Tradesmarter launches Social Radar third party app

Binary options technology company Tradesmarter has today announced the launch of “Social Radar” which is a second generation automated trading, 3rd party application. Going live today at the iFXEXPO Asia which is hosted by ConversionPros in conjunction with Finance Magnates, the new application arrives on the market under the name Social Radar. Reporting live from […]

Binary options technology company Tradesmarter has today announced the launch of “Social Radar” which is a second generation automated trading, 3rd party application.

Going live today at the iFXEXPO Asia which is hosted by ConversionPros in conjunction with Finance Magnates, the new application arrives on the market under the name Social Radar.

Reporting live from iFXEXPO Asia, FinanceFeeds spoke to Tradesmarter CEO Yoni Avital with regard to the launch of the application, stating:

“This unique 3rd party app has now gone live and is available to all our corporate partners from this week.”

“It’s important for me to say that since social trading and the following of lead traders by retail customers became a huge matter for regulatory authorities in that regulators could rule that this may constitute a form of advisory or money management service , we at Tradesmarter decided to hold back from adding this functionality although for several years despite having received several requests.”

“Now, with the ability to work closely with another development company such as LeadDaWay, their use of our SMARTER API has great potential to take this innovation to a place in which the industry can adopt it on a widespread basis without the fear of conflict between a broker and software provider.”

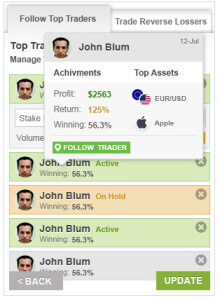

According to Tradersmarter, Social Radar combines a sophisticated trader’s profile matching technology with a unique, practical and attractive calendar view.

Tradesmarter and LeadDaWay purposefully combined technology with marketing expertise in order to create the Social Radar automated trading application, taking into consideration some key broker-trader engagement Key Performance Indicators (KPI).

Some of the intended aspects which are potentially advantageous to brokers are that the new application aims to significantly increasing trading volume, improve conversion and retention and enhance the broker-trader relationship, whilst remaining device-neutral.

“Understanding the reality of a trusted partner with whom one can follow and trade with based on successful real-time results, the Social Radar was developed according to the trader’s needs. The trader enjoys trading, taking advantage of following better traders and sharing results with his friends” – Ido Lavi, VP Marketing LeadDaWay.