As Christine Lagarde speaks out after a night of stock market lows, is Canada’s recession due to its reliance on Chinese investment?

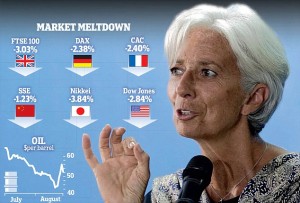

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), issued a grave perspective regarding the outlook of the global financial markets, following another disastrous evening of trading in which heavy losses on global indices were experienced in Asia overnight. The Nikkei fell 3.84 per cent in Tokyo and the Hang Seng was down 2.24 […]

Christine Lagarde, Managing Director of the International Monetary Fund (IMF), issued a grave perspective regarding the outlook of the global financial markets, following another disastrous evening of trading in which heavy losses on global indices were experienced in Asia overnight.

The Nikkei fell 3.84 per cent in Tokyo and the Hang Seng was down 2.24 per cent in Hong Kong during the night, as well as the Shanghai Composite index – the main benchmark in China – closing its business day down another 1.23 per cent and has now lost nearly 40 per cent of its value since June.

Whether the Chinese stock exchange debacle is the deliberate action of the government in order to intentionally devalue prices of stock in other parts of the world, giving China vast buying power in acquiring stakes in Western companies, or whether it is a genuine result of market conditions, Ms. Lagarde stated “We expect global growth to remain moderate and likely weaker than we anticipated last July” during a speech in Jakarta, Indonesia.

“This reflects two forces, a weaker than expected recovery in advanced economies and a further slowdown in emerging economies especially in Latin America. Asia as a region is still expected to lead global growth. But even here, the pace is turning out slower than expected, with the risk that it may slow even further given the recent spike in global risk aversion and financial market volatility” she concluded.

According to a report by the Daily Mail, verious senior officials from other regions including China, South Korea, the United States, Canada, Britain and the eurozone, share a similar viewpont, and the IMF has adjusted its global growth forecast for this year from 3.5 per cent to 3.3 per cent in July but Ms. Lagarde suggested that now looked optimistic. The world economy grew by a subdued 3.4 per cent in 2014.

Canada’s 10 year high fueled only by Chinese investment as recession finally arrives?

For those who have visited Toronto during the past ten years, a vast increase in investment in real estate by developers from China would have likely been one of the most noticable developments, ranging from luxury apartment towers which resemble those of Beijing, Hong Kong and Shanghai, to large shopping malls such as the one in Markham, Ontario, which host entirely Chinese businesses ranging from luxury goods outlets to restaurants, all funded with liquid cash – no commercial bank loans or venture capital investments.

Whilst most of the Western countries suffered financial crises, credit crunches and property repossessions, Canada’s economy remained strong, with no credit crunch and a continuing surge in property prices and stock values of Canadian companies.

Many analysts put this down to Canada’s conservative fiscal policy, however a nation with a large socialized policy, less emphasis on private enterprise than south of the border in the United States, and personal debt at relatively high levels, managed to remain in financially good condition largely due to investment from China, at a time when China’s new generation of wealthy young investors were taking their money into Canada.

One in three residents of the Greater Toronto Area is of Chinese origin, therefore marking the city, North America’s third largest financial center, as not only a gateway to the West for China and vice versa, but also as a city whose local economy has been boosted tremendously by Chinese investment, and therefore has not been reliant on local market conditions.

Now that the Chinese stock markets are experiencing rapid falls, it is an interesting coincidence that Canada has entered a recession. Could it be that Sino-Canadian business relations were so instrumental to Canada that its fate is linked to that of the exchanges in Shanghai and Beijing, and indeed, should prices fall in Canada, more cash-rich Chinese investors may swoop in.

One thing is most certainly for sure, investment in Forex by China’s high net worth traders is likely to increase to higher levels than ever.

Photograph courtesy of Pixabay.