vast entities by selling government owned housing stock to sitting tenants at a discount, it is government-owned shares in one of the world’s largest banks that are on offer. Following in […]

It is 1979 all over again.

Although this time, instead of paying down an unsustainable national debt which was increased by the nationalization of vast entities by selling government owned housing stock to sitting tenants at a discount, it is government-owned shares in one of the world’s largest banks that are on offer.

Following in the fiscal footsteps of former British Prime Minister Baroness Margaret Thatcher, Chancellor of the Exchequer George Osborne has announced today that a £2 billion sale of the government’s share in Lloyds Banking Group PLC (LON:LLOY) will involve prioritizing members of the general public who will be able to purchase the shares at a discounted rate.

Seven years ago, when the financial crisis caused most of Britain’s large banks to become insolvent and as a result look to the taxpayer’s wallet, the British government took a 43% stake in Lloyds Banking Group, however Mr. Osborne believes that it is time that the taxpayer gained a return on such a vast, involuntary investment.

Power to the People: Private investors will be offered a 5% discount and given priority

Selling off government assets in order to empower the investing public and reduce government burden was one of Baroness Thatcher’s most famous policies. In 1979, Britain was on the verge of complete fiscal collapse, had a state owned housing stock the length and breadth of the land which was in a potentially costly state of disrepair, and a disenfranchised business environment with mass unemployment and lack of self-empowerment.

By selling the housing stock to the occupying tenants at a vast discount and then providing ease of establishing businesses, the state burden was reduced significantly, and the new proud owners of their own homes were solvent and successful within a very short time.

Mr. Osborne’s initiative is reminiscent of the housing stock sale in principle, as it puts a large, government asset back into the hands of the private investor, whilst allowing them to profit from the future performance, even if that is more modest than before due to the ability to purchase the shares at a 5% discount.

Members of the public wishing to place an investment of less than £1,000 will be given priority if there is too much demand. The funds raised will be used to reduce the national debt which has increased tremendously since 2008.

Britain as a self-empowered, share-owning democracy

Britain’s economy, despite being very London-centric, has improved exponentially during the past year. London is absolutely booming and new financial technology as well as the City’s old-stagers are performing so well that the country is more than back on track financially, however the debt still remains, and therefore what better way to reduce it than to give an increasingly better off population the chance to reduce the debt whilst improving their own investment portfolio at the same time.

Mr. Osborne spoke on ITV’s Good Morning Britain today, saying:

“We have announced a big sell-off of Lloyds shares to members of the public, small investors, people who are going to have a chance to get something back having put all that money in under the last Labour government.”

Later that day, he was interviewed by Sky News, where he stated

“We have got a big task here which is finally getting the British government out of owning great chunks of the banking system. This final chunk will be the biggest privatisation in 20 years. I don’t want those shares to go to financial investors. We will help to create that share-owning democracy in this country.”

Photograph courtesy of General Jimmy