The quest for the next big crypto investment leads investors through a labyrinth of opportunities, each promising unparalleled growth and utility. Among the contenders, BlockDAG stands out for its innovative approach to transactions and a crypto card that sets new standards.

Search Query: #asic

“A system with limited oversight, that is opaque, unpredictable and unreliable – leading to widescale investor losses or market manipulation or abuse – will ultimately fail to thrive.”

ASIC said that Prospero holds substantial client funds and is concerned about seeing these returned to clients as a priority. The Australian regulator considers that the best way to secure the efficient return of funds to clients is the appointment of liquidators.

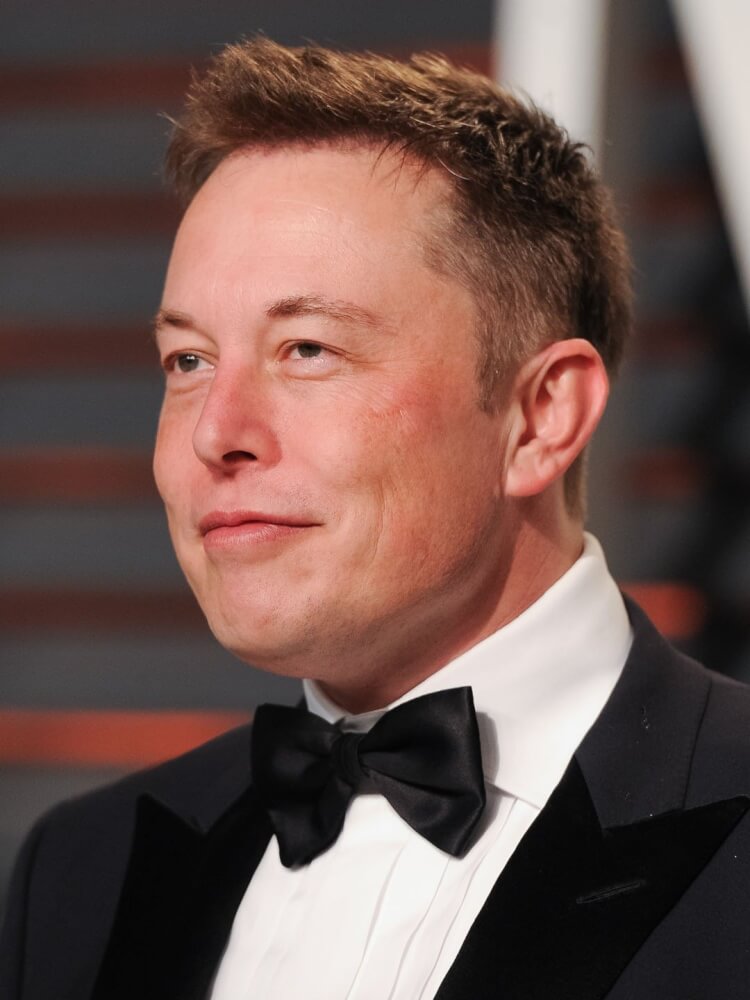

In an absolutely shocking turn of events that nobody could have possibly seen coming, the Australian Securities and Investments Commission (ASIC) has bravely stepped forward to reveal that, yes, those videos of Elon Musk passionately endorsing a cryptocurrency exchange are as fake as a three-dollar bill.

The Australian Securities and Investments Commission (ASIC) has effectively bankrupted Tyson Robert Scholz, the figure behind “Black Wolf Pit.” The action marks a significant crackdown on so-called ‘finfluencers’ and individuals providing unlicensed financial services.

“Market intermediaries should always carefully consider their obligations under Australian law and applicable international codes and standards when undertaking pre-hedging.”

“The Change of Name represents a significant step forward for our operations in Australia and underscores our dedication to offering unparalleled trading services to our clients. By leveraging the strong reputation and global brand recognition of ATFX, we are confident that AT Global Markets (Australia) will continue to thrive and uphold the highest industry standards.”

Their license authorized them to advise on various financial products including basic deposit products, government bonds, life products, interests in managed investment schemes, securities, and superannuation. The company was permitted to provide these services to both retail and wholesale clients.

Founded in 2012, the CFD broker offers access to global forex (FX), indices, Share CFDs, commodities, precious metals, VIX, and more, via the MT4 trading platform.

Instinet operated a crossing system called BLX Australia, often termed a ‘Dark Pool’, from April 1, 2011, until its suspension on October 11, 2022.

“For all organizations, cybersecurity and cyber resilience must be a top priority. ASIC expects this to include oversight of cybersecurity risk throughout the organization’s supply chain – it was alarming that 44% of participants are not managing third-party or supply chain risks. Third-party relationships provide threat actors with easy access to an organization’s systems and networks.”

Israeli social trading and multi-asset brokerage company eToro has signed into a three-year sponsorship agreement with the Australian Professional Leagues (APL), governing body for the highest-level professional men’s and women’s football leagues in Australia and New Zealand.

ASIC excluded certain breaches related to misleading or deceptive conduct and false or misleading representations from being automatically reportable as significant breaches. In addition, AFS licensees now have up to 90 days, up from the original 30 days, to report a situation similar to one previously filed with the regulator.

“We target financial reports where we have identified potential issues in revenue recognition or asset valuation.”

Drawing historical parallels between today’s economic uncertainty and the Third Century Roman Empire’s financial instability, Longo emphasized that crypto, much like any form of money, relies heavily on trust. The irony, he noted, is that although cryptocurrencies were conceived as trustless systems, they have ended up necessitating substantial trust from consumers in various parties involved in the crypto ecosystem.

ASIC has strategically focused its enforcement actions on areas causing the most significant harm to consumers and small businesses. These priorities include sustainable finance, risks related to Australia’s ageing population, and disruptive digital technologies. “We have made considerable progress against these priorities throughout the year, and this work continues.”

ASIC has stated that its investigation into the activities of BBY Limited remains ongoing. The charges against Mr. Maharaj may shed light on broader irregularities within the firm, providing a cautionary tale for oversight and governance in the financial industry.

“Getting remediation wrong is very costly – costly to consumers who bear the burden of a financial firm’s mistakes, but also very costly for firms who have to re-do remediations and repair reputational damage. Going forward, while ASIC will generally not oversee remediation programs, we will consider regulatory action where licensees fail to deliver fair and timely remediation to affected consumers.”

NAB faces a $2.1 million penalty for unconscionable conduct, as the Federal Court rules the bank knowingly overcharged customers, and took over two years to rectify the situation.