We investigate broker response as Turkish Lira collapses in value on day 3 of military coup

FinanceFeeds has conducted an investigation into Turkish Lira trading, and deduced that all of Turkey’s brokerages are offering no restrictions on leverage or margin as the currency tanks in value.

This morning, Turkey’s markets opened to face a third day of political, civil and military unrest, with the national currency, the Lira, continuing its dramatic downward plunge in value.

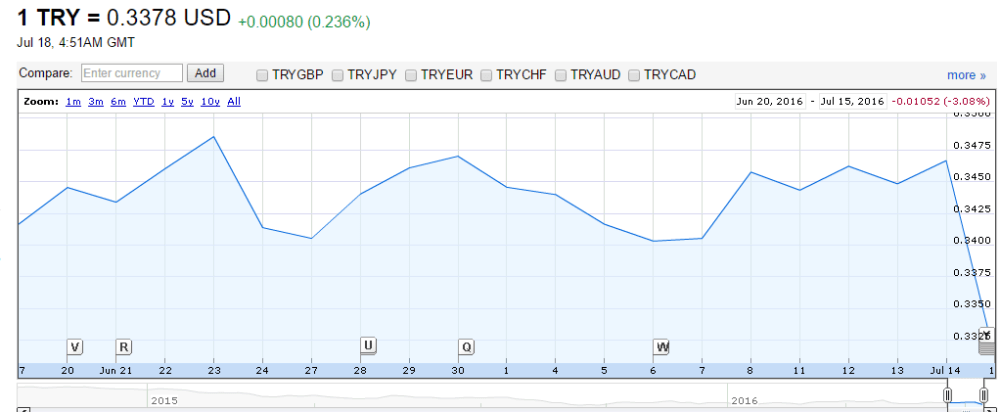

Financial markets, global banks, venues offering listed derivatives and investors all respond very negatively to national instability, and the Turkish Lira’s descent which began on July 15 after a year of relative stability is a case in point.

The Lira had reached high points against the US dollar in the last week of June this year, passing the 0.3475 mark, however on Friday, July 15, following the attempted military coup which resulted in 3,000 casualties in one day as President Recep Tayyip Erdogan vowed that he would take action against what he considered to be treason, the Lira plunged and has been doing so since.

This created volatility, and a very interesting dichotomy has emerged with regard to how brokerages are managing risk with regard to the sudden change in the value of the Lira and the lack of investor confidence that is likely to ensue as a result of the political strife.

Turkey has a very well developed domestic FX industry, its brokers serving only Turkish clients and having their own technology firms as part of the brokerage, therefore by way of stringent regulation, brokers in Turkey are forced to be specialists in their own domestic market.

Strangely, only Western brokerages have begun to take action as it is today entirely possible to trade all FX pairs including the Turkish Lira via all of Turkey’s brokerages.

FinanceFeeds tested Integral Menkul Degerler’s platform, on which it is entirely possible to trade Lira against all pairs, without any restriction.

Destek Menkul Degerler, one of Turkey’s largest brokerages is still offering Turkish Lira trading with absolutely no restrictions in margin or leverage compared to normal trading terms, however the firm has issued a warning on its website to investors, advising them to take their own precautions.

The notice says

“Dear Investors. On July 15th, 2016, events in our country have occurred and impacted on the Turkish lira by causing high volatility. On July 18, 2016, the market price in Lira is very difficult to measure. Our investors are advised to adjust to the status of this development and take into account the margin collateral. Also purchase and sales quotations applied by the bank will be quite high. To our investors who make Turkish Lira denominated money transfers, we strongly advise to consider the situation. Our investors who want to transfer money to support FX accounts outside of work hours can use Garanti Bank, Yapi Kredi Bank, Akbank, İş Bank, Finance Bank, TEB and Agricultural Bank by submitting payments in dollars by wire transfer to our TL accounts.”

Whilst this is sage advice, it does not prevent traders from taking positions on a currency that is central to fiscal volatility against a stable major and exposing themselves to negative client balances, or the broker to potential inability to cover such balances should they go the wrong way.

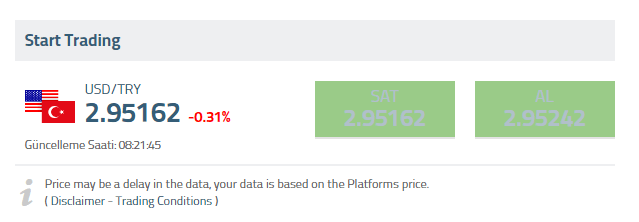

GCM Forex has also taken no action, and has not issued any advisory notices to traders. Currently, on the broker’s website, it is possible to view USD/TRY values in real time and open and close positions as normal with 1:100 leverage.

FinanceFeeds called GCM Forex dealing desk in Istanbul this morning to inquire, and the firm was operating completely as normal.

Saxo Capital Markets Menkul Degerler (Saxo Bank’s Turkish operations) is also continuing to offer Turkish Lira trading. FinanceFeeds made contact with the company’s Istanbul office today to establish the trading conditions for pairs which include the Turkish Lira.

“As far as we know, there is no restriction on trading Turkish Lira pairs, and trading is as normal. For extra peace of mind I will check with one of the traders now” said the Saxo Capital Markets representative. The representative made a very efficient check with the trading desk, and then confirmed that there are no restrictions on trading.

Western firms take risk management action

Interestingly, it is companies outside Turkey that took swift action to mitigate any exposure to client and company that may emerge from the situation in Turkey.

Geoff Last, Director of Institutional Liquidity Sales at Invast Global in Australia this morning told FinanceFeeds “Our Risk Management Team has reviewed our business in Turkish Lira in light of the developments in Turkey and we have implemented enhanced Risk controls as a temporary measure. This has entailed higher margin requirements and lower position limits for some clients.”

“Invast has many strong, long-standing relationships with brokers in Turkey and our thoughts are with our friends there. It is very encouraging to see that the situation appears to be stabilising. Interestingly we have seen very little impact on our turnover originating from Turkey. Volumes have been unaffected” – Geoff Last, Director of Institutional Liquidity Sales, Invast Global

On Friday, London-based ThinkMarkets (previously ThinkForex) set its trading system to close-only on pairs involving the Turkish Lira and also began to look at restricting the margin and size.

FinanceFeeds contacted ThinkMarkets on Friday, at which point a spokesman for the company said “Due to the sudden slump in the Turkish lira the firm will limit transactions to prevent market volatility impacting client trades.”

“Our risk teams will be rigorously assessing the situation and we may look at limiting margin requirements on Turkish lira instruments as events unfold.”

“As a risk averse firm we have taken this measure quickly & swiftly to ensure that we safeguard the interests of our clients and mitigate our risk, hence our decision to limit any further exposure as uncertainty prevails in one of the most influential emerging market nations” continued the spokesman.

This morning, FxPro followed suit, setting Turkish Lira-based pairs to close only.

At CMC Markets in London, it is business as usual. “We are still pricing Turkish Lira, however the pricing team are keeping a close eye on it, and how it will be managed in terms of risk when trades are executed is something that the company will take into account” explained the firm’s dealing desk this morning.

In Britain, CFD and spread betting companies operate differently to those overseas insofar as the CFD is a type of OTC futures contract, therefore risk can be mitigated much easier, despite it being much harder to clear and price CFDs upon execution than spot FX transactions.

FXCM is also continuing to price Lira, however spreads are up to 18.7 on the USDTRY pair.

FXPRIMUS today spoke to FinanceFeeds, explaining “Following the volatile events and attempted Coup d’état in Turkey on 15 July, the FXPRIMUS risk team has been closely monitoring the Turkish Lira in order to assess whether any changes need be made to margin requirements or otherwise, in order to protect client investments. As of today (18 July 2016), the FXPRIMUS team can confirm that the Lira has returned to a stable level matching pre-coup conditions. As such, no changes are being to made margin on the Turkish Lira. If clients have any concerns about trading on the Lira or any other instruments, our support team are ready and available to assist.”

The key factor here is risk management. Indeed, many firms, including all companies in Turkey which have a solely Turkish customer base, are carrying on with normal terms, however the ability to internalize orders that could lead to negative balances is vital.