30 years of Optiver: Prop shop takes a look back at its trading history

On April 9, 1986, Proprietary trading house Optiver went into business. Here is a look back at 30 years with its clearing partner ABN AMRO, from the day that the first call option took place. Source: Optiver Optiver, a Dutch market making firm headquartered in Amsterdam, has been around since 1986 and trades securities […]

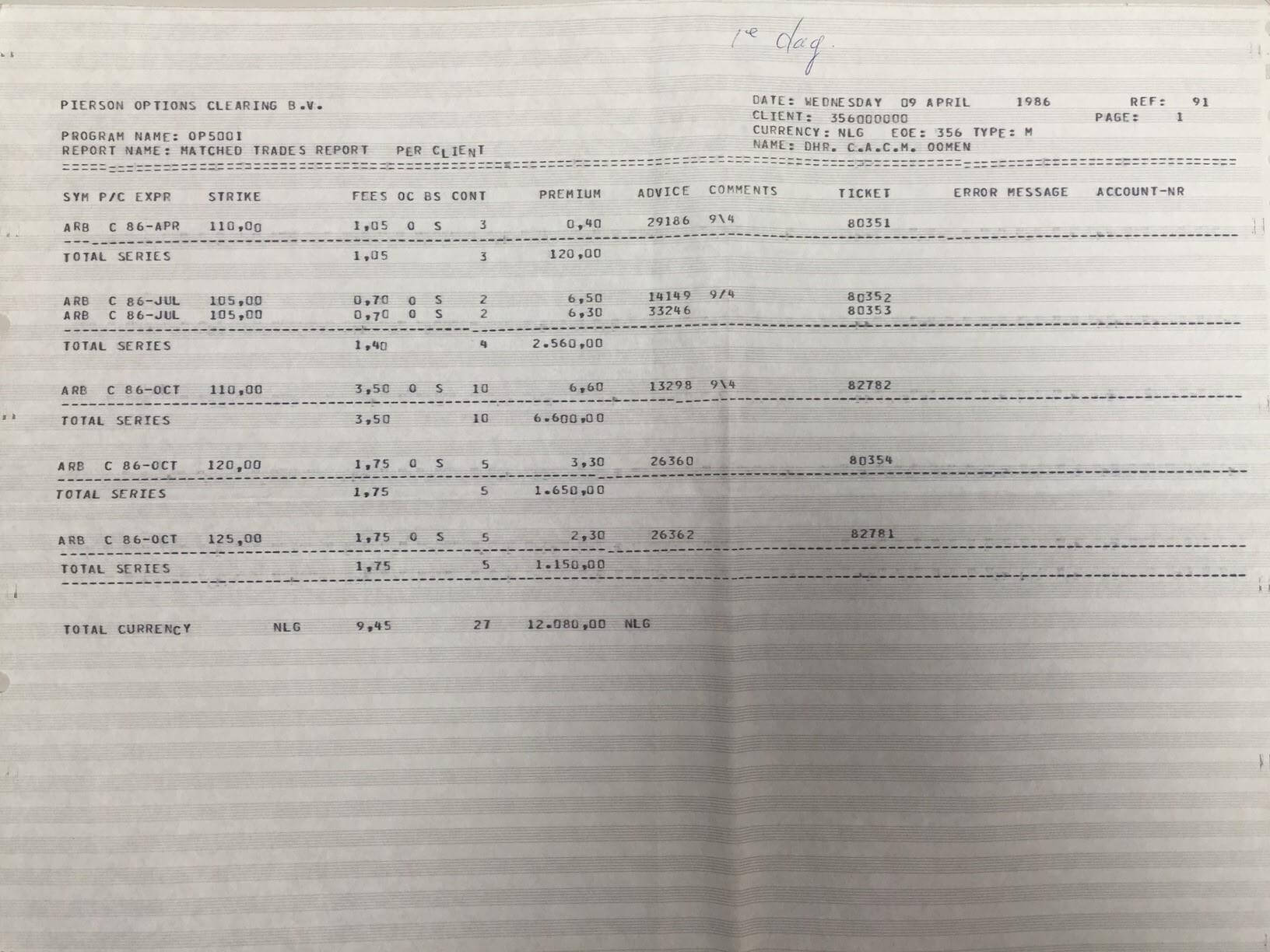

On April 9, 1986, Proprietary trading house Optiver went into business. Here is a look back at 30 years with its clearing partner ABN AMRO, from the day that the first call option took place.

Source: Optiver

Optiver, a Dutch market making firm headquartered in Amsterdam, has been around since 1986 and trades securities and derivatives on more than 50 major US, European and Asian exchanges, including stocks, bonds, options, futures, ETF’s, among other derivatives. Founded by CEO Johann Kaemingk, Optiver took on external shareholders, including majority shareholder Amro Bank, in 1989.

In the early 90s, the company expanded its business to Paris, Frankfurt and London, followed by Sidney in 1996, with floor trading transitioning steadily to screen trading. By the end of 1998, Optiver had bought back all stock from external shareholders, and expanded to the US. 2000 saw the firm adding a branch in HongKong, but the office relocated back to Sidney after HK Futures Exchange (HKFE) allowed remote membership.

In 2003, Optiver closed all floor trading activities to focus on screen trading only. After Taipei (2005), the firm reopened its Hong Kong office in 2007 after new regulatory policy required a local representative office, and an on-shore trading office in Japan in 2008. In 2009, launched a joint venture with Blinck Bank and announced the The Order Machine. During the volatile period of the financial crisis (2007-2008), as oil prices soared toward a record near $150 a barrel, US regulators went after market participants with suspicious activities in price manipulation. The CFTC pursued an investigation against Optiver, with the high-frequency trading firm having to pay $14 million to settle the case, and coming to a total of $16.75 million by mid-2015 to decisively shut down the case.

Company Ethos

In a nutshell, the company’s ethos is ‘Value the difference’: “We have valued that difference since 1986; the year we started on the Amsterdam based European Options Exchange with a single floor trader.

Today we are one of the most dynamic, innovative and successful companies in The Netherlands and beyond. Optiver is above all a state of mind. We want you if you want to be the best. When you believe in daily improvement and feel challenged when colleagues outsmart you, which they will. We are looking for you when you like to be seriously rewarded for your performance, when you easily adapt to change and enjoy some humor and fun”, says an official statement.

The global market maker founded by Johann Kaemingk developed a scientific approach to derivatives markets with the leadership of Mr. Kaemingk himself and co-directors Jan Dobber and Leo van den Berg. Employing over 800 staff, the firm has also offices in Chicago – given that most market making businesses are located there – and Sidney. Roughly 40% of the staff are traders, an equal number work in IT and the 20% left are in operations.

Hammergate case – Oil prices manipulation scandal

Trading at their own risk 24/5, Optiver was investigated in June 2008 for manipulating oil prices, following the case against directors Bastiaan Van Kampen and Randal Meijer, as well as Christopher Dowson, which were tried on 19 instances in 2007 “banging” energy futures markets, consisting in acquiring a substancial position leading up to the closing period only to offset it before the end of the close to manipulate prices.

Several years later, the US Commodity Futures Trading Commission (CFTC) fined the indicted traders and Optiver $14 million in 2012 in civil monteray penalties and disgorgement. Its effort to crack down market manipulation didn’t end there. Dowson was banned from trading commodities for 8 years, Meijer for four years and Van Kampen for two. The ongoing lawsuit was filed in June 2015 after Optiver paid a total sum of $16.5 million in a settlement deal. According to the regulator, the scheme scored a profit of $1 million for Optiver.

David Meister, the CFTC’s enforcement chief said: “The CFTC will not tolerate traders who try to gain an unlawful advantage by using sophisticated means to drive oil and gas futures prices in their favor. Manipulative schemes like ‘banging the close’ harm market integrity, and false and misleading statements to exchange officials to cover tracks obstruct the investigative process.”

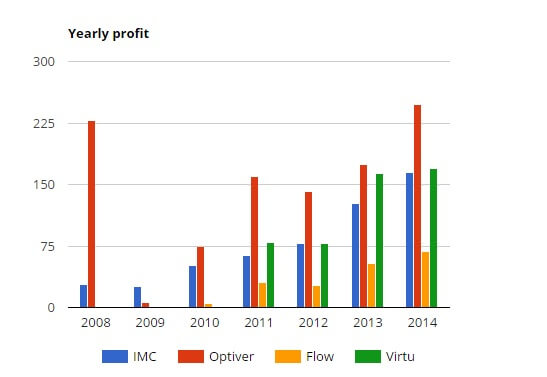

Record Profits in 2014

Optiver had a net profit of €246.9 million attributable to equity holders in 2014, in a significant 23% growth from €174.6 million in 2013, and breaking its 2008 record. At the end of the year, the firm’s total assets were valued at €7.7 billion, up 37.5% year-on-year. Some analysts value Optiver at €3.5 billion.

Since 2012, Optiver has seen the share of income being generated outside the European Union grow over 50%, as the firm increased its presence in Asia through its Australian branch. However, the company opened an office in Shanghai early in 2013 and, like hundreds of foreign hedge funds, Optiver has been working in a regulatory grey area, finding legal ways to bet on Chinese securities while avoiding formal investment channels. Despite the consensual “grey area” Optiver and others are playing at, none of these firms are accused of any wrongdoing.