UK FCA registers steep growth in enquiries about binary options

The FCA reminds that in less than a year, it will regulate certain types of binary options.

The UK Financial Conduct Authority (FCA) has published some fresh data from its Consumer Contact Center, with the report showing that binary options were the type of investment products that saw the most growth in enquiries for the period from December 1, 2015 to November 30, 2016.

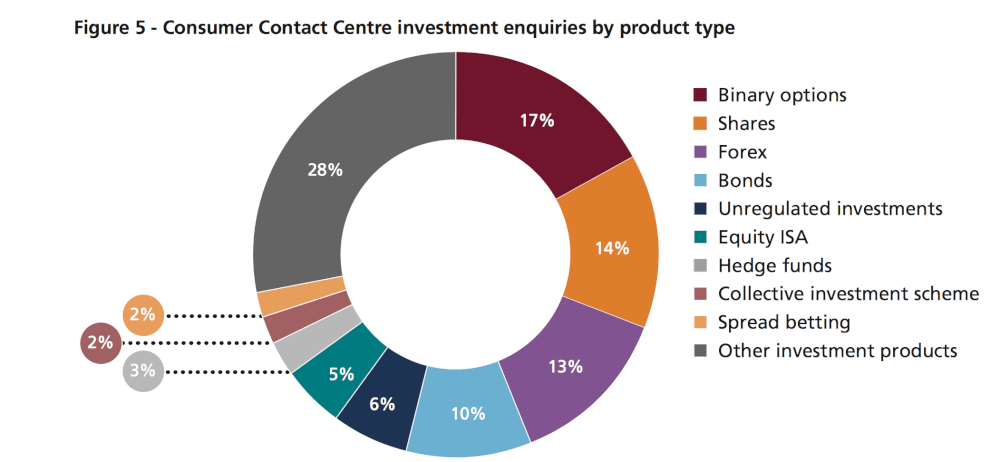

According to the report, binary options accounted for 17% of enquiries within investment products. Consumers have been contacting the FCA mainly to verify whether firms offering binary options are regulated. Other product types where the Contact Center received a lot of enquiries are shares (14%), Forex (13%) and bonds (10%).

The FCA highlights that it does not currently regulate binary options because in the UK they are classified as a gambling product rather than a financial one. Hence, investors do not receive the protections offered by the UK’s financial services regulatory framework when purchasing binary options.

Consumers enquiring about binary options are usually referred to the Gambling Commission, which regulates operators offering binary options (if the operator has remote gambling equipment located in Great Britain) to check if the operator is licensed. The Gambling Commission advises consumers not to use an operator if they have any doubts about whether it is licensed.

However, HM Treasury is bringing certain types of binary options within the regulatory perimeter alongside the implementation of the Markets in Financial Instruments Directive (MiFID) II, the FCA notes. The new rules will apply from January 3, 2018. This means that certain binary options will be regulated by the FCA rather than the Gambling Commission.

Looking further at the data from the latest bulletin, we see that more than 13,100 enquiries (14% of total) related to investment products. Almost 60% of enquiries were from consumers aged over 55.

Meanwhile, Europe is increasingly trying to tackle binary options fraud, with Cyprus seeking to implement new rules for the binary options sector and the Netherlands following France’s example in proposing to outlaw advertising of high-risk financial products, including certain types of CFDs and binary options. EUROPOL is also reported to have joined the fight against binary option fraudsters.