Japan’s retail venue-traded FX volume up 5.6% between June and August, serving as yet more evidence of the drive toward exchanges

The Financial Futures Association of Japan (FFAJ) has today released comprehensive statistics relating to retail FX trading activity in Japan between the months of April and June 2015. In order to reinforce the importance of such a report, it is important to take a close look at some figures which place Japan as the most […]

The Financial Futures Association of Japan (FFAJ) has today released comprehensive statistics relating to retail FX trading activity in Japan between the months of April and June 2015.

In order to reinforce the importance of such a report, it is important to take a close look at some figures which place Japan as the most significant region in the world for retail FX, its own domestic market companies being responsible for between 35% to 40% of all retail FX order flow worldwide, serving a purely domestic audience.

Some 147 FFAJ members were obliged to report their metrics as of the end of June this year, a remarkable number of companies in a nation with a population of 128 million, however the sheer stability of Japan’s FX business is perhaps the most important factor.

Trading Volume

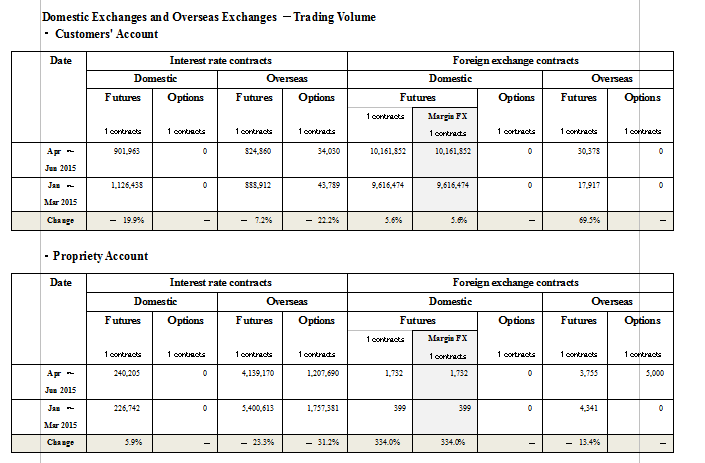

Between April and June 2015, Japan’s traders continued to show a preference for exchange-traded FX, with margin FX contract volume standing at 10,163,584, a 5.6% increment over January to March’s 9,616,873, and in congruence with the very Japanese propensity toward remaining loyal to Japanese companies, trading in overseas on-exchange contracts dropped by 23% to 6,244,883 between April and June this year compared to 8,112,953.

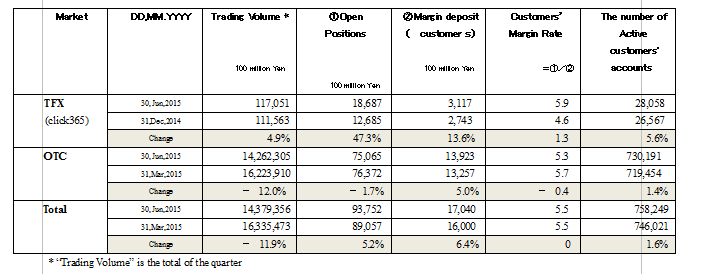

As far as over the counter (OTC) FX trading is concerned, a 12 percent overall downturn made its presence felt during April and June 2015 compared to the previous quarter, with OTC margin FX trading volume across Japan’s entire market standing at 14.2 quadrillion Yen for the quarter compared with 16.2 quadrillion Yen for the period between January and March this year.

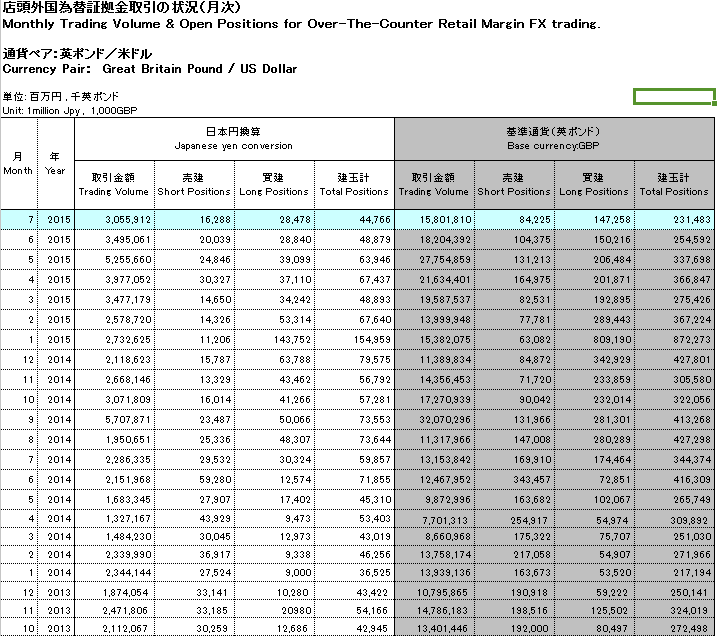

When viewed on a monthly basis, total trading volume in OTC FX as of the end of July 2015, the total volume for the entire month stood at 4.79 trillion Yen, with 73,154 hundred million yen in open positions having been recorded, broken down as follows:

Short: 24,928 hundred million Yen

Long : 48,225 hundred million Yen

Bye bye OTC, Hello Exchange?

The move toward exchange-traded FX among retail traders is particularly interesting in Japan’s notoriously conservative trading environment. During the course of the early part of this year, institutional technology companies in the West including NASDAQ OMX Group, Inc. (NASDAQ:NDAQ) and CME Group Inc (NASDAQ:CME) had demonstrated a clear drive toward furthering the potential of developing exchange-traded FX technology, and rather similarly to other technology-led industries, developments at the very leading edge often filter down to the retail market, just as Formula 1 motor sport technology eventually makes its way onto very mundane road cars.

Clearly, retail participants in Japan are continuing to lead the drive onto exchange, and are doing so via the Tokyo Financial Exchange, a commercial executing venue, and not one solely designed for retail FX.

If this can serve as an indicator of things to come, then it is clear that the pioneering of exchange traded FX contracts in jurisdiction central to the FX industry such as London with North America’s exchange technology giants CME and ICE having introduced facilities on the European side of the Atlantic specifically to spearhead exchange-traded FX, then the debate between senior industry executives earlier this year in New York, to which I was party, can be considered correct.

David Holcombe, Head of FX, NASDAQ explained that “There is a tendency for people in every business to wait and see what happens with regard to the structure of costing the execution process. If you look at the vast difference between using a single provider, the cost is around $13 per million of trading but comparing this with the cost of keeping it bilateral shows that it can accelerate to $170 per million.”

David Emerick, Senior Director, FX Products at CME Europe added to this by stating that “If a clearing house opens itself up to be a cash venue, it can open itself up to a huge liquidity core.”

Further bolstering the prime brokerage perspective, Jasper Chua, Head of FX Prime Brokerage for the Americas at Society Generale demonstrated his view that “Venues and companies should be able to cross-margin to diversify risk away from single products. Prime brokerages are starting to understand how things should be pieced together, starting to understand where their products belong, and where the overall opportunity is in mitigating risk and reducing margins.”

Whether bi-lateral liquidity will suffice and the retail industry will maintain lower costs by sticking to that model as a compromise, or whether the entire business will gravitate toward exchanges is yet unknown however the exchange model will have to make concessions specifically for retail participants should this occur, as profit margins for retail brokerages, even in areas flush with willing customers such as Japan, are already extremely tight, thus the punitively high costs involved in being an exchange member would raise the cost to customers beyond any sensibility.

The question perhaps remains which firm will bring a specific, low-cost retail FX exchange into being, and subsequently which regulator will force transactions onto it.