6 mistakes FX traders make – Guest Editorial

In this research, IG Group takes a close look at six key considerations for retail traders, and what critical mistakes can be avoided to ensure sustainable trading

Becca Cattlin is a contributor within the subject of financial services for publicly listed online trading and investments provider IG Group. Her research and publication covers a range of financial markets, risk management and the effects of politics on markets. Becca has also looked at how psychology impacts the decisions that financial professionals make.

Warren Buffett says there are only two rules that all market participants need to follow: ‘Rule No. 1: never lose money. Rule No. 2: Never forget rule No.1’. But if it’s that simple, why do traders lose more on average than they gain?

The answer is simply that no forex trader – no matter how experienced – is above making a mistake. In fact, these blunders can be a key part of the learning process. What makes a truly successful trader, is how they learn from them and use the experience to improve their performance.

We’ve taken a look at the top six mistakes that traders make and how they can avoid making them again.

1: Holding on to losing trades

The most common, and arguably most damaging, mistake that any trader can make is letting losses run. Some traders will become so paralysed by fear if a trade goes against them, and let the trade continue – whether this is out of hope that the trade will eventually turn around or fear of accepting a loss.

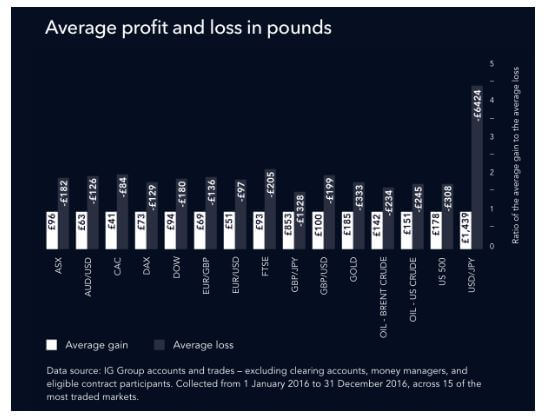

Instead of closing the position earlier and taking just a small loss, these individuals will often completely erode their capital. In fact, IG Group’s ‘Psychology of Trading’ research shows that traders tend to lose significantly more on the trades that go against them than they make on winning trades.

The single most effective way to avoid holding your losses is to predefine your exit points for each trade and stick to this plan – whether this is by using a stop-loss, or just having an awareness of how much capital you can afford to risk on each trade.

2: Trading without a stop-loss

Traders who don’t set stop-losses are at risk of losing more than they are comfortable with on a trade and of being more vulnerable to huge swings in price.

A stop-loss order enables you to close your position automatically if a trade moves against you – all you have to do is predefine a level of loss that is acceptable to you. Most providers will recommend that you attach a stop-loss to every single trade that you make.

Although stop-losses do still carry the risk of slippage – which means they could be executed at a different price than you requested during periods of extreme volatility – the benefits of attaching a stop-loss far outweigh the downside.

3: Closing winning trades too quickly

The opposite to mistake one is closing profitable trades too fast – also known as ‘snatching profits’. This stems from the fear that the market will reverse, and those profits will rapidly turn to losses.

This mistake results in traders closing positions too early, only to watch the market continue to move in their favour.

To prevent this, you could use a trailing stop, which will move with your profit for as long as the market price is moving in the direction you have predicted. But if the market turns, your position will close out at your trailing stop’s new level. This means that you can lock in profits without fearing you’ve closed your trade too early.

4: Trading without a plan

Undisciplined traders, who don’t create a trading plan, may be more prone to making mistakes and losing capital. A lack of consistency and guidelines for each trade can lead to irrational decision making – such as entering and exiting trades without analysis, not having a risk management plan, or not sticking to a strategy or trading style.

Experienced traders will always have a trading plan that they have tried and tested. It should outline exactly how, when and why you will be trading – including your timeframes, risk management rules and methodology for placing trades.

If you don’t have a trading plan, it’s recommended that you trade using a simulator or demo account before you risk capital on live markets.

5: Performing minimal research

There are so many factors that can impact the forex market, that a lack of preparation can be absolute detrimental. It can cause individuals to miss opportunities completely, open a trade that has little chance of success or mismanage an open position.

There is a tendency for traders to just rely on information that they already know, or that confirms their existing ideas of what to trade – these biases can cause them to miss out on information that could have had a serious impact on their decision-making process.

This mistake can be prevented by carrying out fundamental and technical analysis, which can help you to get a clearer idea of an asset’s future price movements and the most advantageous entry and exit points for your trades. Research can never harm your trading, so it’s worth taking the time to really deep-dive into all the factors that could impact your position.

6: Letting emotions cloud your judgement

Emotions are an inevitable part of trading but letting them take over your decision-making process can have extremely negative effects.

For example, if you had a CFD trade open that was currently losing you money, it could be tempting to open even more positions or add capital to the existing trade in order to compensate for the loss. However, the only likely outcome of this is that you’d lose even more money.

This mistake links to many of the other common trading errors, as the way to avoid allowing emotions to cloud your judgement, is to do your research, stick to your plan and know when to cut your losses.

Learn more about the impact of trading psychology.

The subject matter and the content of this article are solely the views of the author. FinanceFeeds does not bear any legal responsibility for the content of this article and they do not reflect the viewpoint of FinanceFeeds or its editorial staff.