1:1000 leverage on ECN accounts. Yes, and I am a hobgoblin

FXTM claims that it can offer 1:1000 leverage on all accounts that are executed via a ‘live market’ ECN. We suspect that this is not the case and that all such orders are being executed internally via a dealing desk, as no liquidity provider or aggregator in the world will allow this. Here are our findings

This is one of those moments in which a choice is presented as to whether to fall off one’s chair in disbelief, or to dismiss such a claim outright.

Retail FX brokerage FXTM, which is an acronym for ForexTime, that operates in Cyprus and is owned by Alpari founder Andrey Dashin, has made a very bold claim that it is allowing a stratospheric leverage ratio of 1:1000 on accounts whose trades the company claims are executed via an electronic communications network (ECN).

An ECN is an electronic execution network which consists of a series of bank and non-bank liquidity providers, therefore when a FX or electronic trading company that operates on an OTC (over the counter) basis states that it offers an ECN execution model, it is stating that it is not internalizing any trades and is sending them to the liquidity provider, which then executes them via the network of aggregated liquidity providers which includes banks and institutional venues.

Making a claim to offer leverage to retail customers at a ratio of 1:1000 even if execution is taking place on a b-book basis is alarming enough, as most of the time, small retail accounts will not be capitalized enough in the live market to be able to make any winning trades, and in ALL recognized regulatory jurisdictions, offering such high leverage to retail clients is illegal, except for with dealing desk licenses in Cyprus.

FXTM is able to circumvent such legislation by offering this facility via its IFSC (Belize) registered company, and Belize, as per many offshore, unrecognized jurisdictions, means pretty much no recourse for clients if something goes awry.

Aside from the regulatory disdain for high leverage around the world, and the odds which are stacked against retail customers in such a highly leveraged environment, there is absolutely no way possible that any retail firm would be able to execute trades via a liquidity provider rather than their own dealing desk at this ratio.

The extension of credit, and risk management procedure of Tier 1 banks to OTC derivatives firms is at an all time low. Banks absolutely do not want to extend credit, even to firms that operate in recognized jurisdictions, are massively well capitalized and have a maximum leverage ratio of 1:25.

Citibank, the world’s largest interbank FX dealer by percentage of global order flow (over 16% of the global Tier 1 FX liquidity market) has stated that it considers the extension of credit to OTC derivatives firms and liquidity providers a potential default risk ratio of an astonishing 56% – and that is among top quality and well capitalized business which is conducted in top quality regions. Not firms offering 1:1000 leverage in offshore jurisdictions with lax regulation.

Putting out a message to potential customers that they are able to execute trades at a ratio of 1:1000 on a live market is, in our opinion, completely misleading, and is damaging to our otherwise very sophisticated industry whose top quality companies in Britain, Australia, Cyprus, North America and the Far East are continually striving for the provision of the best quality trading environments for their customers.

A look at FXTM’s CySec license shows that the firm is registered as “Dealing on own account” which translates to a b-book license. We spoke to former employees at FXTM, all of whom confirmed that 95% of order flow is internalized.

In our quest to examine the rationale behind FXTM’s tall claim, and in the interests of upholding the quality reputation of liquidity providers and institutional firms around the world in that they do not engage in provision of such trading terms, FinanceFeeds contacted senior executives at FXTM for comment on this matter.

Demetrios Zamboglou, Branch Manager at FXTM’s UK office explained to FinanceFeeds “This will just mean that if the Prime broker provides 1% i.e. 1:100 then FXTM needs to have 10 times more in their PB account at all times to cover the client. In other words, the company deposited a lot of money with their liquidity providers.”

FinanceFeeds then contacted FXTM’s customer services department this morning and asked how it is possible to offer 1:1000 on a live market, with no dealing desk. The representative explained “As of September 1 this year, we will be offering 1:1000 on all ECN accounts.”

FinanceFeeds asked the representative how this can be when absolutely no liquidity provider or Tier 1 bank will extend such a high ratio he said “We have the liquidity, therefore we can offer it. If the broker has a large liquidity, then this is entirely possible.”

The representative then asked us to open a demo account and to be able to view the leverage ratio. At that point, FinanceFeeds asked the representative to explain how opening a demo account would show whether trades are being internalized or not, and he said “There is no dealing desk. We have different liquidity providers and execute trades via them”.

Bottom line – there is no way of telling, and we maintain that no liquidity provider will extend such high leverage to OTC derivatives firms.

In order to gain further perspective on risk management relating to high leverage, FinanceFeeds took a close look at the trading conditions provided by ECNs and Prime of Primes.

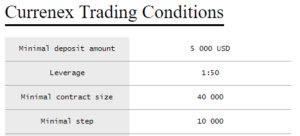

All ECNs are very conservative. Currenex, one of the very largest, has a maximum leverage limit of 1:50.

Hotspot FX is an Institutional ECN, and does not extend credit or leverage to its clients. Leverage and associated credit is determined by the client’s Prime Broker. Most prime brokerages today offer a maximum of 1:50.

1:1000 is theoretically possible in some cases but very very unlikely to ever be carried out – here is how it works

There are cases in which banks and liquidity providers can extend 1:1000 trading conditions to brokerages (that are not located in recognized regulated jurisdictions that restrict leverage on a national basis) and in order to find out, FinanceFeeds met today with an institutional FX specialist in London who has direct relationships with Tier 1 banks.

This particular senior executive explained “It is possible to do this as long as you as a broker can bridge the margin gap.”

He continued “Whether it is a good idea or not is another thing entirely. If a broker offers this to ten clients and they have a maximum net open position of $10 million each, then the theoretical open positions across all clients would be $100 million and I would say they are all long or short. Clients would only give a broker $100,000 in total for this position, but the broker might be ok to do this as long as it has enough margin to cover the margin requirement at the liquidity provider.”

“Currently, banks on average impose an average charge of 3% on USD or EUR, so therefore the broker’s requirement would be $3 million for margin on each of those trades” he explained.

“Therefore, the broker would need to use $2.9 million of its own money to cover the gap, and in theory might need $3 million if those clients are segregated, therefore the broker not being able to use their funds for margin at the bank.”

When asked if he would extend such high leverage to a retail broker, this particular senior executive said “No we would not, the maximum we would allow is 1:50. Banks often keep it down to 1:33. Only market making brokers go over 1:100 as they cannot fund the gap if they are STP (straight through processing).”

According to standard practice, the larger a brokerage is, the more likely that its positions will net off to some extent, therefore if the firm has 20 clients, 10 could be long $100 million and 10 could be short $50 million, so therefore the overall position is $50 million but the broker has received margin for $150 million. In a circumstance like this, with $1.5 million margin receives the broker’s net position is $50 million with its prime brokerage, therefore at 3% it owes $1.5 million in margin.

If this is the case, then the client margins equal the broker’s bank margin requirements but in theory all clients could go the same way and the brokerage could owe more money to the banks than it has from clients.

On this basis, it can be considered nigh on impossible that FXTM is actually processing orders with 1:1000 leverage on anything other than its own dealing desk, and that the only way that it is not doing so is if it is passing the trades to another market maker, which would also debunk any inference that this is ECN execution, as offloading to another market maker does not equal an aggregated network of liquidity.

Caveat emptor….