3 DeFi products to help you gain exposure to the wider crypto market

Even if you’re not entirely sure what it is, you’ve probably seen the word ‘DeFi’ being thrown around a lot over the internet. It’s a really hot term in the crypto community right now — and for a good reason!

DeFi gives investors the power to protect their wealth from capital controls, while removing burdensome Know-Your-Customer (KYC) protocols. Ultimately, it makes the remittance process faster, simpler, and more effective.

But perhaps the greatest reason that DeFi has soared in popularity is that there are so few restrictions that almost anyone can take part. This makes it especially appealing for those who cannot access traditional financial services, either because they lack the required formal documentation, or because such services do not exist in their country.

Let’s take a look at some of the ways that crypto holders can gain exposure to the wider crypto market.

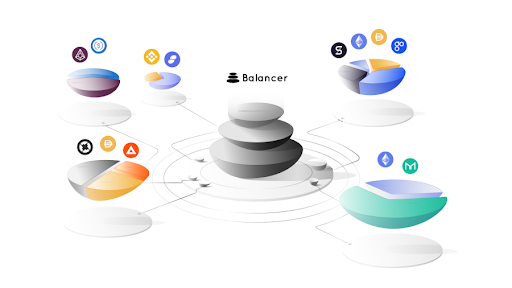

1. Investing using Balancer’s diversified pools that are offered via Polygon

Balancer is an automated portfolio manager and trading platform. It gives users the opportunity to put their crypto assets to work and get the best prices for their trades.

For investors, Balancer essentially turns the concept of an index fund on its head by allowing users to collect fees from traders who rebalance their portfolio by following arbitrage opportunities. Essentially, it lets you manage your portfolio like a pro, without actually having to be a pro, and without the hefty price tag.

By depositing assets into incentivized liquidity pools, you can even claim Balancer’s $BAL token weekly on Tuesdays.

For traders, Balancer pools crowdsourced liquidity from investor portfolios and find the optimal trading price available. Currently, Balancer enables the exchange of any ERC-20 tokens. It’s easy to get started — you don’t even need to create an account or get approval.

Trading on Balancer even allows traders to earn $BAL tokens with every trade. This covers up to 90% of gas fees and is designed to balance out gas costs.

2. DeFi Pulse’s DeFi Pulse Index (DPI) token lets you benefit from the biggest tokens in DeFi

The DPI token is a decentralized finance index token. The DeFi Pulse Index is a market capitalization-weighted index made up of the ten most popular Ethereum-based DeFi tokens.

Essentially, the DPI token allows you to gain exposure to the biggest tokens in decentralized finance.

Instead of buying these DeFi tokens yourself and having to constantly manage your portfolio, you can just buy a single DPI token that gives you exposure to the top 10 tokens. Each month, the token rebalances itself to reflect the state of the market.

If you’d like a more in-depth explanation about exactly how DPI picks its tokens each month, you can read about it here.

3. MakerDAO facilitates collateral-backed loans without an intermediary

MakerDAO is an Ethereum-based decentralized lending platform, designed to enable its users to borrow and lend without the risks associated with volatility. One of the most operational protocols across the crypto ecosystem, it issues the Dai stablecoin and facilitates collateral-backed loans.

The Dai token is a stablecoin. Through supply and demand, it aims to be pegged to USD. You can borrow through the platform by depositing other cryptocurrencies as collateral, and then receiving your loan in Dai.

The other token associated with the ecosystem, known as MKR, is designed to provide backstop liquidity in case the system takes on bad debt. MKR token holders have a role in the governance of the protocol.

DeFi is a great way to earn income, but it can feel intimidating to beginners

Despite the many benefits of DeFi, there’s no doubt it can feel a little intimidating in the beginning — especially if you’re relatively new to the crypto community!

DeFi can be a great way to make lots of money, but it’s important to have a solid understanding of the industry before you dive in headfirst. The above three products will help you gain this understanding.

Just remember to have fun, and only ever invest what you can comfortably afford to lose.