66 funds derided as ‘duds’ by UK research and analytics firm

Q: When is a retail FX broker’s stock a better investment than established funds? A: When the funds are duds.

At the end of last year, when the vast majority of hard-working, dedicated FX industry professionals, brokerages, technology developers, liquidity providers, bankers and traders took a week or more of vacation time and a well deserved seat at the table to enjoy their festivities, the stock market’s winners and losers for 2018 made themselves clear.

Ordinarily, looking at which blue chip pharmaceutical giant or gray suited management consultancy maintained a steady share price through a year of anodyne board meetings, never ending contract renewals and corporate governance policy would be a perfect antidote to insomnia, however at that point something remarkable occurred.

At that time, Retail FX and CFD brokerage Plus500, itself only propelling itself into public listing on the London Stock Exchange’s Alternative Investment Market (AIM) just five years ago as a lean commercial operation became the envy of the retail FX industry with a very clever proprietary digital marketing system that created a massive advantage in terms of operational and customer acquisition efficiency almost by accident just a few years prior at the firm’s original base in Haifa, Israel.

The company, which in terms of headcount and operational size is a fraction of the size of the 30 year established publicly listed electronic trading giants among which it now nestles in London’s Square Mile, and whilst its success and business model is the bete noire of many long term FX industry professionals, this year’s stock market results are testimony to the success of Plus500’s business model.

Unbelievably, Plus500’s stock was the number 2 best performing stock for all of 2018, in every business sector across all of Britain’s publicly listed companies.

Love them or loathe them, the firm’s illusive executives certainly know when to get in and out of deals, as they have entered and exited at exactly the right time on every transaction since the company was founded.

To play devil’s advocate, it could be argued that any monies lost on the company’s b-book platform could be recovered if you own shares in the publicly listed entity itself, and then some!

By contrast, investing in funds is considered a far more sophisticated means of trading the markets, however research by British analytics company FundExpert, the online initiative of 32-year established financial advisory company Dennehy Weller & Co, has identified some 66 under performing funds which would make downmarket Plus500 stock appear very sensible.

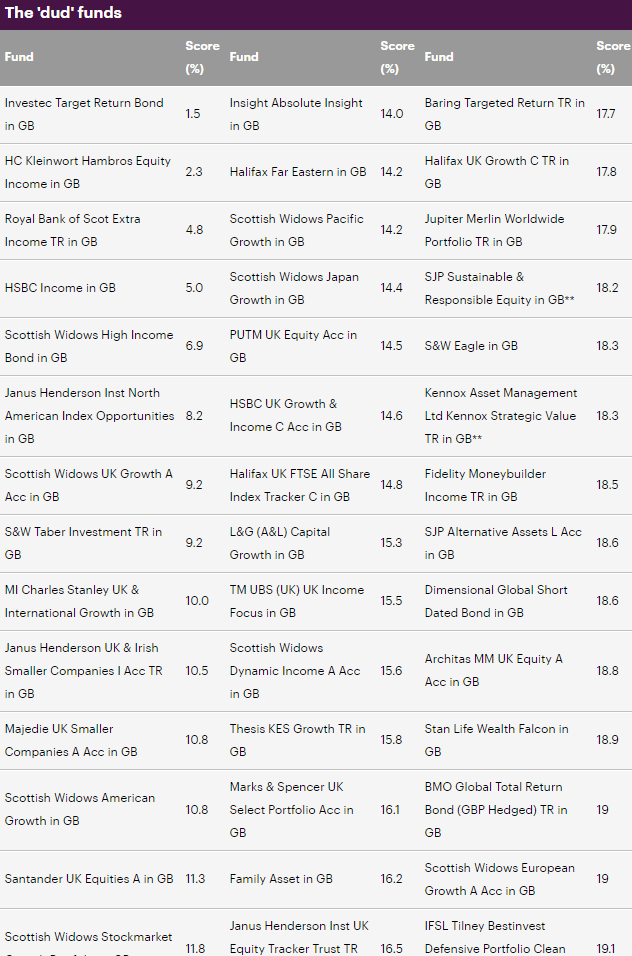

The company identifies what it somewhat amusingly terms as ‘dud’ funds as those that only manage to get into the top 40% of performers in its own sector for 20% of the time.

Its new list of ‘dud’ funds identifies products from major banks such as South African financial giant Investec’s Target Return Bond fund as the worst performer, ahead of HC Kleinwort Hambros Equity Income and Royal Bank of Scotland Extra Income in second and third positions respectively.

The ‘time’ aspect is the 120 overlapping 6-monthly periods in the last 10 years – with a higher weighting being given to more recent periods. For example, a fund with a score of 14.2% has only been in the top 40% of performers 14.2% of the time in the last 10 years. These are not just the bottom 20% of funds but those that are consistently dragging along the bottom of their sector.

Sam Lees, head of research at FundExpert told the Daily mail that investors with a portfolio full of duds should sell them off, and that there’s no point in holding them.

Mr Lees believes that starting from scratch, a successful method for choosing funds must be a straightforward approach to identify top rated funds, that the underlying process must be clear and understandable, the process must be repeatable, long term evidence of extra growth being achieved must be demonstrated and that his firm back tested various methods for selecting funds back to 1994, with Mr Lees saying that the method which stood head and shoulders above alternatives was what is these days known as Dynamic Fund Ratings.

Interesting that public stock of retail FX firms is more valuable than some actual funds, which appears to be contrary to the perception and to the norm.