The risks of GenAI, however, include data breaches, regulatory issues, bias, as well as sub-standard or simply false results.

Search Query: #otc

“Our collaboration with Talos represents yet another step forward in our mission to empower institutional investors with seamless access to all types of digital assets – from unregulated cryptocurrencies to regulated tokenised real-world assets. By partnering with Talos, we’re set to offer unparalleled liquidity, reliability, and robustness to the global institutional trading community.”

“The main challenges posed by this regulation includes completing the numerous new reportable fields for commodity and energy derivatives.”

“With this latest certification, Portofino Technologies is now registered to provide OTC services in both the UK and Switzerland, solidifying our position as one of the most regulatory compliant cryptocurrency market makers globally.”

The partnership will explore various applications for onchain derivatives, leveraging Orbs’ Layer 3 technology. Initial projects include developing a communication oracle linking onchain and offchain systems and a bidding mechanism for hedgers, aimed at minimizing risk and maximizing derivatives trading benefits.

The VASP registration enables B2C2 to provide over-the-counter (OTC) spot crypto services to its institutional clientele. To spearhead the Luxembourg operation B2C2 appointed Denzel Walters.

“Across all our exchanges the quality and depth of liquidity are key. The connectivity with 4OTC’s Libre service will enable more Liquidity Providers to price on LMAX Exchange execution venues, as well as leverage our distribution scale and global exchange infrastructure.”

“We are on continuous watch to improve or complement our portfolio management platform. Although we already have different analytical tools and frameworks to support our portfolio of cross asset volatility and correlation positions, ICE’s excellence in analytics and data will further enrich our capabilities.”

Membrane Labs offers a custody-agnostic settlement network for OTC spot trades, loans, derivatives, and associated collateral management with customizable report-creation capabilities.

Examining the product landscape, the OTC EQD market encompasses a range of instruments, including swaps, forwards, options, contracts for difference, and other products. A noteworthy trend highlighted in the paper is the growth of equity forwards and swaps in comparison to OTC equity options.

This development underscores the significance of financial institutions implementing stringent controls and transparent practices in pricing, aligning with regulatory requirements to avoid enforcement actions and ensure fair dealings with clients.

This report becomes increasingly valuable considering the post-FTX landscape and regulatory challenges facing many centralized exchanges (CEXs), leading traders and institutions towards OTC markets for a more stable and secure structure.

“Building reliable and consistent datasets from difficult-to-obtain market data is a perpetual challenge. Linking MX.3 to OTC Derivatives Data, part of S&P Global Market Intelligence, is of great benefit to clients who use both services.”

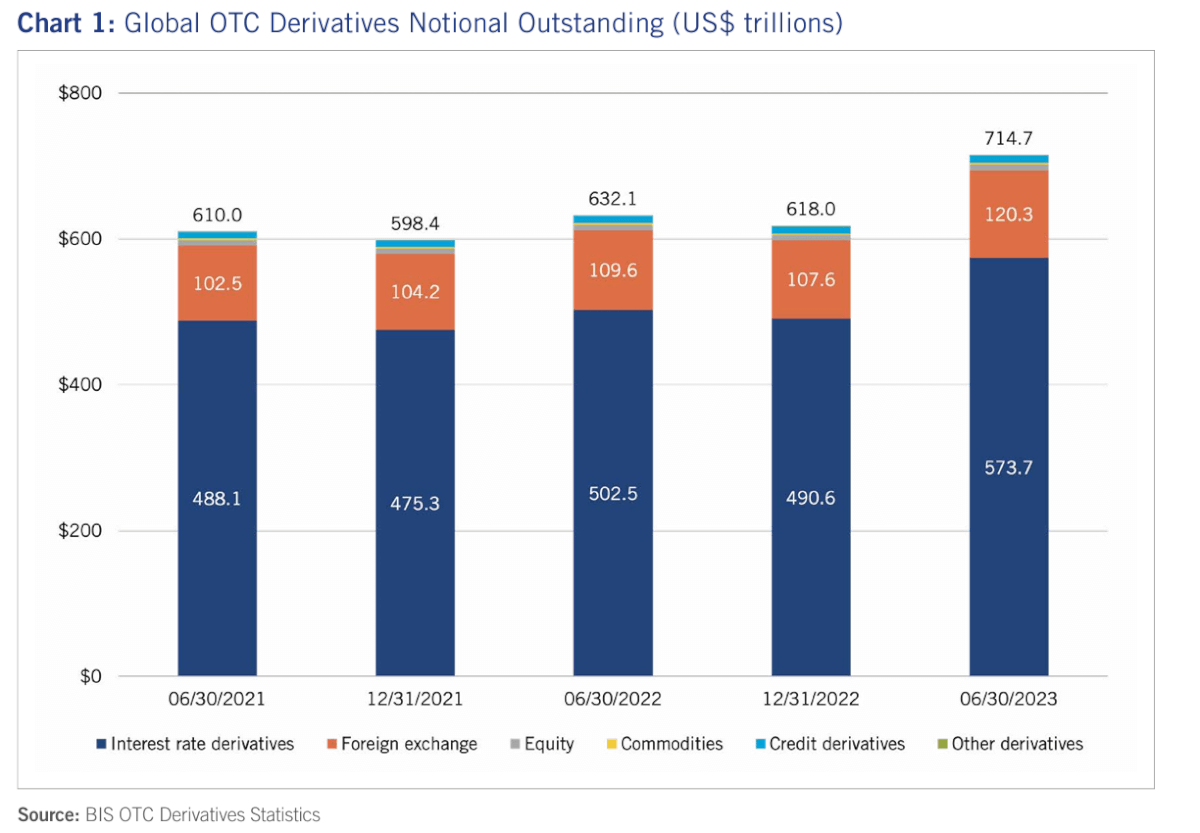

These trends suggest a growing and evolving OTC derivatives market, with an increased focus on risk management and regulatory compliance. The rise in clearing rates, along with the increased initial margin requirements, reflects a more cautious approach to risk in the financial services industry.

Future3 Campus, in partnership with The Open Network (TON) Foundation, has today announced the launch of The TON Bootcamp, an incubation program to foster mini-app development within TON’s Web3 ecosystem in Telegram.

“Our study suggests that Custom Basket Forwards (CBFs) can solve the investment trilemma for firms offering a margin efficient, customisable product with low trading costs. As asset managers continue to innovate and meet investor demands for thematic, ESG, and climate investments, the sell-side is well placed to offer access to listed products that can serve these requirements.”

DTCC unveils a groundbreaking service, OTC Direct Connect, utilizing cloud technology to revolutionize access to OTC derivatives data, streamlining the process for market professionals.

DAMEX’s new integration of FM Liquidity Match by Finery Markets elevates its OTC trading platform, streamlining the trading experience for its customers.

“Delivering our unique datasets through a best-in-class data management tool such as ZEMA allows businesses to reduce manual intervention through enhanced data accuracy and consistency. This leads to faster trade execution and risk assessment while improving risk mitigation and reporting capabilities, benefiting all counterparties involved in the trade cycle.”