User experience is critical as R&D doubles down on sales model

A very important dynamic within the retail FX sector at the moment is the diversion away from concentrating such a large percentage of resources on sales, and instead empowering brokerages via technology, specifically what has become widely regarded within the online and e-commerce world as the ‘user experience.” Indeed, this is a factor which has […]

A very important dynamic within the retail FX sector at the moment is the diversion away from concentrating such a large percentage of resources on sales, and instead empowering brokerages via technology, specifically what has become widely regarded within the online and e-commerce world as the ‘user experience.”

Indeed, this is a factor which has been gaining momentum over the past year, as investment in technological and data-orientate methods of attracting clients whilst at the same time maintaining their interest is becoming a paramount cause in this ever-cost sensitive and competitive business.

Those companies wishing to diversify their services, as well as attempt to mitigate the costs associated with continually having to onboard new customers are beginning to take a closer look at the user experience that today’s very well informed and technology-savvy traders are, well, experiencing.

Technology-led companies such as Saxo Bank, itself a major disruptor of financial technology, had realized this early, and indeed took a close look at how to develop a device-neutral platform which maintains the settings of a particular trader, regardless of operating system and regardless of hardware.

At the launch of the SaxoTraderGo platform one year ago in Paris, it was evident that there were many factors to consider with regard to ensuring that users of hand held devices can continue, uninterrupted, to use the same trading platform with unaltered parameters.

Smartphone device turnover – here are the real figures

In many regions of the world today, smartphone ownership is not just commonplace, but many retail customers upgrade and replace their smartphones on a regular basis, often with different models that use different operating systems to the one owned previously.

Just one month after SaxoTraderGo was launched in Paris, it began its international roll out.

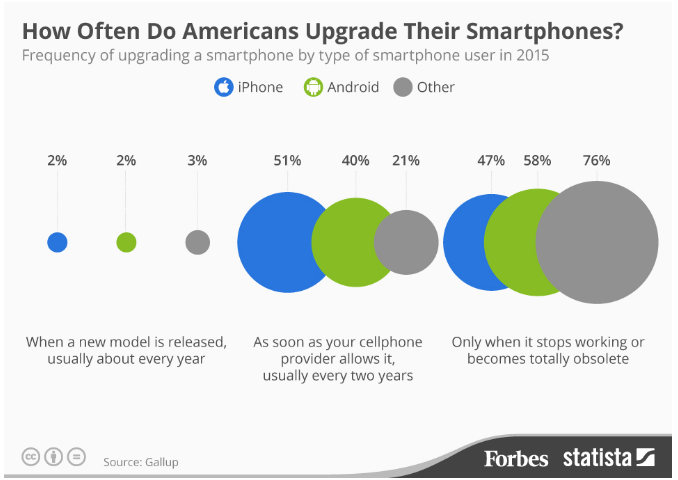

At that time, in June 2015, a Gallup poll in the United States showed that iPhone users upgrade more frequently than those using Google’s Android operating system.

51 percent of iPhone owners would upgrade to a new model as soon as their provider allows it (usually every two years) compared to 47 percent who would wait until their existing iPhone becomes obsolete.

40 percent of Android users would exchange their old handset for a new one every two years while 58 percent would wait until their existing model stops working.

Bearing in mind the length of development time to create new platforms in which the settings can be saved on a server, and the resultant cost of maintaining pace with this rate of turnover in handheld devices, it is not only more cost effective, but retains a wider audience to go down the device-neutral route.

Many companies followed suit, however some have done so by focusing on specific areas. Last month, O-SYSTEMS launched a fully automated binary options software solution which means that binary options brands can avoid the sales-floor model that has proliferated so far, instead empowering the user to make self-determined choices.

The new platform features user-specific calls to action and reduces the cost of operations for brands.

Last month, in Limassol, Cyprus, FinanceFeeds spoke to O-SYSTEMS CEO Haim Lagziel who explained “Currently, most firms in the business are looking at a CPA (Cost Per Acquisition) of between $350, $450, and within that particular customer base, 70% of the live accounts that are opened fit into the category of those which would have played online lotteries rather than those who may be experienced at trading financial markets”

“As a result of this, the expectations of this type of client base are considerably different to those of retail FX firms, because within the traditional model of using sales calls, a client who may deposit an initial $250 often thinks that he will be rich and win, rather like in a fixed bet made on an online lottery, as opposed to making strategic analysis about manually trading a financial market.

Because of this, the lifetime value of such clients is very very low indeed. By engaging customers via an automated system and not going down the traditional route, lifetime value can be extended exponentially, and the customer demographic can be much more sustainable” – Haim Lagziel, CEO, O-SYSTEMS.

Adding to the developments which have taken place recently in front-end trading platform technology such as these two very different but equally innovative solutions is the need to look behind the user interface itself, and take a close look at how big data can be used in order to ‘learn’ the behavior of customers via past experience, and according to customer buying habits.

CBOE LIVEVOL, the data and market information division of Chicago Board Options Exchange (CBOE) just two weeks ago launched an Amazon-style market data portal which has brought the use of institutional market data from Chicago’s largest venue and technology providers and derivatives marketplaces into the hands of the retail trader.

The clever thing here is that not only is the trader able to be empowered by using CBOE data, a method which previously would have been out of reach as Bloomberg Terminal, Thomson Reuters Eikon and other institutional services have very high subscription fees, but importantly, big data can be collected that can help CBOE fine tune its service and engage users for longer periods of time.

One particular master at this in the technology space is fintech company Tradency, which, 10 years after launching its Mirror Trader copy trading solution, has amassed vast data with regard to how strategies work, and as a result has been able to create a new system which automates the selection of strategies in order to optimize user experience and extend lifetime value.

Today, speaking to Leehee Gerti, Head of Marketing at Tradency, FinanceFeeds took a look at how Tradency views this type of development. “Tradency is investing a lot of time and efforts into optimizing its products user interface and user experience. Our business model has always focused on the “partnering” side of things” explained Ms. Gerti.

“Our relationship with our customers is on-going and inclusive, we listen to their feedbacks, ideas and wishes and try to optimize our products accordingly.”

“Our products are always in process of optimization and we do not mean adding only a feature or taking one off, but of understanding the whole process, the client journey and the current market trends” she continued.

RoboX, our newest FX Robo-advisor is only two months old, and already is now being provided in version 7 form. One of our clients came to us with a request to design a new process in which traders can allow the RoboX system to set parameters automatically in order to safeguard customer money and minimize risks. As a result of this request, we added “Guard me” which enables traders to set stop/loss boundary to their entire account” she concluded.

It is most certainly apparent that alongside the drive toward improving the user experience of platforms and the solutions that connect to such platforms, technology vendors are working closely with brokerages on an exponential basis in order to push the boundaries of innovation, with maintaining a long-term customer base being the driving force behind it.

Featured image: Saxo Bank’s headquarters, Hellerup, Denmark. All photography copyright FinanceFeeds