Barclays Q3 profit declines by 10% as new CEO James Staley has his work cut out

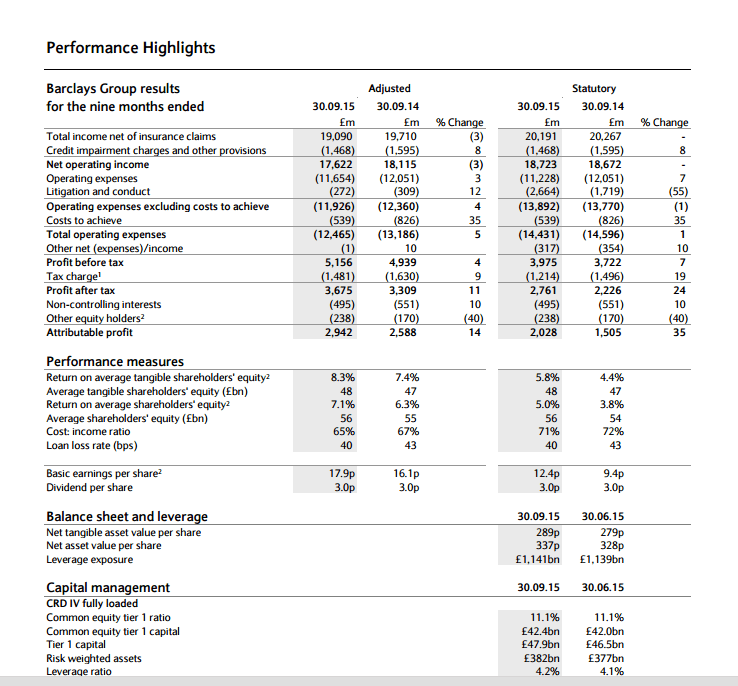

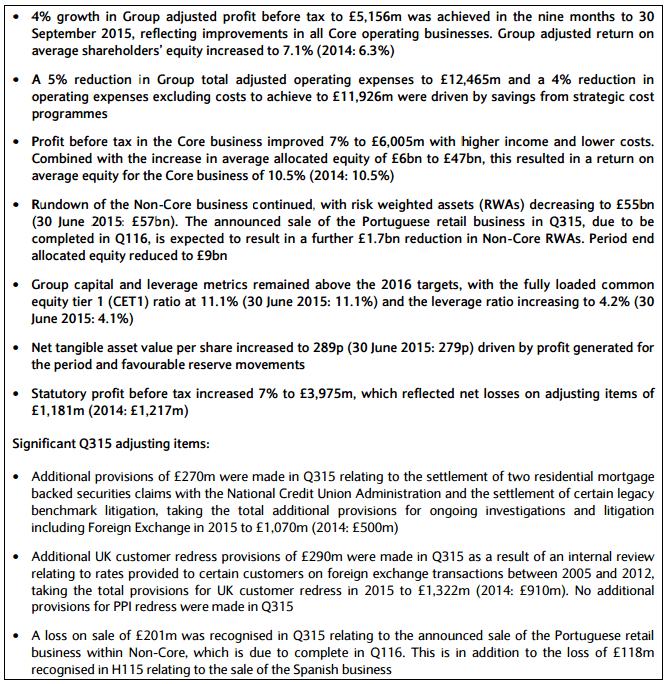

British financial giant Barclays PLC (LON:BARC) has released its third quarter earnings for this financial year, with a 10% drop in adjusted pre-tax profit compared to the same period last year. Statutory pre-tax profit dropped below the £1 billion mark during the third quarter of the year, standing at £861 million compared to £1.77 billion […]

British financial giant Barclays PLC (LON:BARC) has released its third quarter earnings for this financial year, with a 10% drop in adjusted pre-tax profit compared to the same period last year.

Statutory pre-tax profit dropped below the £1 billion mark during the third quarter of the year, standing at £861 million compared to £1.77 billion in the second quarter of the year.

Newly appointed CEO James Staley has his work cut out as leadership of Barclays, one of the world’s largest banks and handler of a vast percentage of global interbank FX order flow, will involve setting the bank’s operations back on an even keel after a year of extremely expensive regulatory fines and class action settlements relating to FX rate manipulation and misselling of PPI policies, as well as a slump in overall activity which blighted the firm during 2014 resulting in the company considering the redundancy of some 19,000 members of staff.

Liquidity decrease

The bank’s liquidity pool has actually decreased slightly from £145 billion as of June 30, 2015 to £142 billion as of September 30 this year, with an estimated liquidity coverage ratio of 121% having reduced to 118% by September 30.