MONEX Group reports highest trading activity since January during buoyant August

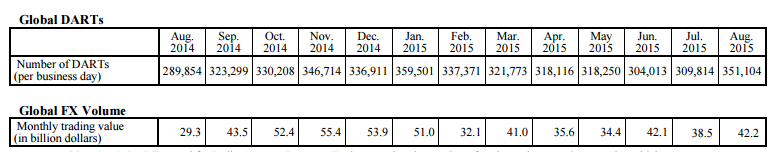

Japanese electronic trading giant Monex Group, Inc. (TYO:8698) has today reported its trading volume data for the month of August 2015, with the figures demonstrating a recovery from the stagnation experienced in trading activity during July. In August, global FX volume traded at Monex amounted to a total of $42.2 billion, representing a 9.61% increase […]

Japanese electronic trading giant Monex Group, Inc. (TYO:8698) has today reported its trading volume data for the month of August 2015, with the figures demonstrating a recovery from the stagnation experienced in trading activity during July.

In August, global FX volume traded at Monex amounted to a total of $42.2 billion, representing a 9.61% increase over July’s $38.5 billion total volume, however more interestingly, total volume in August was higher than any monthly total at Monex Group since January this year.

January was an unusual month for Japanese retail FX companies, as traders rode a wave of volatility created by the Swiss National Bank’s removal of the 1.20 peg on the EURCHF pair on January 15. Ordinarily conservative Japanese traders who do not routinely trade the Swiss Franc, had not run domestic companies into negative balance exposure due to the market conditions caused by the Swiss National Bank’s action, however the ensuing volatility was attractive to many traders who were able to capitalize on market volatility during the last two weeks of January without the instability caused in markets where firms and traders caught a cold due to exposure to negative balances.

Therefore, when bearing this in mind, August’s total FX volume figure represents a very good overall montly result for Monex Group.

In North America, Monex Group’s US subsidiary TradeStation also experienced a considerabel increase in trading activity, with daily average revenue trades standing at 139,882 in August compared to 114,068 in July. In congruence with Monex Group’s overall dynamic for August, TradeStation’s daily average was its highest since January.