5 Penny stocks worth noting from Monday’s trading session

Penny stock traders had plenty of stocks to follow on Monday, some of which offered daily returns that far exceed the yearly return of a major index

By Jeff Broth.

Jeff Broth is a business writer, mentor, and financial advisor. He has been consulting for SMBs and entrepreneurs for the past seven years.

U.S. equity markets are on track to end 2020 on a high note as the bull rebound off March’s lows appears to still have legs. While long term-investors are banking on another year of stable 6% to 10% annual returns, some of the top penny stocks rewarded investors with much larger returns in a fraction of the time.

Here is a summary of some of the more notable penny stocks that attracted the attention of traders on Monday and offered the potential for far superior returns.

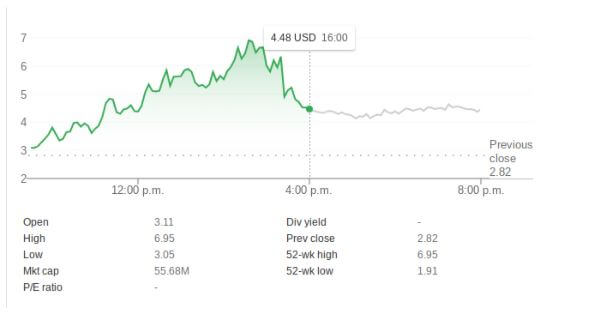

BioCardia Doubles After Heart Failure Trial Results

BioCardia, Inc. (NASDAQ: BCDA) is a developer of therapies to treat cardiovascular and respiratory diseases. On Monday, the company said it expects to receive feedback from the data safety monitoring board (DSMB) by the end of Tuesday regarding interim data from its Phase 3 pivotal trial.

The company is currently examining the safety and efficacy of its CardiAMP cell therapy for the treatment of patients with ischemic heart failure. Investors and traders were optimistic that forthcoming data from the study could lead the FDA to approve its therapy to treat the large and unmet clinical need.

Shares of BioCardia opened Monday at $3.11 and rose to a new 52-week high of $6.95 before losing a lot of momentum. But the stock closed Monday at $4.48, good for a daily gain just shy of 60%.

Synlogic Advances Clinical Stage Trial

Synlogic, Inc. (NASDAQ: SYBX) designs medicines that target validated underlying biology to treat diseases. The company’s main product line is Synthetic Biotic that is used for the treatment of metabolic disorders.

On Monday, traders bought Synlogic’s stock after the company said its investigational drug called SYNB1891 for the treatment of solid tumors and lymphoma advanced into a combination therapy stage of its ongoing Phase 1 trial.

Ongoing and interim results show so far that SYNB1891 is safe and well-tolerated and full Phase 1 results will be presented at a future medical meeting.

Shares of Synlogic opened for trading Monday morning at $3.03 and drifted lower throughout the trading session. The stock closed at $2.54, good for a 14% daily gain.

Amarin Announces Scientific Findings, Analyst Sees 380% Upside Potential

Amarin Corporation (NASDAQ: AMRN) is a pharmaceutical company dedicated to improving cardiovascular health. Its lead product is called VASCEPA and is available by prescription in several countries, including the U.S. and Canada.

On Monday, the company detailed scientific findings it presented during a virtual scientific presentation. What may have attracted traders’ attention is the company’s exposure as a COVID-19 play.

Amarin detailed how an ongoing trial of COVID-19 positive patients showed those who received VASCEPA saw a 52% reduction in symptoms versus just a 24% reduction observed in people who received standard usual care.

While Amarin’s stock barely ended higher on Monday, analysts at research firm Piper Sandler highlighted in a note their expectations for “tremendous upside” to $19 per share, or roughly 380% upside.

AnPac Bio-Medical Science Co Progresses In Cancer Treatment

AnPac Bio-Medical ScienceCo (NASDAQ: ANPC) is a biotechnology that focuses on early cancer screening and detection. The company’s CDA (Cancer Differentiation Analysis) platform has been shown to detect the risk of more than 20 different types of cancer with high sensitivity and specificity.

On Monday, the company said in a business update its technology and processes made significant progress in detecting pre-cancer diseases.

The announcement follows the completion of a prospective large population screening consisting of 110,000 individuals and more than 150,000 samples using its CDA technology and a follow-up study of 13,000. Initial results showed its platform was able to screen out and confirm pre-cancer cases at roughly 4.5 times that of cancer cases.

“From a commercialization perspective, this breakthrough has significant ramifications for market and customer needs, and revenue generation potential,” AnPac Bio Chairman and CEO Dr. Chris Yu said in the press release.

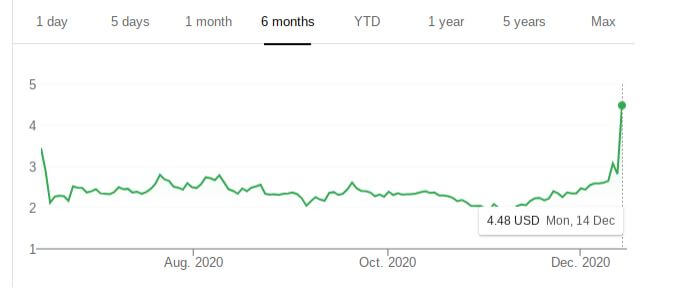

Shares of AnPac opened for trading Monday at $8.45 and quickly hit a daily high of $8.65 before losing momentum and ending the day at $5.70, good for a 35% daily return.

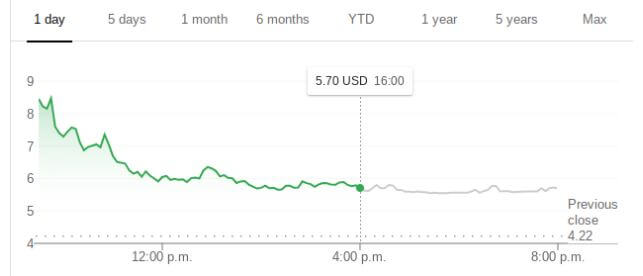

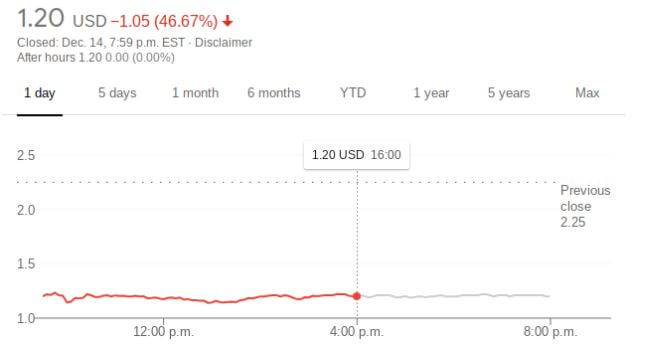

Aerpio Pharmaceuticals Plunges After Mixed Phase 2 Results

Aerpio Pharmaceuticals, Inc. (NASDAQ: ARPO) is a biopharmaceutical company focused on treating ocular diseases and diabetic complications along with other indications. The company’s lead compound is called razuprotafib and is being developed as a potential treatment for open angle glaucoma.

On Monday, the company released mixed results from a Phase 2 study of its razuprotafib. On the positive side, razuprotafib along with a combination of latanoprost demonstrated a statistically significant improvement after 28 compared to those treated with just a latanoprost monotherapy.

However, what seems to have attracted the attention of bears and penny stock short sellers was the company’s acknowledgment that the razuprotafib once-daily dose group did not show a statistically significant improvement over the same 28-day period.

Shares of Arepa opened Monday at $1.22 which marks a notable decline from Friday’s close of $2.25. The stock ended the day near where it started at $1.20 which implies a decline of more than 45%.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.